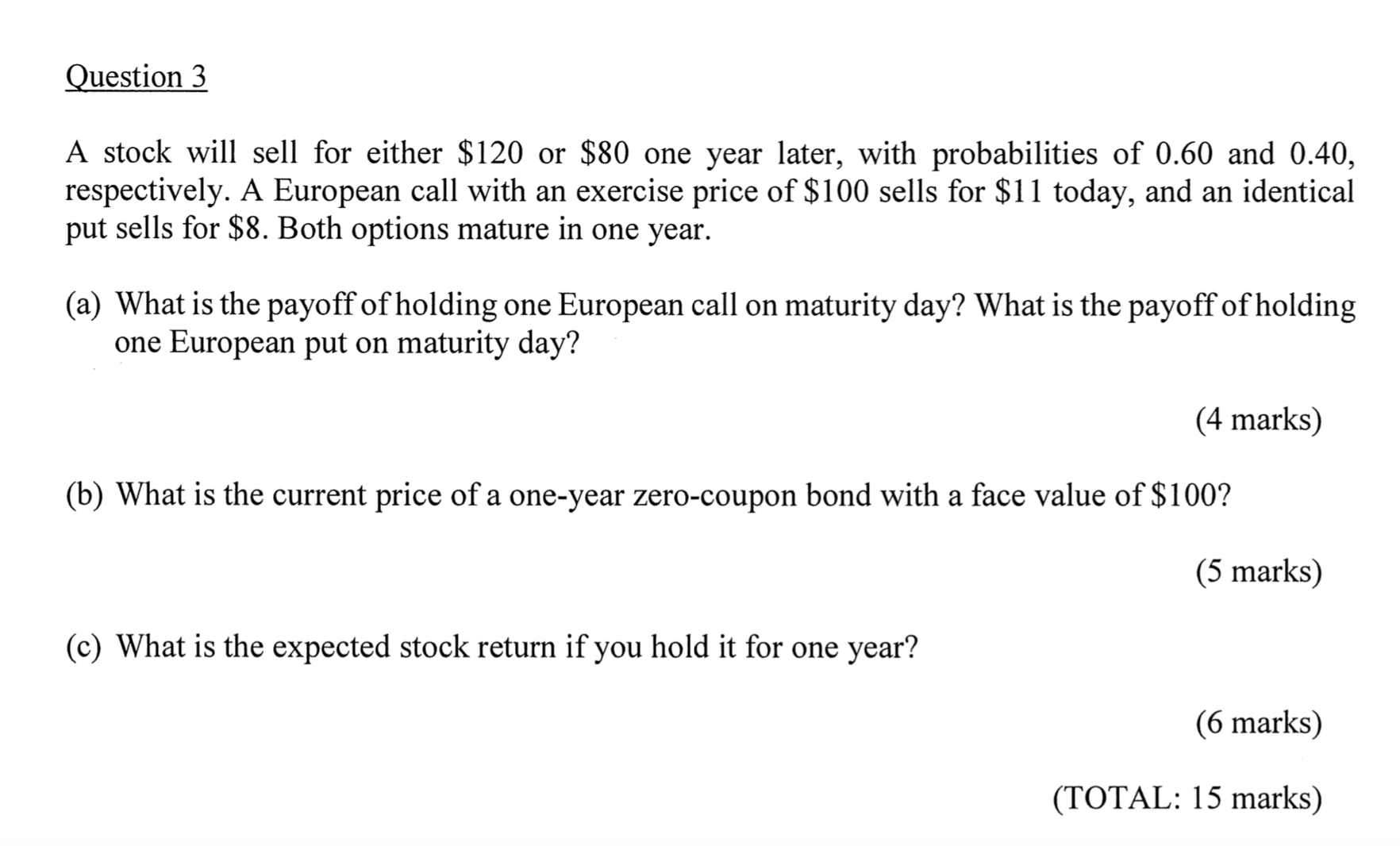

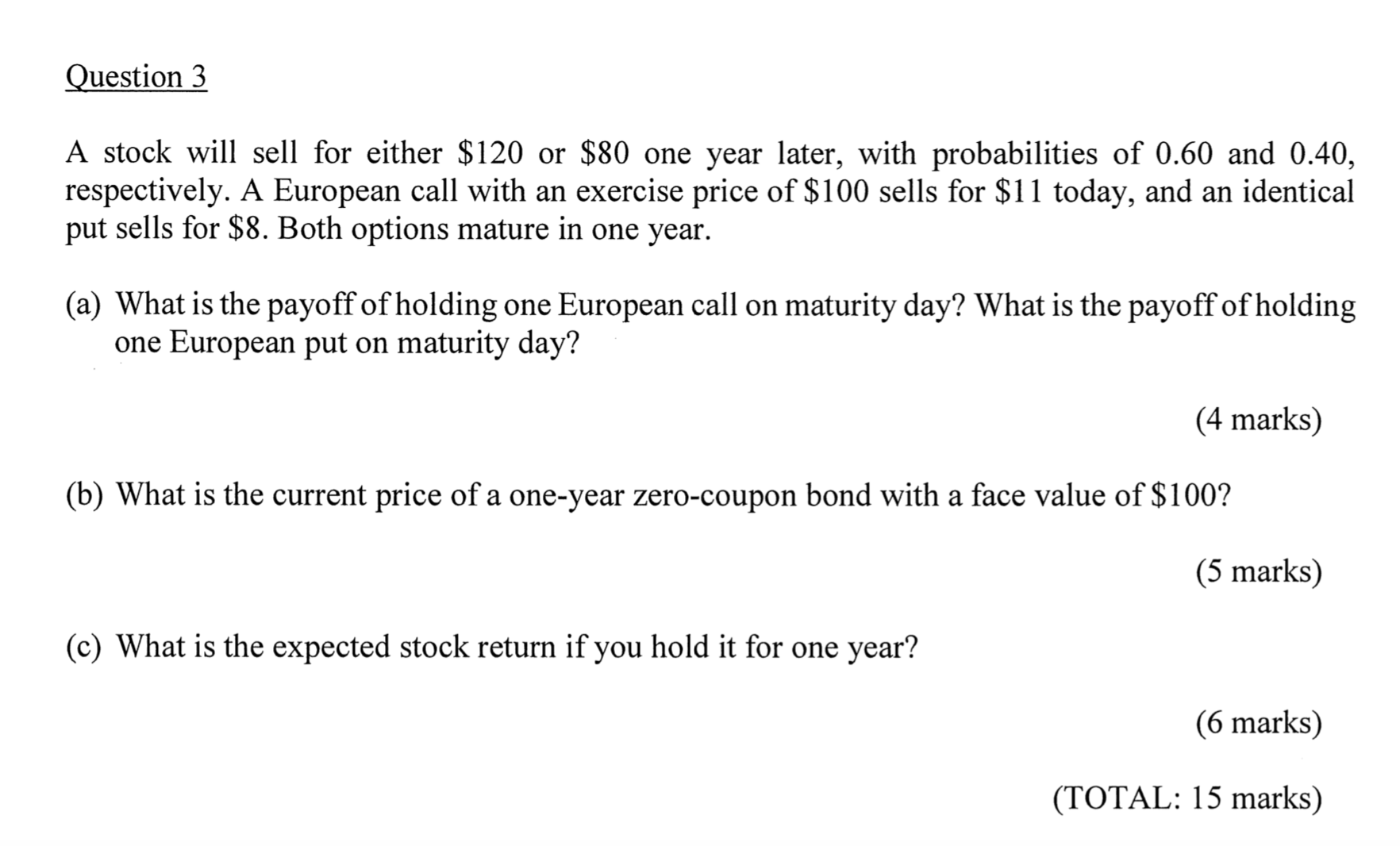

Question: Help please! Question 3 A stock will sell for either $120 or $80 one year later, with probabilities of 0.60 and 0.40, respectively. A European

Help please!

Question 3 A stock will sell for either $120 or $80 one year later, with probabilities of 0.60 and 0.40, respectively. A European call with an exercise price of $100 sells for $11 today, and an identical put sells for $8. Both options mature in one year. (a) What is the payoff of holding one European call on maturity day? What is the payoff of holding one European put on maturity day? (4 marks) (b) What is the current price of a one-year zero-coupon bond with a face value of $100? (5 marks) (0) What is the expected stock return if you hold it for one year? (6 marks) (TOTAL: 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts