Question: Help please! please answer all! type the answers. Thank you! 5 Exercise 9-14 (Algo) Conventional retail method [LO9-3) 5 points Campbell Corporation uses the retail

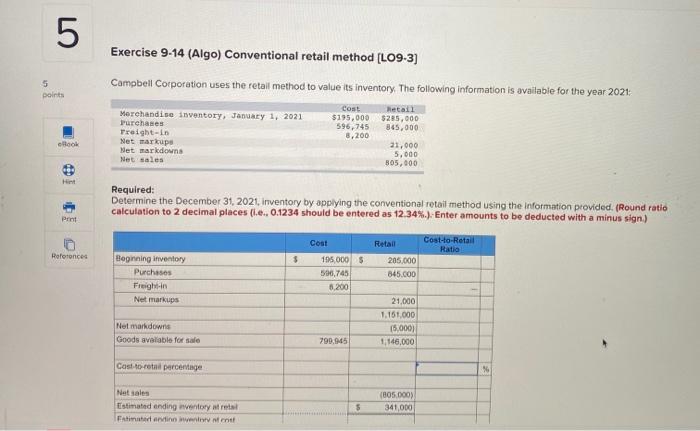

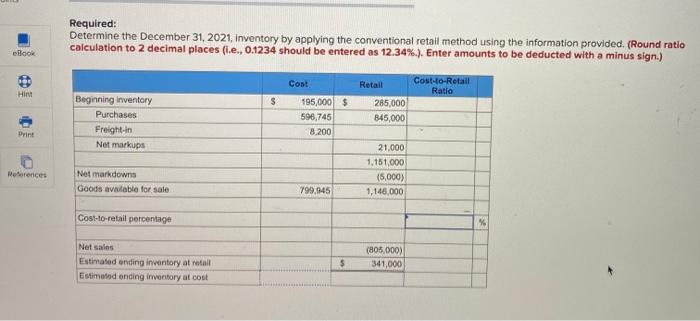

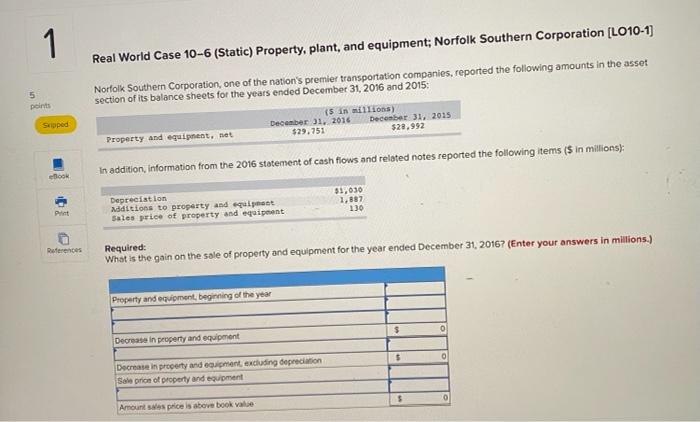

5 Exercise 9-14 (Algo) Conventional retail method [LO9-3) 5 points Campbell Corporation uses the retail method to value its inventory. The following information is available for the year 2021 Cost Retail Merchandise inventory, January 1, 2021 $195,000 $285,000 Purchases 596,745 845,000 Traight-in 8,200 Net markupe 21.000 Net markdowns 5.000 Net sales 805,000 Book Hint Required: Determine the December 31, 2021, inventory by applying the conventional retail method using the information provided. (Round ratio calculation to 2 decimal places (ie.. 0.1234 should be entered as 12.34%...Enter amounts to be deducted with a minus sign) Print Cost Retail Cost-to-Retail Ratio References $ Beginning inventory Purchases Freight Net markups 195,000 $ 596,745 5.200 205.000 845.000 Netmarkdown Goods avaliable for sale 21,000 1.151.000 65.000) 1,146,000 299.945 Cost to coal percentage * Net sales Estimated ending inventory test Et arviennent (805.000) 341,000 $ Required: Determine the December 31, 2021, Inventory by applying the conventional retail method using the information provided. (Round ratio calculation to 2 decimal places (ie., 0.1234 should be entered as 12.34%). Enter amounts to be deducted with a minus sign.) eBook Cont Retail Cost-to-Retail Ratio Hint S Beginning inventory Purchases Freight-in Net markups 195,000 $ 596,745 8.200 285,000 845,000 Print References Netmarkdowns Goods available for sale 21.000 1,151,000 (5,000) 1,145,000 799.945 Cost-to-retail percentage % Net sales Estimated ending inventory at all Estimated ending inventory at cost (805.000) 341,000 $ 1 Real World Case 10-6 (Static) Property, plant, and equipment; Norfolk Southern Corporation (LO10-1] 5 points Norfolk Southern Corporation, one of the nation's premier transportation companies, reported the following amounts in the assot section of its balance sheets for the years ended December 31, 2016 and 2015: (5 millions) December 31, 2016 December 31, 2015 Property and equipment, net $29.751 $22.992 Suped In addition, information from the 2016 statement of cash flows and related notes reported the following items (5 in millions); ook 31.030 1,887 Puit Depreciation Addition to property and equipment Sales price of property and equipment 130 References Required: What is the gain on the sale of property and equipment for the year ended December 31, 20167 (Enter your answers in millions.) Property and equipment, beginning of the year $ O Decrease in property and equipment $ Decrease in property and equipment, excluding depreciation Sole prion of property and equipment $ Amount price is above book was

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts