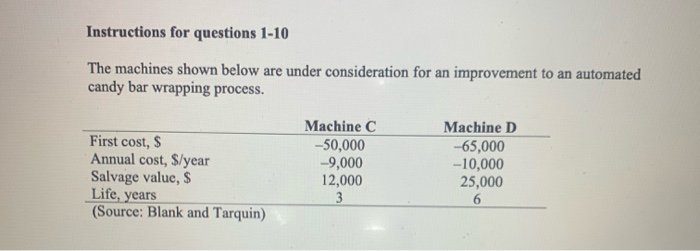

Question: help please! please help with 8,9,10 Instructions for questions 1-10 The machines shown below are under consideration for an improvement to an automated candy bar

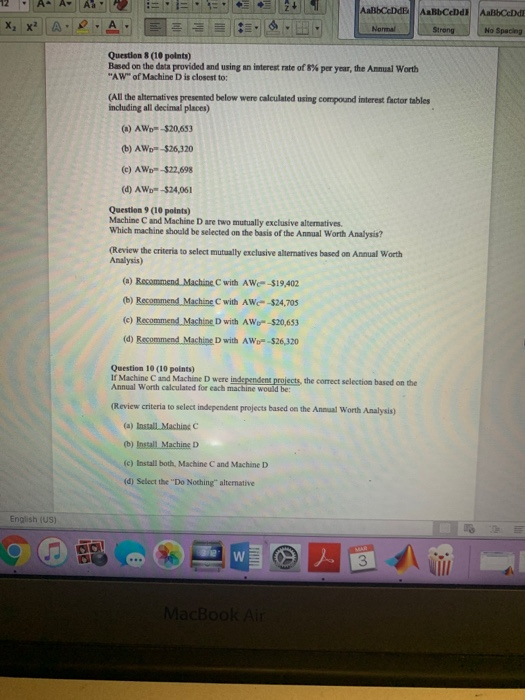

Instructions for questions 1-10 The machines shown below are under consideration for an improvement to an automated candy bar wrapping process. First cost, $ Annual cost, S/year Salvage value, $ Life, years (Source: Blank and Tarquin) Machine C -50,000 -9,000 12,000 Machine D -65,000 -10,000 25,000 12 AA ASE X, X? A. A AaBbceDdE ABCeDdl Aalb DdE Normal Strong No Spacing E- Question 8 (10 points) Based on the data provided and using an interest rate of 8% per year, the Annual Worth "AW" of Machine D is closest to: (All the alternatives presented below were calculated using compound interest factor tables including all decimal places) (a) AW--$20,653 (b) AW--$26,320 (c) AW--$22,698 (d) AW--$24,061 Question 9 (10 points) Machine C and Machine D are two mutually exclusive alternatives Which machine should be selected on the basis of the Annual Worth Analysis? (Review the criteria to select mutually exclusive alternatives based on Annual Worth Analysis) (6) Recommend. Machine C with AW-519,402 (b) Recommend Machine C with AW -824,705 (c) Recommend Machine D with AW--$20,653 (d) Recommend Machine D with AW 526,320 Question 10 (10 points) If Machine C and Machine D were independent projects, the correct selection based on the Annual Worth calculated for each machine would be: (Review criteria to select independent projects based on the Annual Worth Analysis) (a) Install Machine C (b) Install Machine D (c) Install both, Machine C and Machine D (d) Select the "Do Nothing alternative English (US)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts