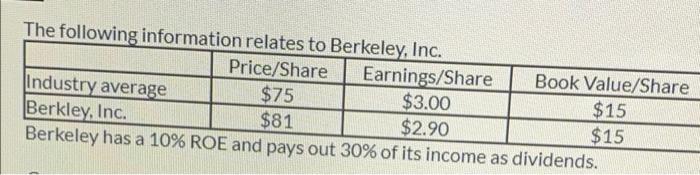

Question: Help please !!!! The following information relates to Berkeley, Inc. Price/Share Industry average $75 Berkley, Inc. $81 Berkeley has a 10% ROE and pays out

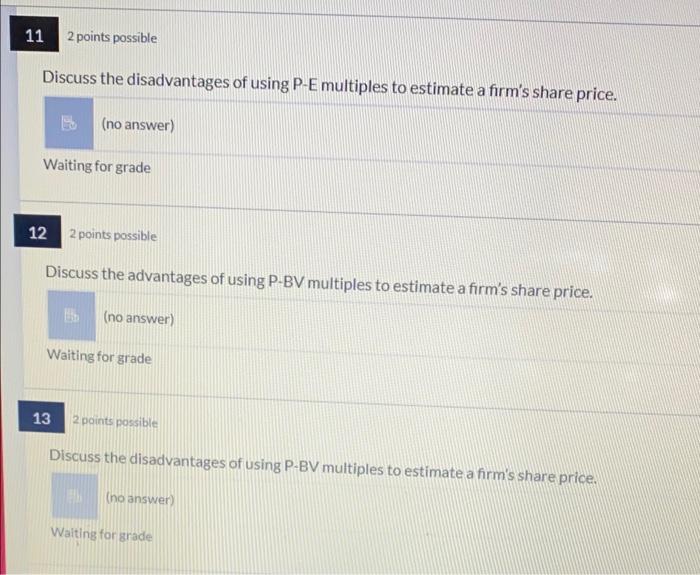

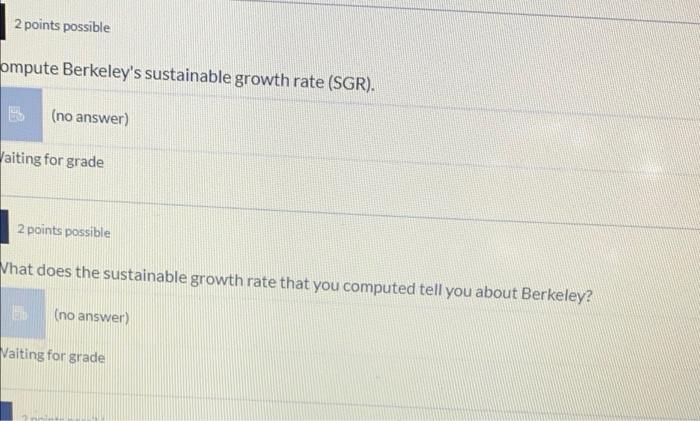

The following information relates to Berkeley, Inc. Price/Share Industry average $75 Berkley, Inc. $81 Berkeley has a 10% ROE and pays out 30% of its income as dividends. Earnings/Share $3.00 $2.90 Book Value/Share $15 $15 11 2 points possible Discuss the disadvantages of using P-E multiples to estimate a firm's share price. Waiting for grade (no answer) 12 2 points possible Discuss the advantages of using P-BV multiples to estimate a firm's share price. (no answer) 13 H Waiting for grade 2 points possible Discuss the disadvantages of using P-BV multiples to estimate a firm's share price. (no answer) Waiting for grade 2 points possible ompute Berkeley's sustainable growth rate (SGR). (no answer) Waiting for grade 2 points possible What does the sustainable growth rate that you computed tell you about Berkeley? (no answer) Vaiting for grade

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts