Question: Help please!!! Last person got answer wrong. Jay Corporation has decided to prepare contribution income statements for internal planning. begin{tabular}{|l|r|} hline Budgeted information for Quarter

Help please!!! Last person got answer wrong.

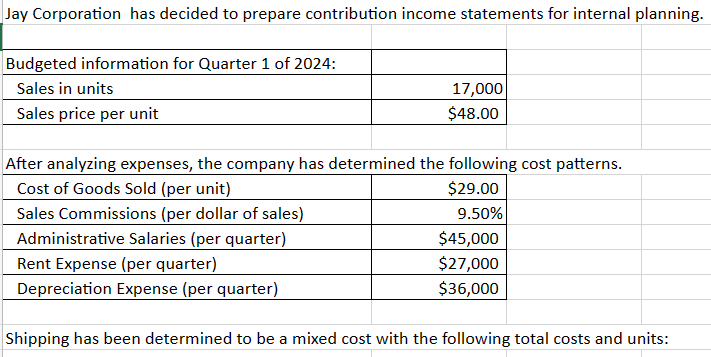

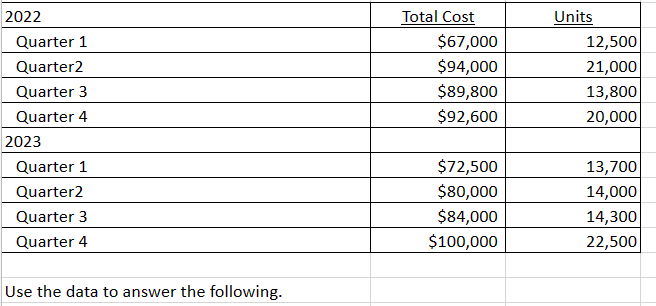

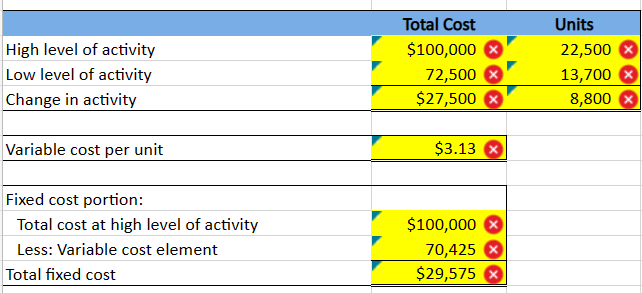

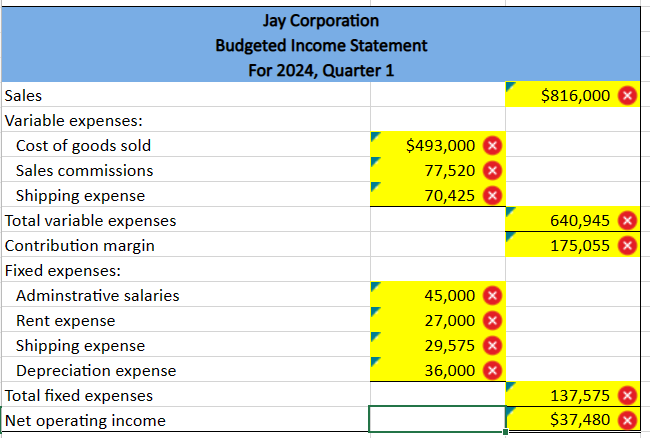

Jay Corporation has decided to prepare contribution income statements for internal planning. \begin{tabular}{|l|r|} \hline Budgeted information for Quarter 1 of 2024: & \\ \hline Sales in units & 17,000 \\ \hline Sales price per unit & $48.00 \\ \hline \end{tabular} After analyzing expenses, the company has determined the following cost patterns. \begin{tabular}{|l|r|} \hline Cost of Goods Sold (per unit) & $29.00 \\ \hline Sales Commissions (per dollar of sales) & 9.50% \\ \hline Administrative Salaries (per quarter) & $45,000 \\ \hline Rent Expense (per quarter) & $27,000 \\ \hline Depreciation Expense (per quarter) & $36,000 \\ \hline \end{tabular} Shipping has been determined to be a mixed cost with the following total costs and units: \begin{tabular}{|l|r|r|} \hline 2022 & \multicolumn{1}{|c|}{ Total Cost } & \multicolumn{1}{l|}{ Units } \\ \hline Quarter 1 & $67,000 & 12,500 \\ \hline Quarter2 & $94,000 & 21,000 \\ \hline Quarter 3 & $89,800 & 13,800 \\ \hline Quarter 4 & $92,600 & 20,000 \\ \hline 2023 & & \\ \hline Quarter 1 & $72,500 & 13,700 \\ \hline Quarter2 & $80,000 & 14,000 \\ \hline Quarter 3 & $84,000 & 14,300 \\ \hline Quarter 4 & $100,000 & 22,500 \\ \hline \end{tabular} Use the data to answer the following. \begin{tabular}{|lrr|} \hline & Total Cost & \multicolumn{1}{l|}{ Units } \\ \hline High level of activity & $100,000 & 22,500 \\ \hline Low level of activity & 72,500 & 13,700 \\ \hline Change in activity & $27,500 & 8,800 \\ \hline \hline \end{tabular} Variable cost per unit $3.13x Fixed cost portion: \begin{tabular}{|lrr|} \hline Total cost at high level of activity & $100,000 \\ 70,425 \\ \hline Less: Variable cost element & $29,575 \\ \hline Total fixed cost & = \\ \hline \hline \end{tabular} Jay Corporation Budgeted Income Statement For 2024, Quarter 1 Sales Variable expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts