Question: Help please. practice: 1 6 - Partnership income allocation - Complex, net loss The partnership agreement of Alex, Carl, and Erika provides that profits are

Help please. practice:Partnership income allocationComplex, net loss

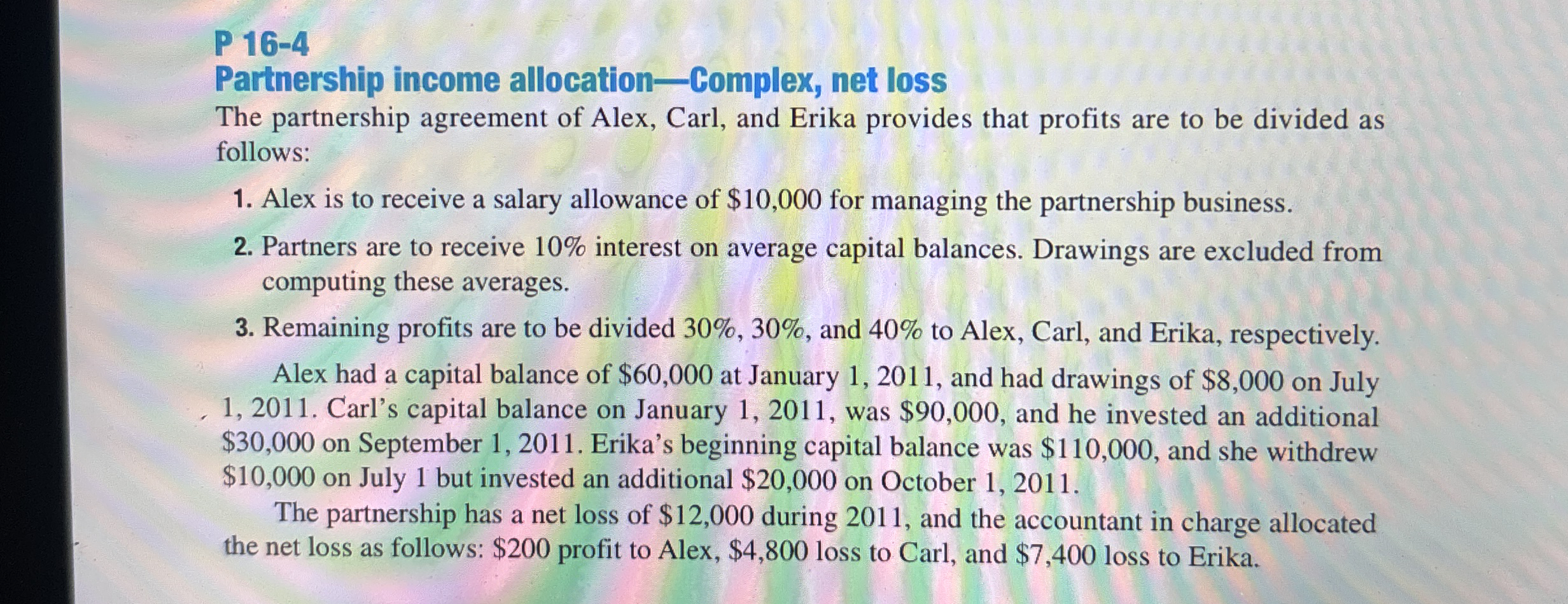

The partnership agreement of Alex, Carl, and Erika provides that profits are to be divided as follows:

Alex is to receive a salary allowance of $ for managing the partnership business.

Partners are to receive interest on average capital balances. Drawings are excluded from computing these averages.

Remaining profits are to be divided and to Alex, Carl, and Erika, respectively.

Alex had a capital balance of $ at January and had drawings of $ on July Carl's capital balance on January was $ and he invested an additional $ on September Erika's beginning capital balance was $ and she withdrew $ on July but invested an additional $ on October

The partnership has a net loss of $ during and the accountant in charge allocated the net loss as follows: $ profit to Alex, $ loss to Carl, and $ loss to Erika.REQUIRED

A schedule to show the correct allocation of the partnership net loss for

A statement of partnership capital for the year ended December

Journal entries to correct the books of the partnership at December assuming that all closing entries for the year have been recorded.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock