Question: help please :) The returns on Asset A have a standard deviation of 0.29, and those of B have a standard deviation of 0.13. If

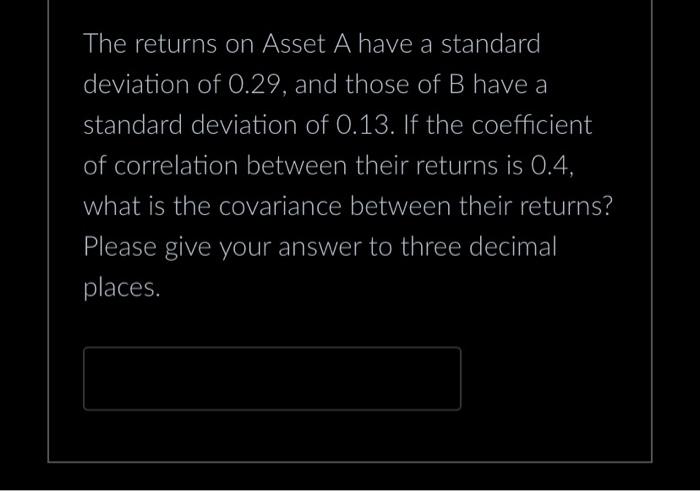

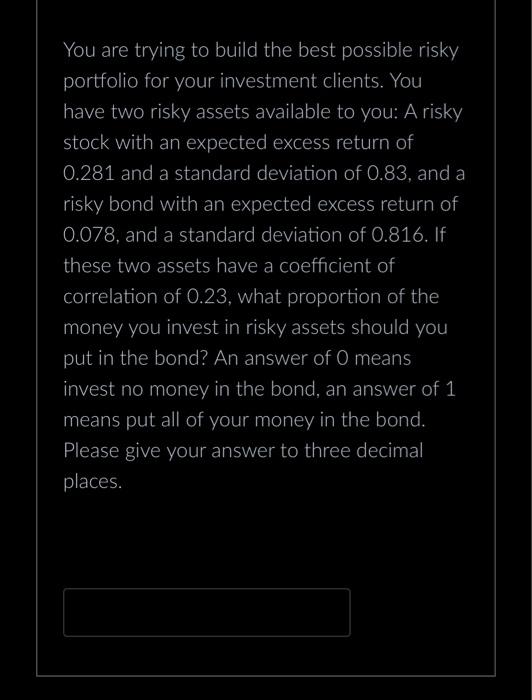

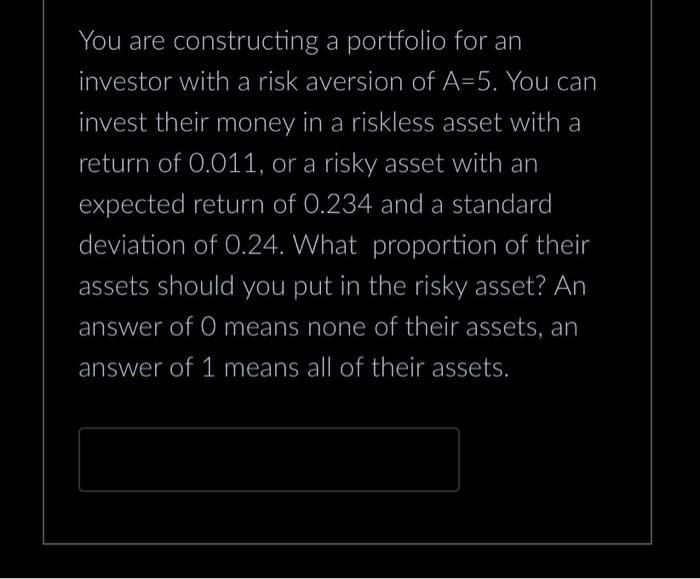

The returns on Asset A have a standard deviation of 0.29, and those of B have a standard deviation of 0.13. If the coefficient of correlation between their returns is 0.4, What is the covariance between their returns? Please give your answer to three decimal places. You are trying to build the best possible risky portfolio for your investment clients. You have two risky assets available to you: A risky stock with an expected excess return of 0.281 and a standard deviation of 0.83, and a risky bond with an expected excess return of 0.078, and a standard deviation of 0.816. If these two assets have a coefficient of correlation of 0.23, what proportion of the money you invest in risky assets should you put in the bond? An answer of O means invest no money in the bond, an answer of 1 means put all of your money in the bond. Please give your answer to three decimal places. You are constructing a portfolio for an investor with a risk aversion of A=5. You can invest their money in a riskless asset with a return of 0.011, or a risky asset with an expected return of 0.234 and a standard deviation of 0.24. What proportion of their assets should you put in the risky asset? An answer of O means none of their assets, an answer of 1 means all of their assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts