Question: help please Problem 1 [25 points) In 2020, Magic Johnson (single) sells the following capital assets he had: Google stock date acquired 12/15/2016, date sold

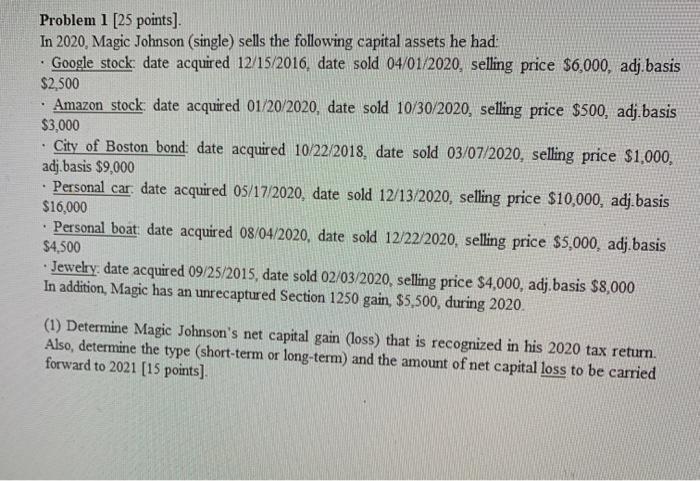

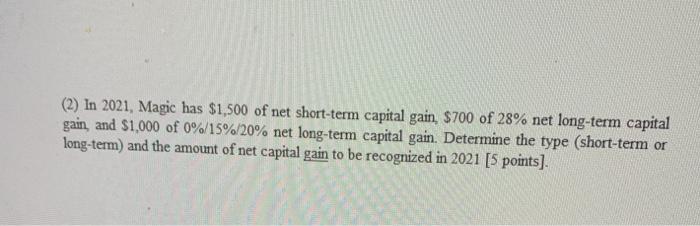

Problem 1 [25 points) In 2020, Magic Johnson (single) sells the following capital assets he had: Google stock date acquired 12/15/2016, date sold 04/01/2020, selling price $6,000, adj basis $2,500 Amazon stock date acquired 01/20/2020, date sold 10/30/2020, selling price $500, adj.basis $3,000 City of Boston bond: date acquired 10/22/2018, date sold 03/07/2020, selling price $1,000, adj.basis $9,000 Personal car. date acquired 05/17/2020, date sold 12/13/2020, selling price $10,000, adj. basis $16,000 Personal boat date acquired 08/04/2020, date sold 12/22/2020, selling price $5,000, adj.basis $4,500 - Jewelry date acquired 09/25/2015, date sold 02/03/2020. selling price $4,000, adj.basis $8,000 In addition, Magic has an unrecaptured Section 1250 gain, $5,500, during 2020 . . (1) Determine Magic Johnson's net capital gain (loss) that is recognized in his 2020 tax return. Also, determine the type (short-term or long-term) and the amount of net capital loss to be carried forward to 2021 [15 points) (2) In 2021, Magic has $1,500 of net short-term capital gain, $700 of 28% net long-term capital gain, and $1,000 of 0% 15% 20% net long-term capital gain. Determine the type (short-term or long-term) and the amount of net capital gain to be recognized in 2021 [5 points). Problem 1 [25 points) In 2020, Magic Johnson (single) sells the following capital assets he had: Google stock date acquired 12/15/2016, date sold 04/01/2020, selling price $6,000, adj basis $2,500 Amazon stock date acquired 01/20/2020, date sold 10/30/2020, selling price $500, adj.basis $3,000 City of Boston bond: date acquired 10/22/2018, date sold 03/07/2020, selling price $1,000, adj.basis $9,000 Personal car. date acquired 05/17/2020, date sold 12/13/2020, selling price $10,000, adj. basis $16,000 Personal boat date acquired 08/04/2020, date sold 12/22/2020, selling price $5,000, adj.basis $4,500 - Jewelry date acquired 09/25/2015, date sold 02/03/2020. selling price $4,000, adj.basis $8,000 In addition, Magic has an unrecaptured Section 1250 gain, $5,500, during 2020 . . (1) Determine Magic Johnson's net capital gain (loss) that is recognized in his 2020 tax return. Also, determine the type (short-term or long-term) and the amount of net capital loss to be carried forward to 2021 [15 points) (2) In 2021, Magic has $1,500 of net short-term capital gain, $700 of 28% net long-term capital gain, and $1,000 of 0% 15% 20% net long-term capital gain. Determine the type (short-term or long-term) and the amount of net capital gain to be recognized in 2021 [5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts