Question: help please Please select the correct answer choice. Question 7 4 pts Exactly five years ago, General Motors issued non-callable bonds that matured in 20

help please

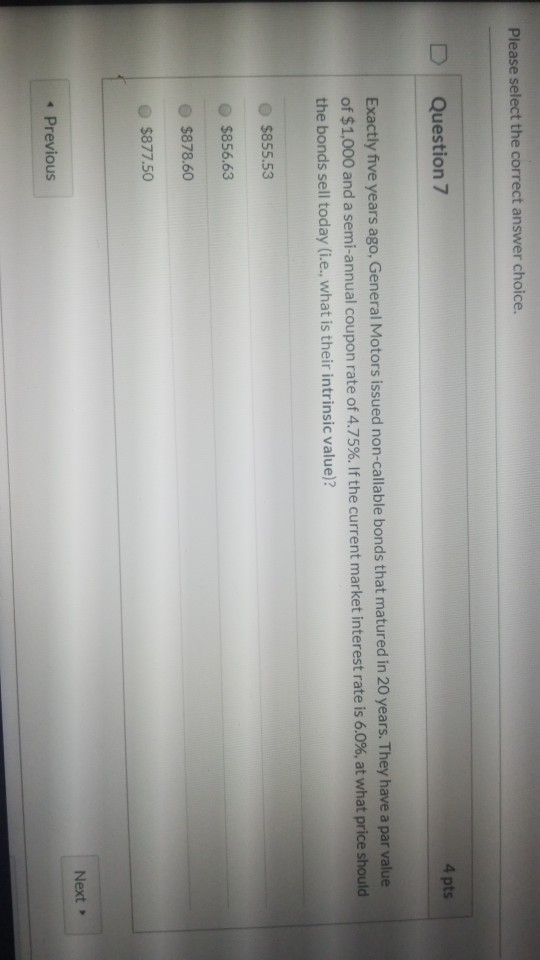

Please select the correct answer choice. Question 7 4 pts Exactly five years ago, General Motors issued non-callable bonds that matured in 20 years. They have a par value of $1,000 and a semi-annual coupon rate of 4.75%. If the current market interest rate is 6.0%, at what price should the bonds sell today (i.e., what is their intrinsic value)? $855.53 $856.63 $878.60 $877.50 Next > Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts