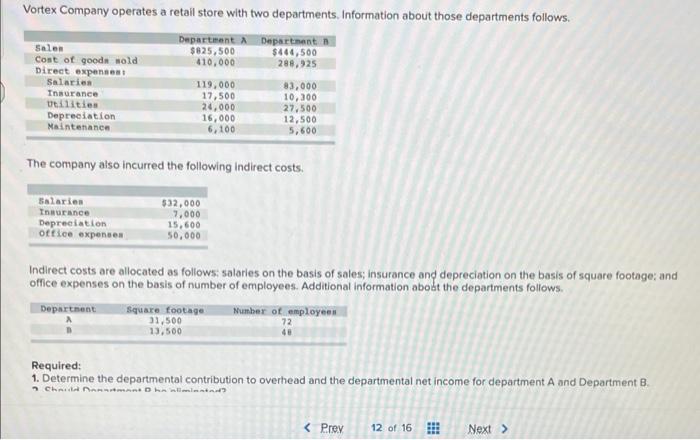

Question: help please! Vortex Company operates a retail store with two departments. Information about those departments follows. Department A $825,500 410,000 Department $444,500 288,925 Salon Cont

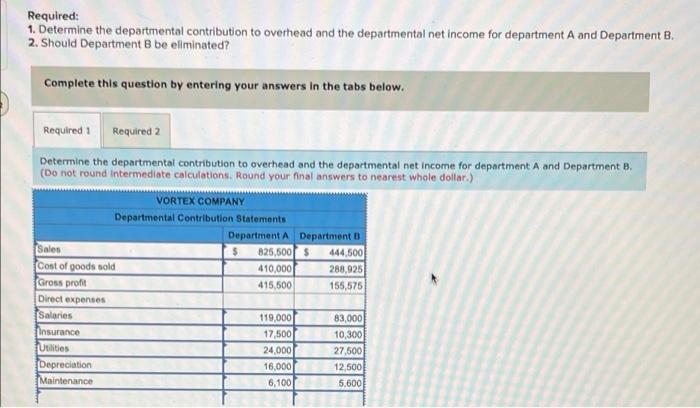

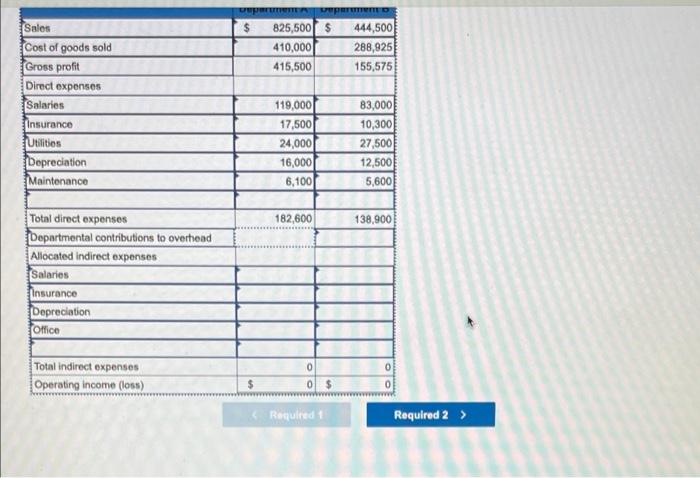

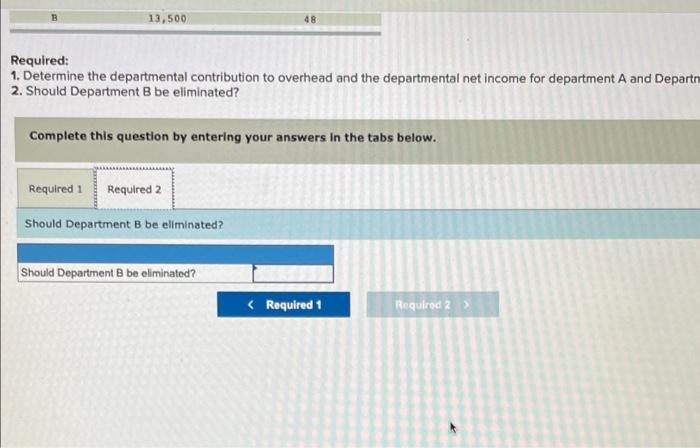

Vortex Company operates a retail store with two departments. Information about those departments follows. Department A $825,500 410,000 Department $444,500 288,925 Salon Cont of goods wala Direct expenses Salaries Insurance tilities Depreciation Maintenance 119,000 17,500 24,000 16,000 6.100 83,000 10,300 27,500 12,500 5,600 The company also incurred the following Indirect costs. Salaries Tourance Depreciation ottice expenses 532,000 7.000 15,600 50,000 Indirect costs are allocated as follows: salaries on the basis of sales; Insurance and depreciation on the basis of square footage and office expenses on the basis of number of employees. Additional information abost the departments follows Department square footage Number of employees 31.500 13,500 72 40 Required: 1. Determine the departmental contribution to overhead and the departmental net income for department A and Department B. Chandant Dhwani Required: 1. Determine the departmental contribution to overhead and the departmental net income for department A and Department B. 2. Should Department Bbe eliminated? Complete this question by entering your answers in the tabs below. Required: Required 2 Determine the departmental contribution to overhead and the departmental net income for department A and Department B. (Do not round Intermediate calculations, Round your final answers to nearest whole dollar) VORTEX COMPANY Departmental Contribution Statements Department Department B Sales $ 825,500 $ 444,500 Cost of goods sold 410,000 288,925 Gross profit 415,500 155,575 Direct expenses Salaries 119,000 83,000 Insurance 17,500 10,300 Utilities 24,000 27,500 Depreciation 16,000 12,500 Maintenance 5,600 6,100 up wepo 825,500 $ 444,500 410,000 288,925 415,500 155,575 Sales Cost of goods sold Gross profit Direct expenses Salaries Insurance Utilities Depreciation Maintenance 119,000 17,500 24,000 16,000 6,100 83,000 10,300 27,500 12,500 5,600 182,600 138,900 Total direct expenses Departmental contributions to overhead Allocated indirect expenses Salarios Insurance Depreciation Office Total Indirect expenses Operating income (loss) 0 0 $ $ 0 Required 1 Required 2 > 13,500 Required: 1. Determine the departmental contribution to overhead and the departmental net income for department A and Depart 2. Should Department B be eliminated? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Should Department B be eliminated? Should Department B be eliminated?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts