Question: help please show work 10. Saturn Inc. bought a machine on January 1, Year 1, for $400,000. Saturn uses the straight-line method of depreciation and

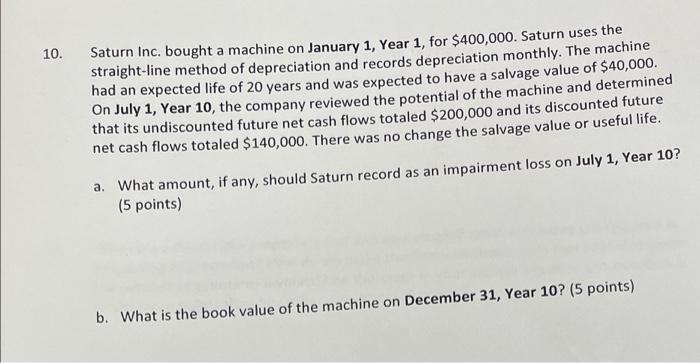

10. Saturn Inc. bought a machine on January 1, Year 1, for $400,000. Saturn uses the straight-line method of depreciation and records depreciation monthly. The machine had an expected life of 20 years and was expected to have a salvage value of $40,000. On July 1, Year 10, the company reviewed the potential of the machine and determined that its undiscounted future net cash flows totaled $200,000 and its discounted future net cash flows totaled $140,000. There was no change the salvage value or useful life. a. What amount, if any, should Saturn record as an impairment loss on July 1, Year 10? (5 points) b. What is the book value of the machine on December 31, Year 10? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts