Question: Help! Pleased keep in the same format so i can read it. Thank you! Problem 17-11 Culver Corp. invested its excess cash in securities during

Help! Pleased keep in the same format so i can read it. Thank you!

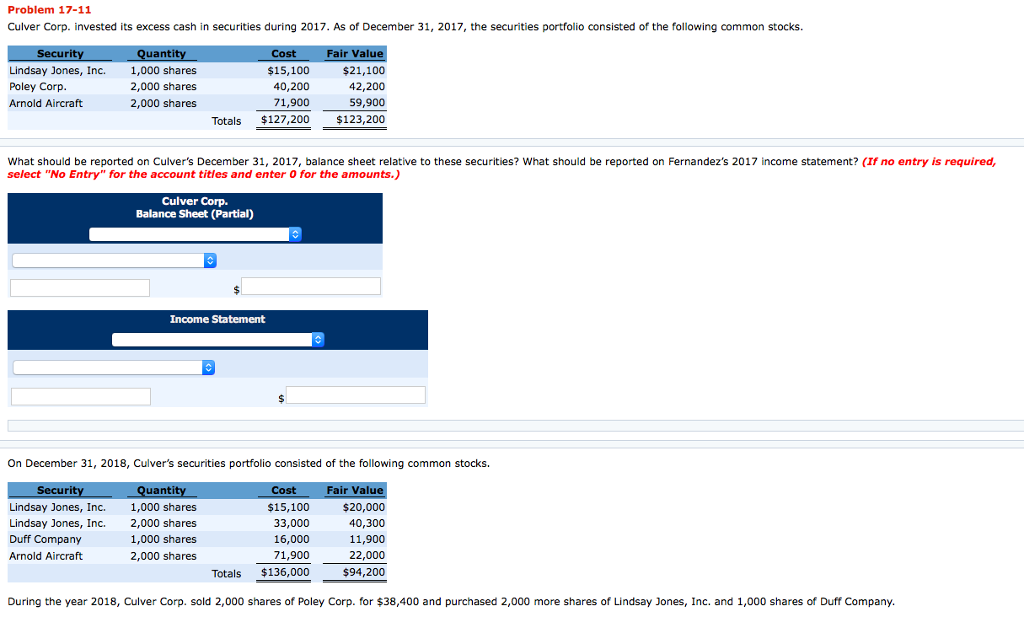

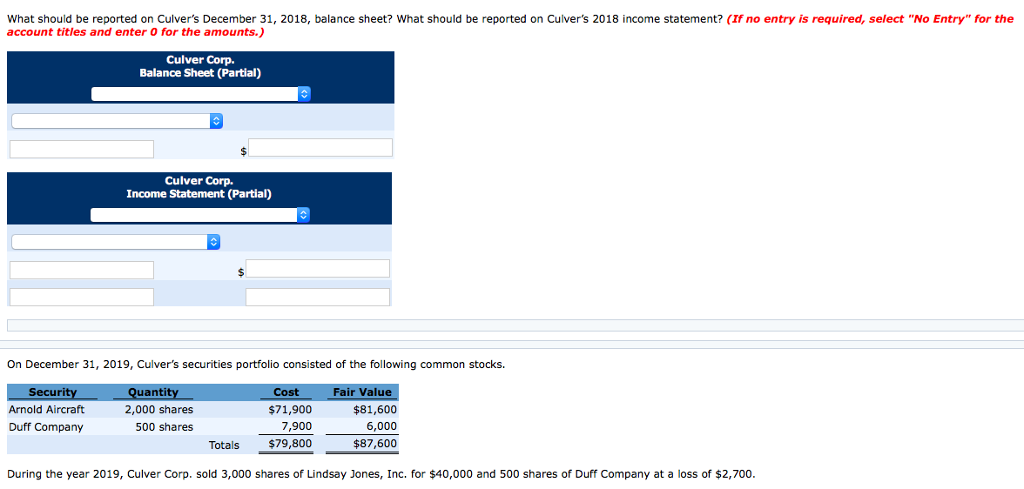

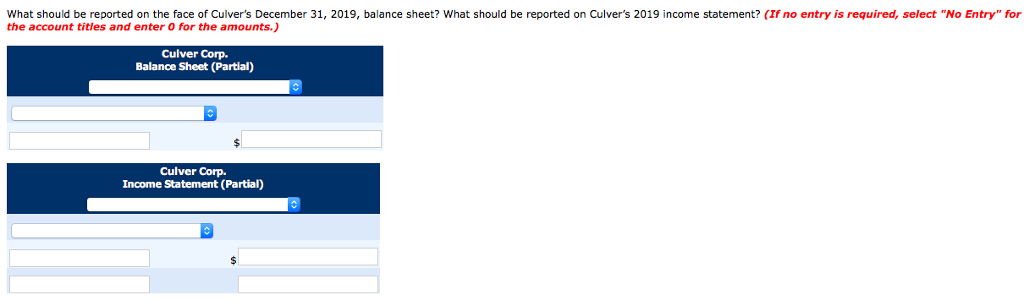

Problem 17-11 Culver Corp. invested its excess cash in securities during 2017. As of December 31, 2017, the securities portfolio consisted of the following common stocks. Quantity Security Cost Fair Value $15,100 Lindsay Jones, Inc. 1,000 shares $21,100 40,200 42,200 Poley Corp. 2,000 shares Arnold Aircraft 2,000 shares 71,900 59,900 Totals $127,200 $123,200 What should be reported on Culver's December 31, 2017, balance sheet relative to these securities? What should be reported on Fernandez's 2017 come statement? (If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Culver Corp. Balance Sheet (Partial) Income Statement On December 31, 2018, Culver's securities portfolio consisted of the following common stocks. Quantity Security Cost Fair Value $15,100 $20,000 Lindsay Jones, Inc. 1,000 shares 33,000 40,300 Lindsay Jones, Inc. 2,000 shares Duff Company 16,000 1,000 shares 11,900 22,000 1,900 Arnold Aircraft 2,000 shares Totals $136,000 $94,200 During the year 2018, Culver Corp. sold 2,000 shares of Poley Corp. for $38,400 and purchased 2,000 more shares of Lindsay Jones Inc. and 1,000 shares of Duff Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts