Question: Help Please!! The excel sheets are attached below. The yellow blanks are what needs to be filled in. I also included the instruction sheet as

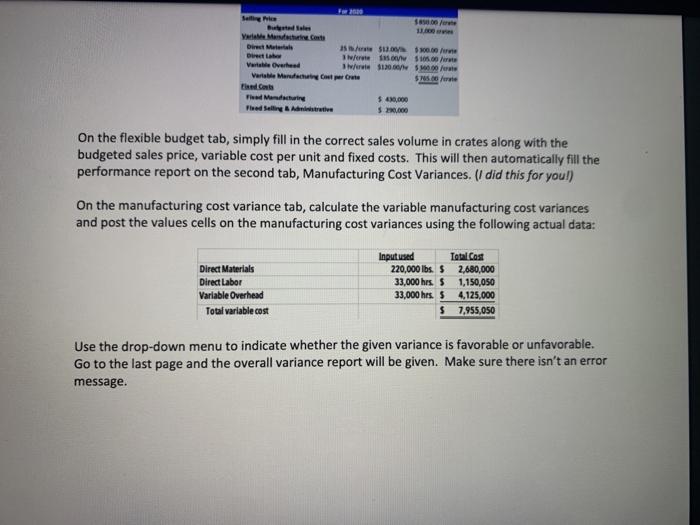

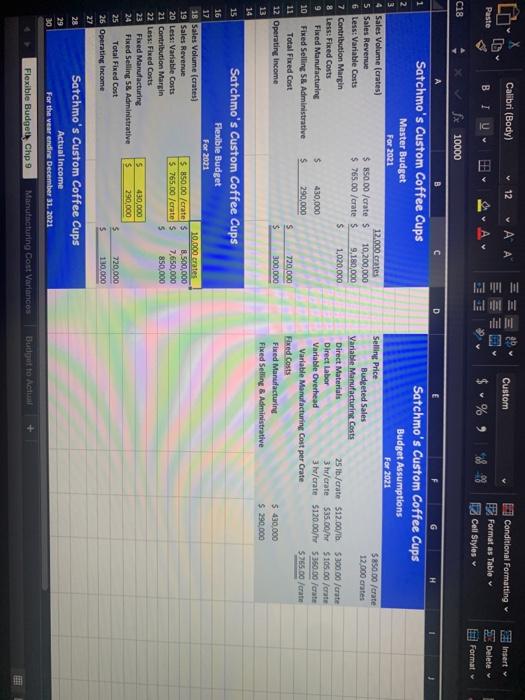

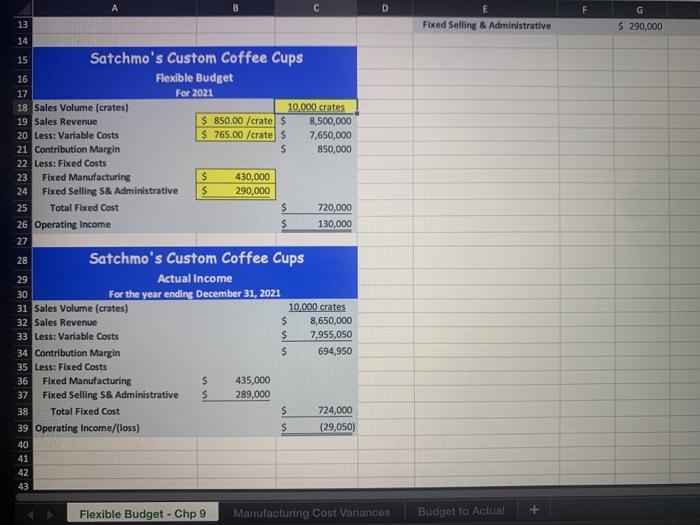

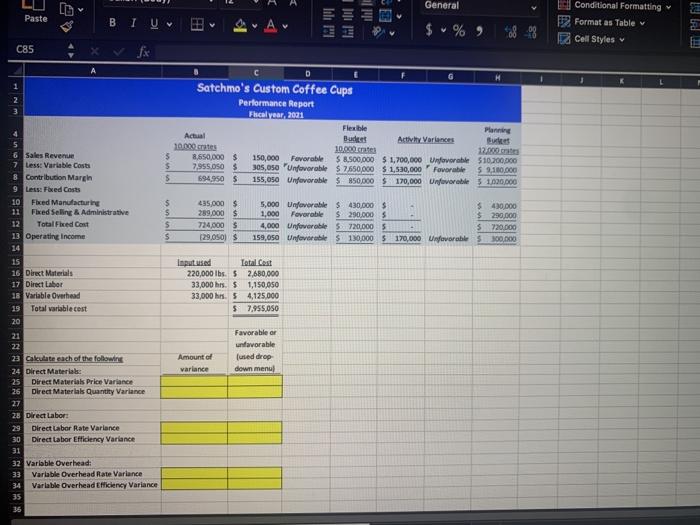

Selle talile | Ye Merce.com Direct Me Detta Vertele Overhead I. Sto. More VW 105.00 / $120.0 0.0 $430,000 $20.000 On the flexible budget tab, simply fill in the correct sales volume in crates along with the budgeted sales price, variable cost per unit and fixed costs. This will then automatically fill the performance report on the second tab, Manufacturing Cost Variances. (I did this for you!) On the manufacturing cost variance tab, calculate the variable manufacturing cost variances and post the values cells on the manufacturing cost variances using the following actual data: Direct Materials Direct Labor Variable Overhead Total variable cost Inputused Total Cost 220,000 lbs. $ 2,680,000 33,000 hrs. $ 1,150,050 33,000 hrs. 5 4,125,000 $ 7,955,050 Use the drop-down menu to indicate whether the given variance is favorable or unfavorable. Go to the last page and the overall variance report will be given. Make sure there isn't an error message. D G 13 Fixed Selling & Administrative $ 290,000 15 Satchmo's Custom Coffee Cups 16 Flexible Budget 17 For 2021 18 Sales Volume (crates) 10,000 crates 19 Sales Revenue $ 850.00 /crates 8,500,000 20 Less: Variable costs $ 765.00 /crates 7,650,000 21 Contribution Margin $ 850,000 22 Less: Fixed Costs 23 Fixed Manufacturing $ 430,000 24 Fixed Selling S8 Administrative s 290,000 25 Total Fixed Cost $ 720,000 26 Operating Income $ 130,000 27 28 Satchmo's Custom Coffee Cups 29 Actual Income 30 For the year ending December 31, 2021 31 Sales Volume (crates) 10,000 crates 32 Sales Revenue $ 8,650,000 33 Less: Variable costs $ 7,955,050 34 Contribution Margin $ 694,950 35 Less: Fixed Costs 36 Fixed Manufacturing s 435,000 37 Fixed Selling S& Administrative $ 289,000 38 Total Fixed Cost $ 724,000 39 Operating Income/(loss) $ (29,050) 40 41 42 43 Flexible Budget - Chp 9 Manufacturing Cost Variances Budget to Actual General Paste BIU $ % 9 El Conditional Formatting 2 Format as Table Cell Styles C85 2 3 D Satchmo's Custom Coffee Cups Performance Report Fhical year 2001 Flexible Planning Actual Budet Activy Varlences Burke 10000.crates 10,000 cute 12.000 $ 8,650,000 $ 150,000 Favorable $8.500.000 $1,700,000 Unfavorable 510.200.000 $ 7.955.00 $ 305,050 Unfoverable $ 7.650,000 $1,530,000 Favorable 59.100.000 $ 694,950 $ 155,050 Unfavorable $ 850,000 $ 170,000 Unfavorable 5 1.020.000 6 Sales Revenue 7 Less: Variable costs 8 Contribution Margin 9 Less: Feed Costs 10 Fixed Manufacturing 11 Faxed Selling & Administrative 12 Total Fixed Cost 13 Operating Income $ $ 5 $ 435,000 $ 289.000 $ 724,000 S 29.050) 5,000 Unfoveable $430,000 $ 1,000 Favorable $ 290,000 $ 4,000 Unfoverable 5.720.000 S 159,050 Unfovere S 130.000 5 $430,000 $ 290,000 5 720.000 170,000 Unfavorables 300,000 Inputused Total Cost 220,000 lbs. $ 2,680,000 33,000 hrs. 1,150,950 33,000 hrs. 5 4,125.000 5 7.955.050 Favorable or unfavorable used drop down menul Amount of variance 15 16 Direct Materials 17 Direct Labor 18 Variable Overhead 19 Total variablecest 20 21 22 23 Calculate each of the following 24 Direct Material: 25 Direct Materials Price Variance 26 Direct Materials Quantity Variance 27 28 Direct Labor: 29 Direct Labor Rate Variance 30 Direct Labor Efficiency Variance 31 32 Variable Overhead: 33 Variable Overhead Rate Variance 34 Variable Overhead Efficiency Variance 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts