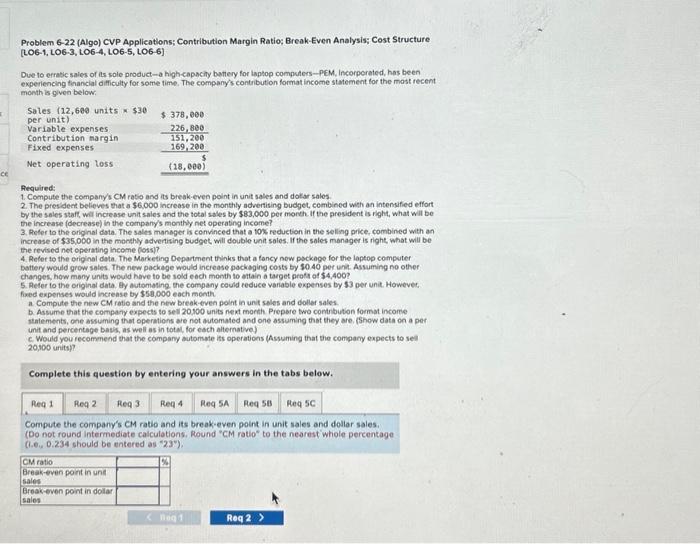

Question: HELP PLEASE Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO6-1, LOG-3, LO6-4, LOG-5, LOG-6] Due to erratic saies of its

![Analysis; Cost Structure [LO6-1, LOG-3, LO6-4, LOG-5, LOG-6] Due to erratic saies](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f1e73fea891_40766f1e73f7280e.jpg)

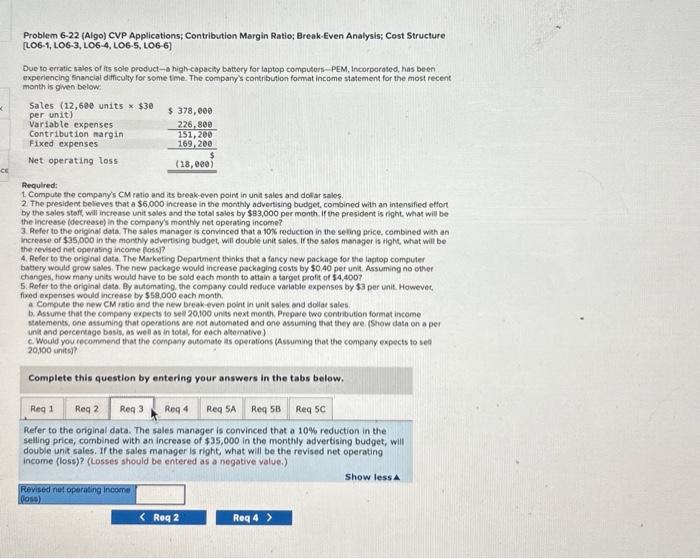

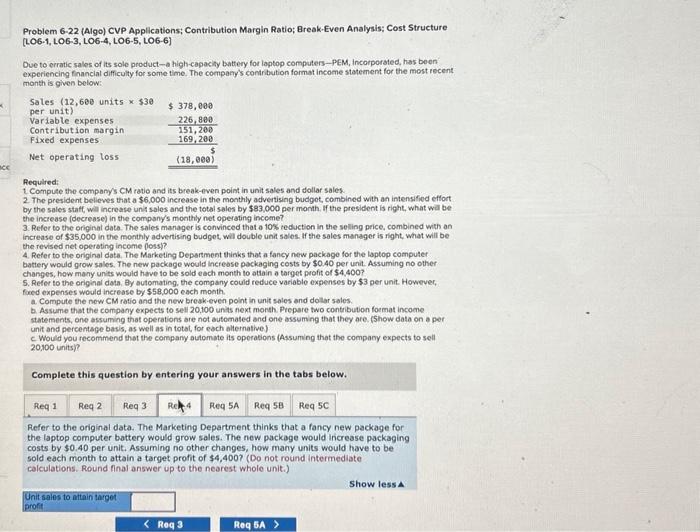

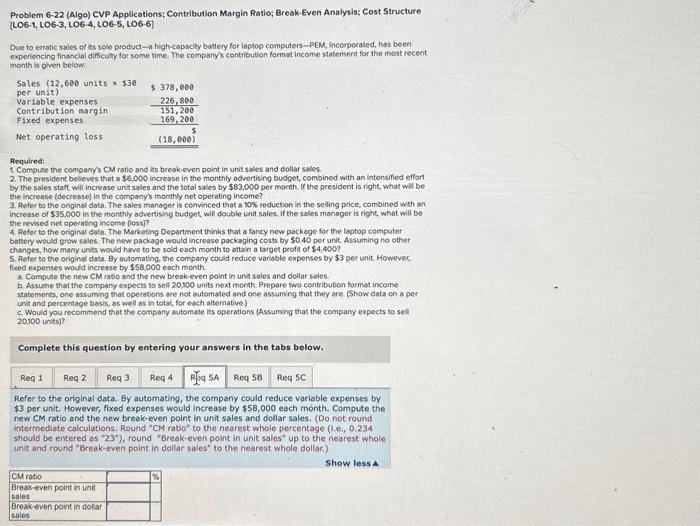

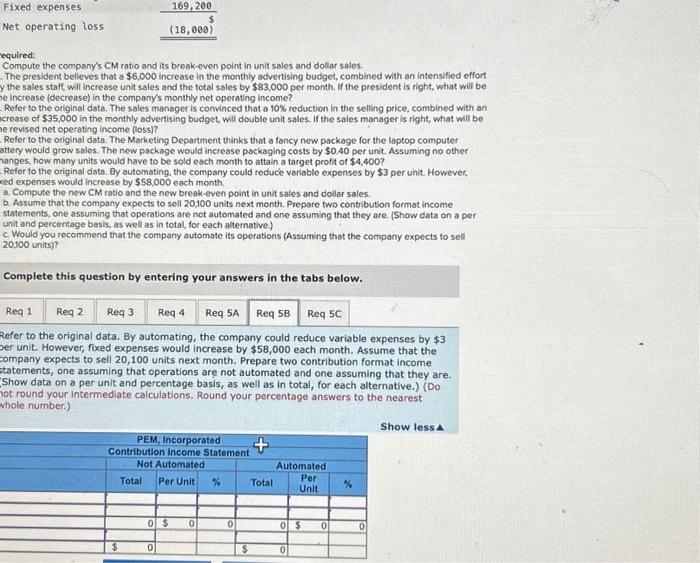

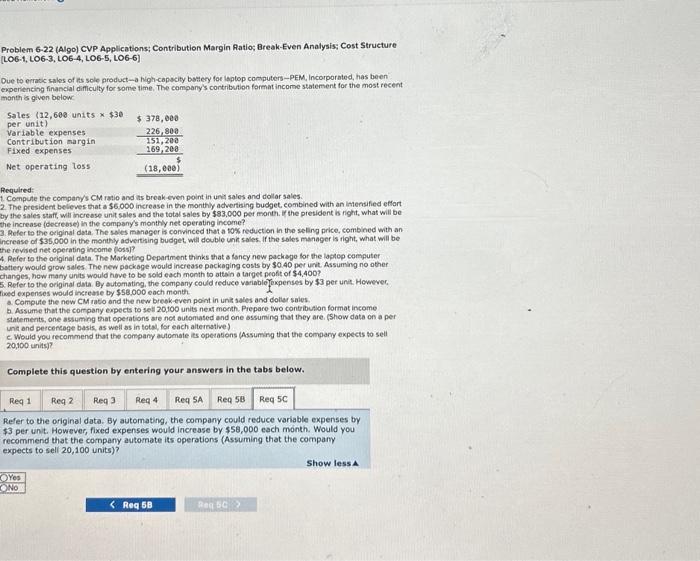

Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO6-1, LOG-3, LO6-4, LOG-5, LOG-6] Due to erratic saies of its sole product-a high-capscily batiery for iaptop computers-PEM, Incerperated, has been experiencing thancial difficulty for some time. The company's contribution format income statement for the most recent month is given below; Aequired: 1. Compute the company/s CM ratio and its break-even point in unit sales and dolar salos. 2. The presidect believes that a $6,000 increese in the monthly advertising budget, cembined with an intensified effort the increase (decrease) in the company's monthy net operating income? 3. Acfer to the original data. The sales manoger is convinced that a tok reduction in the selling price, combined with an increase of $35.000 in the monthly advertising budget will double unit soles. If the sales manager is right, what will be the revised net operating income foss)? 4. Refer to the eriginal data. The Marketing Department thinks that a fancy now pockage for the laptop computer battery would grow sales. The new package would increase pockaging costs by 5040 per unit. Assuming no other changes, how many units would have to be sold eech month to attain a target prott of 54,400 ? 5. Aeter to the original data. Hy automating the company could reduce vanable expenses by $3 oer unit, However, fixed expenses would incrense by $58,000 each menth a. Compute the new CM ratio and the new break-even polnt in unit sales and doller sales b. Assume that the company expects to sell 20.00 units next morth Prepare two contribution format income itatements, one assuming that eperations are not astomated and one assuming that they are, (Show data on a per unit and percentage bass, as well as in total, for esch alternative) c. Would yourecommend that the company automste its operations (Assuming that the company expects to sell 20,000 units)? Complete this question by entering your answers in the tabs below. Compute the company's CM ratio and its break-even point in unit sales and doular sales. (Do not round intermediate calculations, Round " CM ratio" to the nearest whole percentage (c1eu,0.234 should be entered as 23). Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LOG-1, LOG-3, LOG-4, LOG-5, LOG-6] Due to erratic sales of its sole product-a high-capacity battery for loptop computers-pEM, incorporated, has been experiencing financial dificulty for some time. The compary's contribution format inceme statement for the most recent month is given below Required: 1. Compute the company's CM ratio and its breakeven point in unit sales and dollar sales: 2. The president believes that a $6,000 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will increase unit sales and the total sales by $83,000 per month. If the president is right, what will be the increase (decrease) in the company's monthly net operating income? 3. Refer to the original data. The sales manager is cemvinced that a tos reduction in the selling price, combined with an increase of $35,000 in the monthly advertising budget, will double unit sales, If the seles manager is right, what will be the revised net operating income (loss)? 4. Refer to the original data. The Marketing Department thinks that a fancy new pockage for the laptop computer battery would grow sales. The new package would increase packaging costs by 50.40 per unit. Assuming no other changes, how many units would have to be sold each month to attain a torget profit of $4,400 ? 5. Refer to the original data. By autemating, the company could reduce voriable expenses by $3 per unit However. fixed expenses would increase by $58,000 each month. a. Compute the new CM ratio and the new break-even point in unit sales and dollar sales. b. Assume that the company expects to sell 20,100 units next month, Prepare wo contribution tormat income statements, one assuming that operations are not automated and one assuming that they are. (Show data on a per unit and pereentage basis, as well as in total, for each alternative) c. Would you recommend that the company automate its operations (Assuming that the compary expects to sed 20,100 units?? Complete this question by entering your answers in the tabs below. The president believes that a $6,000 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will increase unit sales and the total sales by $83,000 per month. If the president is right, what will be the increase (decrease) in the company's monthly net operating income? (Do not round intermediate calculations.) Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LOG-1, LOG-3, LOG-4, LOG-5, LOG-6] Due to erratic sales of its sole preduct-i high-capacily battery for laptop compusers-PEM, incorporated, has be-en experiencing financial difficulty for some time. The company's contribution format income statement for the most recent month is given below: Required: 1. Compute the company's CM ratio and its break-even point in unit sales and dol ar salos. 2. The president believes that a $6,000 increase in the monthly advertising budget, combined with an intensified effort by the sales staft, will increase unit soles and the total salos by $83,000 per month. If the president is right what will be the increase (decreese) in the company's monthy net operating income? 3. Refer to the original data. The sales manager is convinced that a 10% reduction in the seling arice, combined with an increase of $35,000 in the monthly advertesing budget, will double unit soles. If the sales manager is tight, what will be the revised net operating income foss)? 4. Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would grew sales. The new package would increase peckaging costs by $0.40 per unit, Assuming no other changes, how many units would have to be sold each month to atiain a target profit of 54,400 ? 5. Refer to the original data. By automating. the company could reduce variable expenses by $3 per unit. Howevet, fixed expenses would increase by $58,000 each month a Compute the new CM ratio and the new breakeven point in unit sales and dolar sales b. Assume that the compary expects to ses 20,100 units next month. Prepare wo contibution format income statements, one assuming that operations are not automated and one assuming that they are. [Show data on a pel unit and percentage basis, as well as in total, fer each alteinative) c. Would you recommend that the company automate ats operations (Assuming that the company expects to sed 20,00 units)? Complete this question by entering your answers in the tabs below. Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price, combined with an increase of $35,000 in the monthly advertising budget, will double unit sales. If the sales manager is right, what will be the revised net operating income (loss)? (Losses should be entered as a negative value.) Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LOG1,LOG3,LOG4,LOG5, LOG-6] Due to erratic sales of its sole product-a high-capacily battery for loptop computers-PEM, incorporated, has been Due to erratic sales of its sole prodvct-a high-capaciay battery for loptop computers-PEM, incorporated, thas been month is given below: Requlred 1 Compue the company's CM ratio and its break-even point in unit sales and dollar sales- 2. The president believes that a $6,000 increase in the monthly advertising budgot, combined with an intensified effort by the sales statf, will increase un: sales and the total sales by $83,000 per month, if the president is right, what wal be the increase (decrease) in the compsny's monthly net operating income? 3. Refor to the original data. The saies manager is convinced that a 10 s reduction in the seling price, combined with an increase of $35,000 in the monthly advertising budget, will double unit sales. If the sales manager is right, what will be the revised net operating income (oss)? 4. Refer to the original data. The Marketing Depsrtment thinks that a fancy new package for the laptop computer battery would grow sales. The new package would increbse pockaging costs by $0.40 per unit. Assuming no other changes, haw many units would have to be sold each month to atiain a target profit of 54,400 ? 5. Refer to the original data, Ey automating, the company could reduce variable expenses by $3 per unit However, ficed expenses would increase by $58,000 each month. a. Compute the new CM ratio and the new break-even point in unit soles and dolar sales. b. Assume that the company expects to sell 20,100 units next morth. Prepare two contribution format income statements, one assuming that operations are not autemated and one assuming that they are. (5how data on a per unit and percentage basis, as well as in totat, for each alternathe) c. Would you recommend that the company astomate its operations (Assuming that the company expects to sell 20,100 units)? Complete this question by entering your answers in the tabs below. Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would grow sales. The new packoge would increase packaging costs by $0.40 per unit, Assuming no other changes, how many units would have to be sold each month to attain a target profit of $4,400? (Do not round intermediate calculations. Round final answer up to the nearest whole unit.) Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO61,LOG3,LOG4,LOG5,LOG6] Doe to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM, Incorperated, has been experiencing financibl difficulty for some time. The company's contribution formst income statement for the inost recent month is glven below: Required: 1 Compthe the company's CM ratio and iss beeak-even point in unit sales and dollar saler. 2. The president beseves that a $6,000 increase in the monthly advertising budget, comoined with an intensified elfort by the sales staft will increase und sales and the total sales by $83,000 per mont. If the president is right, what wal be the increase (decresse) in the compary's monthly net operating income? 3, Aefer to the onginal data. The sales manager is cenvinced that a fos reduetion in the seaing price, combined wth an increase of $35,000 in the monthly advertising budget will double unit sales. If the sales manager is right, what will be the revised net operating incorme floss]? 4. Aefer to the original dats. The Marketing Department thinks that a fancy new package for the laptop computer bstiery would grew sales. The new package would increase packaging costs by $0.40 per unit. Assuming no other changes, how many units would have to be sold each month to ottain a target peoft of $4,400 ? 5. Refer to the orlgind data. By automating, the company could reduce varable expenses by $3 per unit However, fired expenses would increase by $58,000 each month. a. Compute the new CM ratio and the new break-even point in unit sales and dellar sales b. Assume that the company expects to sel 20109 units next merth. Prepare wo contribution format income statements, one assumng that operations are not automated and one assuming that they are. (Show dats on a per unit and percentage basis, as well as in total, for each alternative) c. Would you recommend that the company automate its operations (Assuming that the company expects to se: 20,100 inits? Cemplete this question by entering your answers in the tabs below. Refer to the original data. By automating, the company could reduce variable expenses by $3 per unit. However, foxed expenses would increase by $58,000 each month. Compute the new CM ratio and the new break-even point in unit sales and dollar sales, (Do not round intermediate calculations, Round " CM rabo" to the nearest whole percentage (1,e4,0.234 shiould be entered as "23"), round "Break-even polnt in unit sales" up to the nearest whole urit and round "Break-even point in dollar sales" to the nearest whole dollar) equired: Compute the company's CM ratio and its break-even point in unit soles and dollar sales The president believes that a $6,000 increase in the monthly advertising budget, combined with an intensified effort y the sales stafe, will increase unit sales and the total sales by $83,000 per month. If the president is right, what will be he increase (decrease) in the company's monthly net operating income? Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price, combined with an crease of $35,000 in the monthly advertising budget, will double unit sales. If the sales manager is right, what will be e revised net operating income (loss)? Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer attery would grow sales. The new package would increase packaging costs by $0,40 per unit. Assuming no other nanges, how many units would have to be sold each month to attain a target profit of $4,400 ? Refer to the original dato. By automating, the company could reduce voriable expenses by $3 per unit. However. ced expenses would increase by $58,000 each month. a. Compute the new CM ratio and the new break-even point in unit sales and dollar sales. b. Assume that the company expects to sell 20,100 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. (Show data on a per unit and percentage basis, as well as in total, for each alternative) c. Would you rocommend that the company automate its operations (Assuming thot the company expects to sell 20,100 units)? Complete this question by entering your answers in the tabs below. Refer to the original data. By automating, the company could reduce variable expenses by $3 ber unit. However, fixed expenses would increase by $58,000 each month. Assume that the company expects to sell 20,100 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. 'Show data on a per unit and percentage basis, as well as in total, for each alternative.) (Do hot round your intermediate calculations. Round your percentage answers to the nearest whole number.) Problem 6-22 (Algo) CVP Applicatons; Contribution Margin Aatio; Break-Even Analysis; Cost Structure. Due to errack sales of its sole groduct-a high-capacity bstiery for isptop computers - PEM, Incorporated, has been experiencing financial difficulty for some time. The company's contribution forenat income statement for the most recent manth is given below: Required: 1. Compute the company/ CM ratio and its broak-even point in und sales and dollor sales. 2. The president beleves that a 56.000 increase in the monthly advertising budget, combined with an latersified effort by the sales staft, wit increase unit sales and the total sales by $83,000 pet month. if the pretident is night, what will be the increase (decrebse) in the company's monthly net eperating income? 3. Refer to the eriginal dota. The soles manager is convinced that a toes reduction in the seling price, combined with an increase of $35,000 in the monthy advertising budget, will double unk sales. If the soles manager is right, what will be the revised net operating income goss]? 4. Rofer to the original data. The Marketing Department thinks that a fancy new packago for the lapteg cemputer bettery would grow sales. The new pockoge would increase pockoging costs by 90.40 per urit, Assuming no other changes, how many units would hove to be sold each month to attain a target peoft of 54,400 ? 5. Refer to the original deta. By automating, the company could reduce variablefowpenses by $3 per unit Hewever. fied expenses would increale by $58,000 each month a. Compute the new CM ratio and the new brekk-even point in unit sales and doliar saies. b. Assume that the cortpany expects to sell 20,100 units nest month. Prepare two contribusion format income statements, one assuming that operations are not automated and one assuming that they are. (Show data on a per unt and percencoge basis, as well as in total, for each alternstive) c. Would you recammend that the company automate its opetations (Assuming that the compary axpects to sell 20,100 units? Complete this question by entering your answers in the tabs below. Refer to the original data. By automating, the company could reduce variable expenses by $3 per unt. However, fixed expenses would increase by $58,000 each month. Would you recommend that the company automate its operations (Assuming that the company expects to sell 20,100 units)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts