Question: Help please MENT CALCULATOR MESSAGE MY INSTRUCTOR FULL CES r 15 rease ciss rcise rcise Exercise 15-12 The partnership agreement of ABC Associates provides that

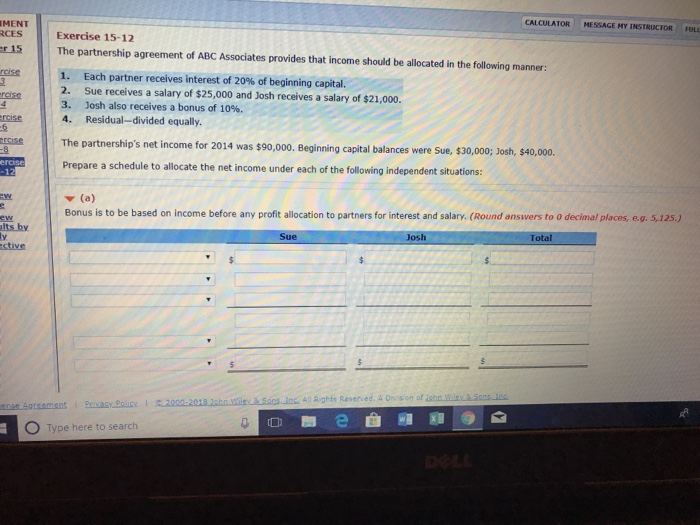

MENT CALCULATOR MESSAGE MY INSTRUCTOR FULL CES r 15 rease ciss rcise rcise Exercise 15-12 The partnership agreement of ABC Associates provides that income should be allocated in the following manner: 1. 2. 3. 4. Each partner receives interest of 20% of beginning capital. Sue receives a salary of $25,000 and Josh receives a salary of $21,000. Josh also receives a bonus of 10%. Residual-divided equally. The partnership's net income for 2014 was $90,000. Beginning capital balances were Sue, $30,000; Josh, $40,000. Prepare a schedule to allocate the net income under each of the following independent situations Bonus is to be based on income before any profit allocation to partners for interest and salary. (Round answers to 0 decimal places, e.g. 5,125.) lts by ota stive In All Rights Reserve O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts