Question: help, please. these are three different questions. please pay attention to the instructions in each question. and I'm stuck on the ones i marked help

help, please.

these are three different questions. please pay attention to the instructions in each question. and I'm stuck on the ones i marked "help"

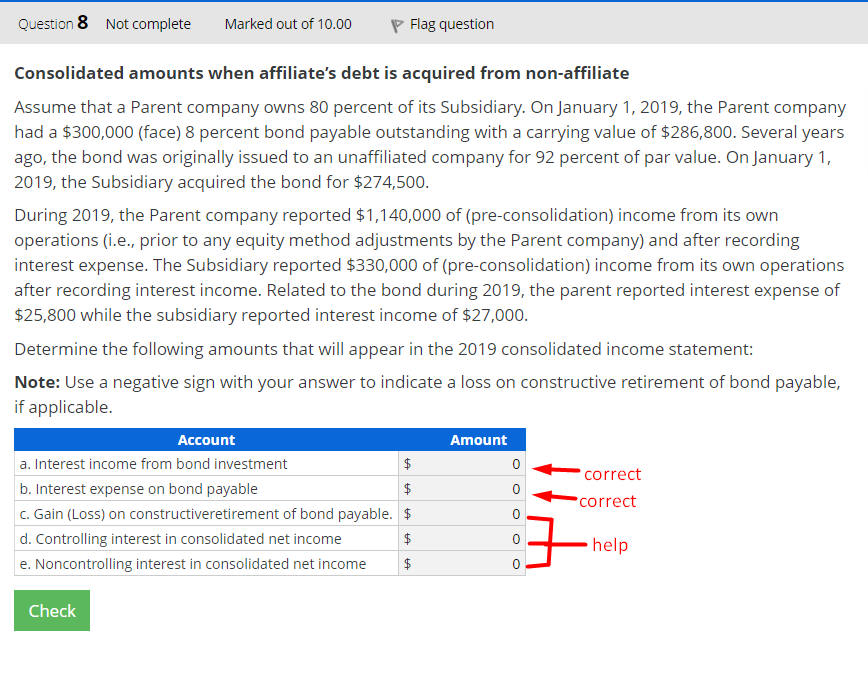

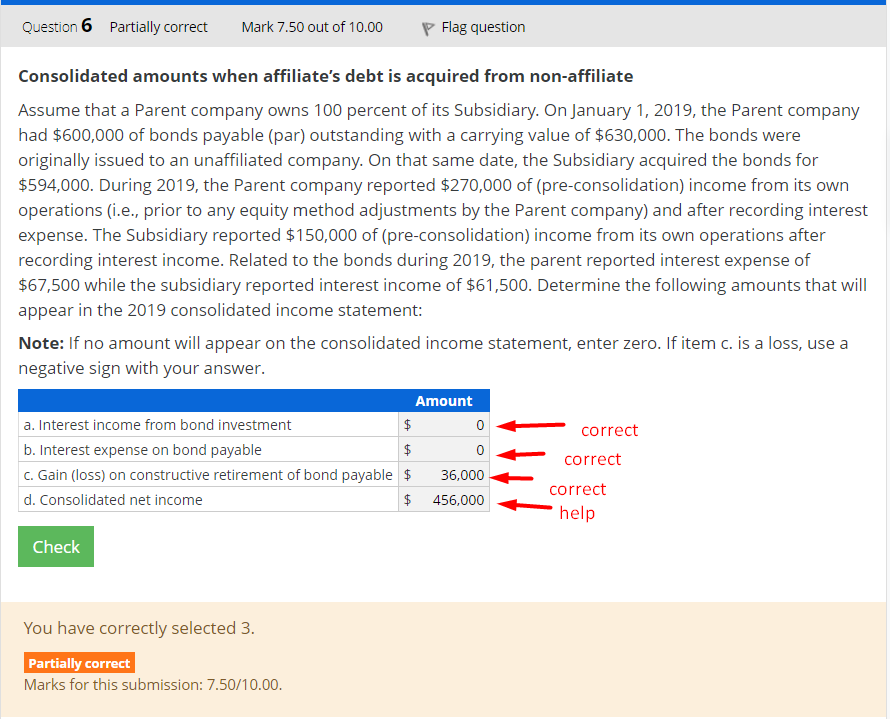

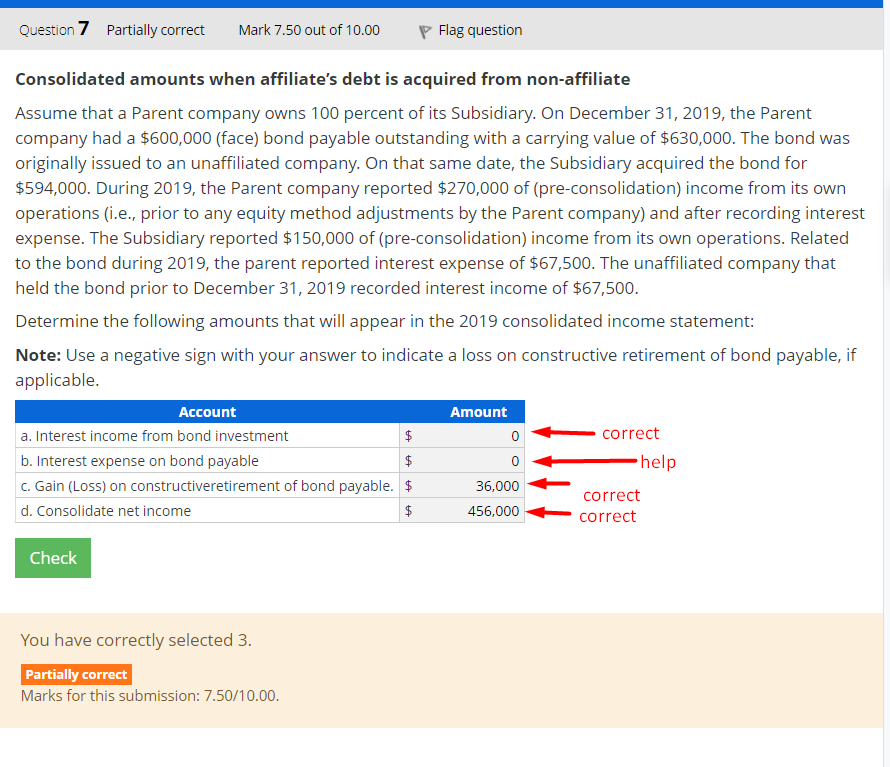

Question 8 Not complete Marked out of 10.00 Flag question Consolidated amounts when affiliate's debt is acquired from non-affiliate Assume that a Parent company owns 80 percent of its Subsidiary. On January 1, 2019, the Parent company had a $300,000 (face) 8 percent bond payable outstanding with a carrying value of $286,800. Several years ago, the bond was originally issued to an unaffiliated company for 92 percent of par value. On January 1, 2019, the Subsidiary acquired the bond for $274,500. During 2019, the Parent company reported $1,140,000 of (pre-consolidation) income from its own operations (i.e., prior to any equity method adjustments by the Parent company) and after recording interest expense. The Subsidiary reported $330,000 of (pre-consolidation) income from its own operations after recording interest income. Related to the bond during 2019, the parent reported interest expense of $25,800 while the subsidiary reported interest income of $27,000. Determine the following amounts that will appear in the 2019 consolidated income statement: Note: Use a negative sign with your answer to indicate a loss on constructive retirement of bond payable, if applicable. Account Amount a. Interest income from bond investment +A 0 correct b. Interest expense on bond payable +A 0 correct c. Gain (Loss) on constructiveretirement of bond payable. 0 d. Controlling interest in consolidated net income +A help e. Noncontrolling interest in consolidated net income +A 0 CheckQuestion 5 Partially correct Mark 2.50 out of 10.00 ? Flag question Consolidated amounts when afliate's debt is acquired from non-affiliate Assume that a Parent company owns 100 percent of its Subsidiary. On January 1, 2019, the Pa rent company had $600,000 of bonds payable (par) outstanding with a carrying value of $630,000. The bonds were originally issued to an unaffiliated company. On that same date, the Subsidiary acquired the bonds for $594,000. During 2019, the Parent company reported $270,000 of(preconso|idation} income from its own operations (i.e., prior to any equity method adjustments by the Parent company} and after recording interest expense. The Subsidiary reported $150,000 ot{preconsolidation) income from its own operations after recording interest income. Related to the bonds during 2019, the parent reported interest expense of $67,500 while the subsidiary reported interest income of $61,500. Determine the following amounts that will appear in the 2019 consolidated income statement: Note: If no amount will appear on the consolidated income statement, enter zero. If item c. is a loss, use a negative sign with your answer. a. Interest income from bond investment $ 0 all correct b. Interest expense on bond payable 15 0 '_ correct c. Gain {loss} on constructive retirement of bond payable $ 36.000 .1 d. Consolidated net income 15 456.000 \"623:? You have correctly selected 3. Partially correct Marks for this submission: 7.50.0 0.00. Question 7 Partially correct Mark 7.50 out of 10.00 ? Flag question Consolidated amounts when afliate's debt is acquired from non-affiliate Assume that a Parent company owns 100 percent of its Subsidiary. On December 31, 2019, the Parent company had a $600,000 (face) bond payable outstanding with a carrying value of $630,000. The bond was originally issued to an unafliated company. On that same date, the Subsidiary acquired the bond for $594,000. During 2019, the Parent company reported $270,000 of(preconsolidation} income from its own operations (i.e., prior to any equity method adjustments by the Parent company} and after recording interest expense. The Subsidiary reported $150,000 of{pre-consolidation) income from its own operations. Related to the bond during 2019, the parent reported interest expense of $67,500. The unaffiliated company that held the bond prior to December 31, 2019 recorded interest income of $67,500. Determine the following amounts that will appear in the 2019 consolidated income statement: Note: Use a negative sign with your answer to indicate a loss on constructive retirement of bond payable, if applicable. a. Interest income from bond investment $ 0 '1' correct 0. Interest expense on bond payable $ 0 _he|p c.Gain[Loss}on constructiveretirement of bond payable. $ 36,000 *I correct d. Consolidate net income $ 456,000 1. correct You have correctly selected 3. Marks for this submission: 7.50.0 0.00