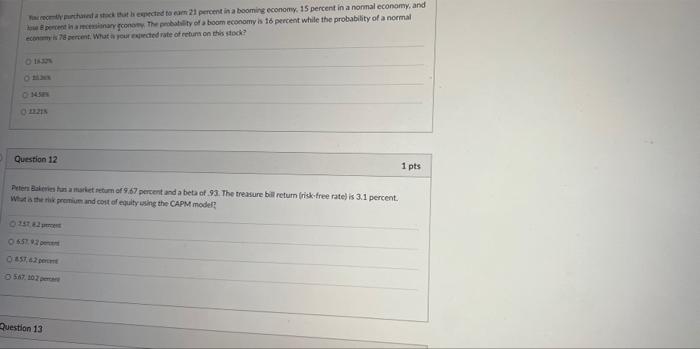

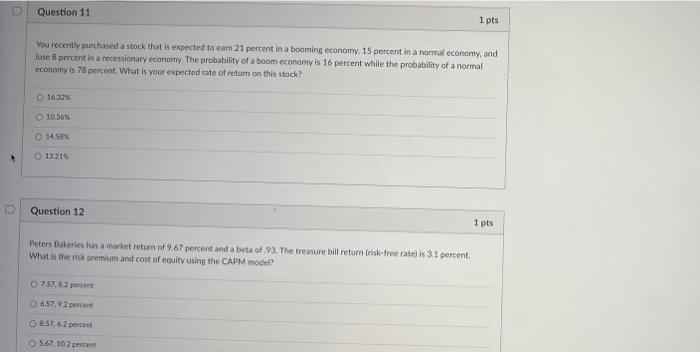

Question: help please these two rectly purchased a stock that is expected to eam 21 percent in a booming economy, 15 percent in a normal economy,

rectly purchased a stock that is expected to eam 21 percent in a booming economy, 15 percent in a normal economy, and ose percent in a recessionary gconomy. The probability of a boom economy is 16 percent while the probability of a normal economy is 78 percent. What is your expected rate of return on this stock? - 34.58 22218 Question 12 1 pts Peters Bakeries has a market return of 9.67 percent and a beta of 93. The treasure bill return (risk-free rate) is 3.1 percent. What is the risk premium and cost of equity using the CAPM model? 657.9.2 085762 Question 13 Question 11 1 pts You recently purchased a stock that is expected to earn 21 percent in a booming economy, 15 percent in a normal economy, and lose 8 percent in a recessionary economy. The probability of a boom economy is 16 percent while the probability of a normal economy is 78 percent. What is your expected rate of return on this stock? O 16.32% 10.36% O 14.58% 1321 Question 12: 1 pts Peters Bakeries has a market return of 9.67 percent and a beta of.93. The treasure bill return (risk-free rate) is 3.1 percent. What is the risk premium and cost of equity using the CAPM model? O7.57.8.2 portent O6.57,92 percent O857, 62 percent 5.67, 102 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts