Question: help please! Question 2 (Chapter 9) (a) Suzie is self-employed and travels from San Francisco to Sydney, Australia for a business trip. However, she also

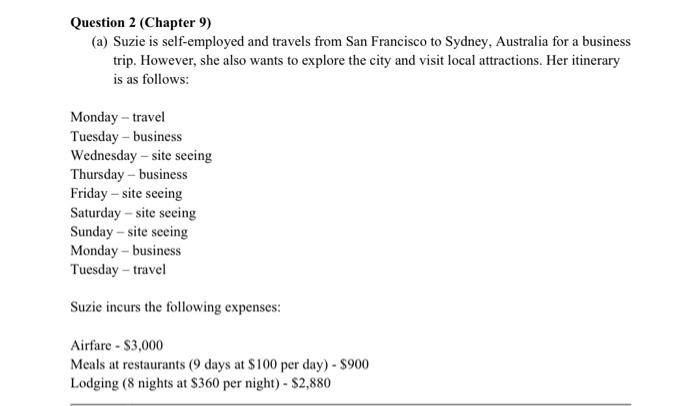

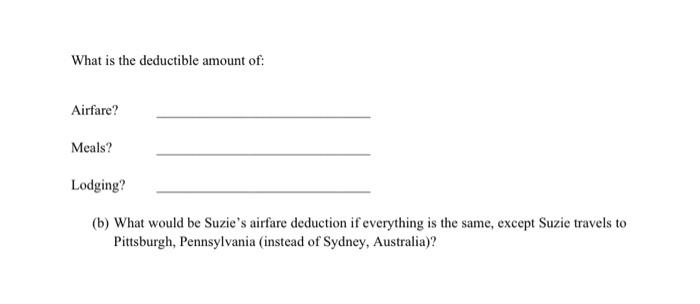

Question 2 (Chapter 9) (a) Suzie is self-employed and travels from San Francisco to Sydney, Australia for a business trip. However, she also wants to explore the city and visit local attractions. Her itinerary is as follows: Monday - travel Tuesday - business Wednesday - site seeing Thursday - business Friday - site seeing Saturday - site seeing Sunday - site seeing Monday - business Tuesday - travel Suzie incurs the following expenses: Airfare - \$3,000 Meals at restaurants ( 9 days at $100 per day) - $900 Lodging ( 8 nights at $360 per night) - \$2,880 What is the deductible amount of: Airfare? Meals? Lodging? (b) What would be Suzie's airfare deduction if everything is the same, except Suzie travels to Pittsburgh, Pennsylvania (instead of Sydney, Australia)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts