Question: help please Question 4 1 pts 4. Given that quoted forward exchange rate for British pounds is $1.65, one can generate a riskless profit by

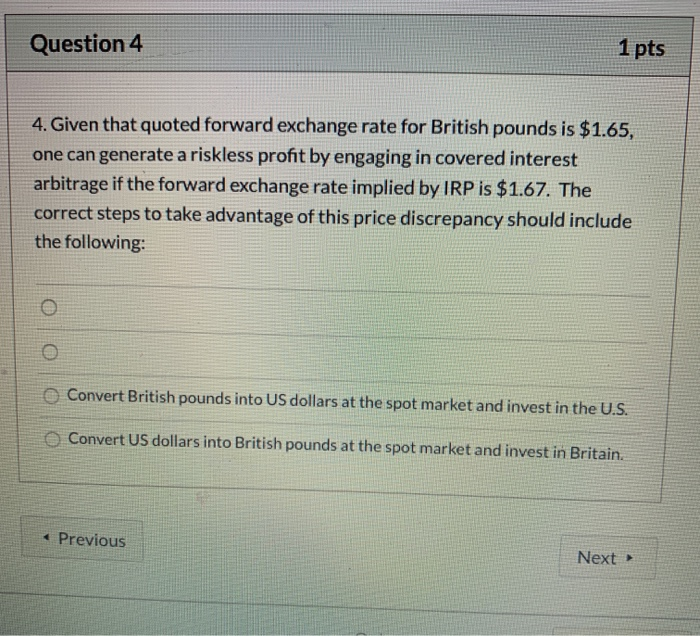

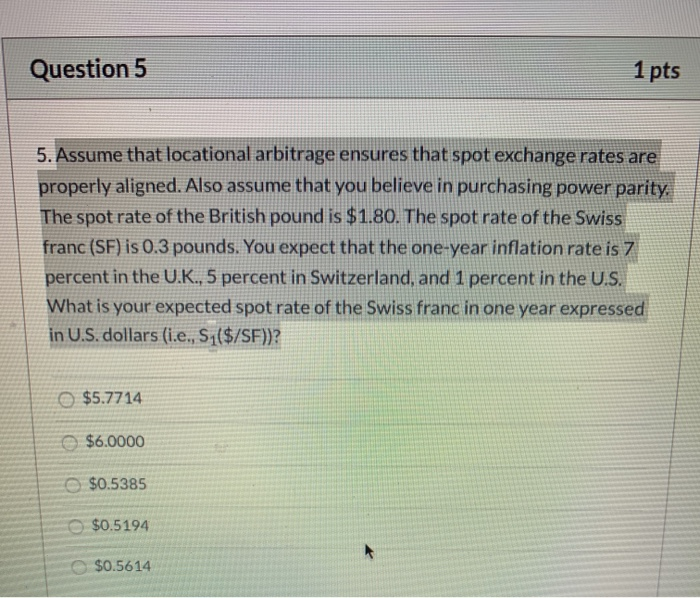

Question 4 1 pts 4. Given that quoted forward exchange rate for British pounds is $1.65, one can generate a riskless profit by engaging in covered interest arbitrage if the forward exchange rate implied by IRP is $1.67. The correct steps to take advantage of this price discrepancy should include the following: Convert British pounds into US dollars at the spot market and invest in the U.S. Convert US dollars into British pounds at the spot market and invest in Britain. Question 5 1 pts 5. Assume that locational arbitrage ensures that spot exchange rates are properly aligned. Also assume that you believe in purchasing power parity. The spot rate of the British pound is $1.80. The spot rate of the Swiss franc (SF) is 0.3 pounds. You expect that the one-year inflation rate is 7 percent in the U.K., 5 percent in Switzerland, and 1 percent in the U.S. What is your expected spot rate of the Swiss franc in one year expressed in U.S. dollars (i.e., Sy($/SF))? $5.7714 $6.0000 $0.5385 $0.5194 $0.5614

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts