Question: Help please Question 5 5 pts A firm is currently unlevered. Its equity Beta is 1.15. Assume the company will change its capital structure to

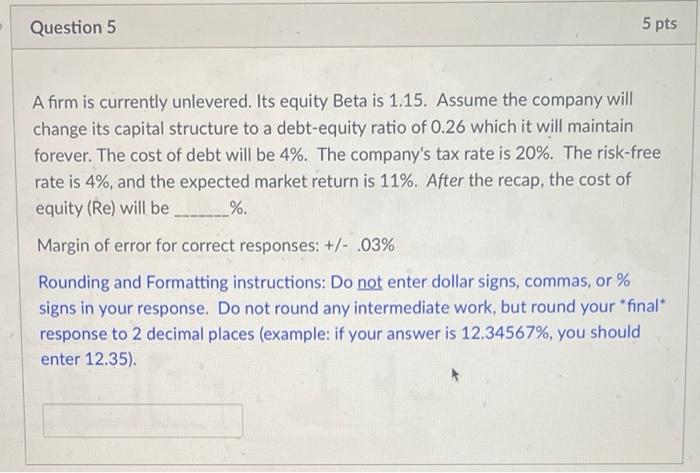

Question 5 5 pts A firm is currently unlevered. Its equity Beta is 1.15. Assume the company will change its capital structure to a debt-equity ratio of 0.26 which it will maintain forever. The cost of debt will be 4%. The company's tax rate is 20%. The risk-free rate is 4%, and the expected market return is 11%. After the recap, the cost of equity (Re) will be _%. Margin of error for correct responses: +/- .03% Rounding and Formatting instructions: Do not enter dollar signs, commas, or % signs in your response. Do not round any intermediate work, but round your "final response to 2 decimal places (example: if your answer is 12.34567%, you should enter 12.35)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts