Question: HELP PLEASE Marginal and average tax rates Partner A, a single taxpayer, is one of two partners in a small business. As such, she receives

HELP PLEASE

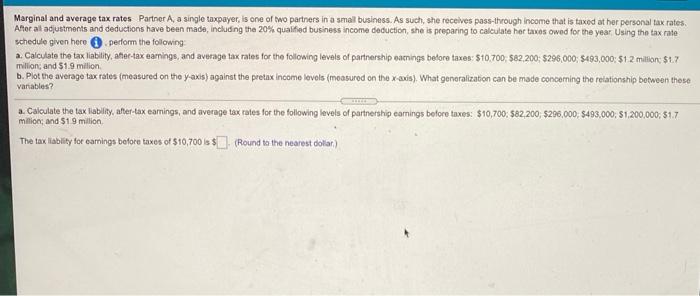

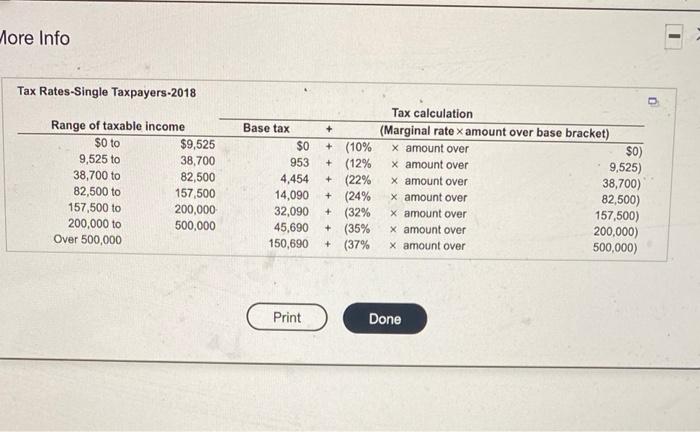

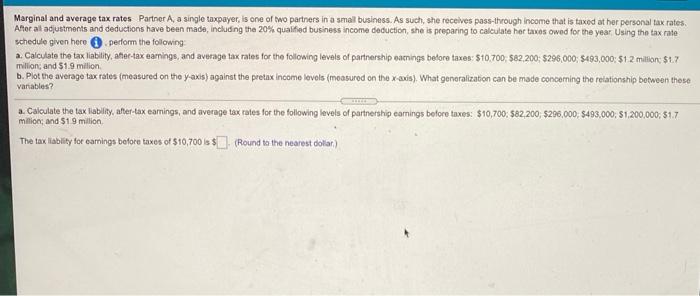

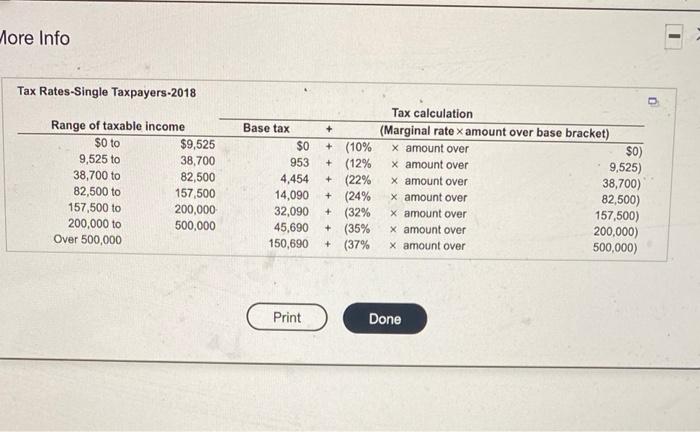

Marginal and average tax rates Partner A, a single taxpayer, is one of two partners in a small business. As such, she receives pass-through income that is taxed at her personal tax rates. After all adjustments and deductions have been made, including the 20% qualified business income deduction, she is preparing to calculate her taxes owed for the year Using the tax rato schedule given hero perform the following a. Calculate the tax liability, aner-tax earnings, and average tax rates for the following levels of partnership warnings before taxes: $10.700;$82,200 $206,000 $493,000: $1.2 million: $17 million and $1.9 milion 5. Plot the average tax rates (measured on the y-axis) against the pretax income levels (measured on the x avis) What generalization can be made concerning the relationship between thote Variables? a Calculate the tax lability, after-tax earings, and average tax rates for the following levels of partnership earnings before taxes: $10,700:$82,200, $206,000: $493,000: S1,200,000, 317 million and $19 million The tax liability for earnings before taxes of $10,700 1 $(Round to the nearest dolar) More Info Tax Rates-Single Taxpayers-2018 + $0) + Range of taxable income $0 to $9,525 9,525 to 38,700 38,700 to 82,500 82,500 to 157,500 157,500 to 200,000 200,000 to 500,000 Over 500,000 Base tax $0 953 4,454 14,090 32,090 45,690 150,690 Tax calculation (Marginal rate x amount over base bracket) + (10% x amount over + (12% X amount over 9,525) (22% x amount over 38,700) + (24% x amount over 82,500) + (32% X amount over 157,500) + (35% x amount over 200,000) + (37% x amount over 500,000) Print Done

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock