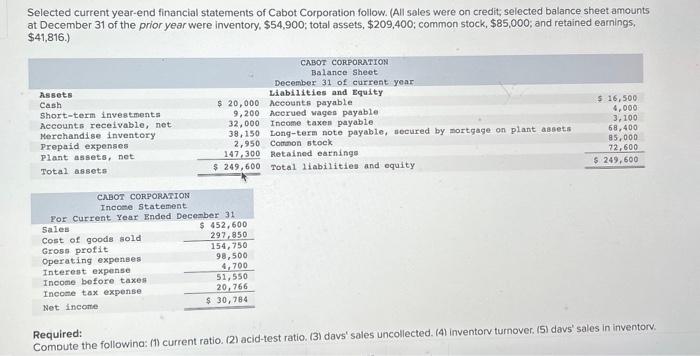

Question: help please Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6)

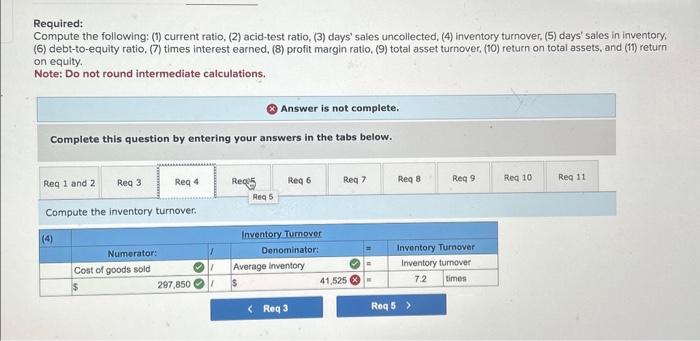

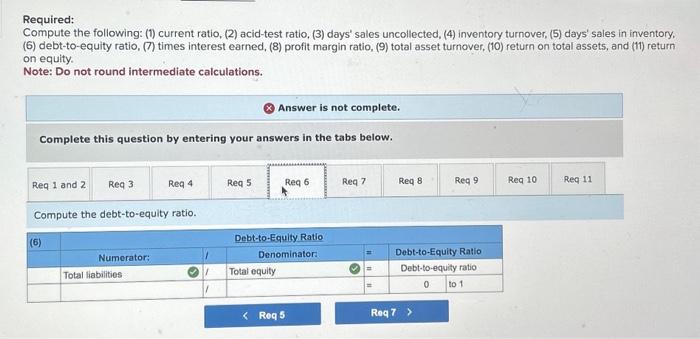

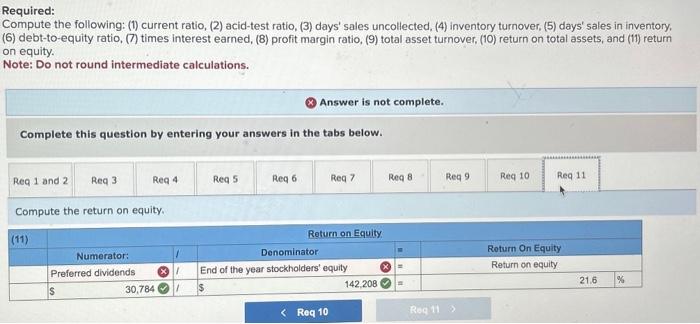

Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the inventory turnover. lequired: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, 6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the return on equity. Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $54,900; total assets, $209,400; common stock, $85,000; and retained earnings, $41,816.) Required: Comoute the followina: (1) current ratio. (2) acid-test ratio. (3) davs' sales uncollected. (4) inventorv turnover. (5) davs' sales in inventorv. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the debt-to-equity ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts