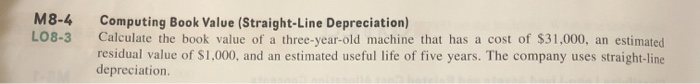

Question: help please M8-4 LO8-3 Computing Book Value (Straight-Line Depreciation) Calculate the book value of a three-year-old machine that has a cost of $31,000, an estimated

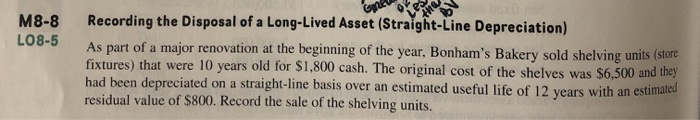

M8-4 LO8-3 Computing Book Value (Straight-Line Depreciation) Calculate the book value of a three-year-old machine that has a cost of $31,000, an estimated residual value of $1,000, and an estimated useful life of five years. The company uses straight-line! depreciation M8-8 LO8-5 Recording the Disposal of a Long-Lived Asset (Straight-Line Depreciation) As part of a major renovation at the beginning of the year, Bonham's Bakery sold shelving units (store fixtures) that were 10 years old for $1,800 cash. The original cost of the shelves was $6,500 and they had been depreciated on a straight-line basis over an estimated useful life of 12 years with an estimated residual value of $800. Record the sale of the shelving units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts