Question: help plis Problem 10-12 (Static) Understanding note disclosures and financial summary data LO 10-4, 10-5, 10-9 This problem is based on the 2020 annual report

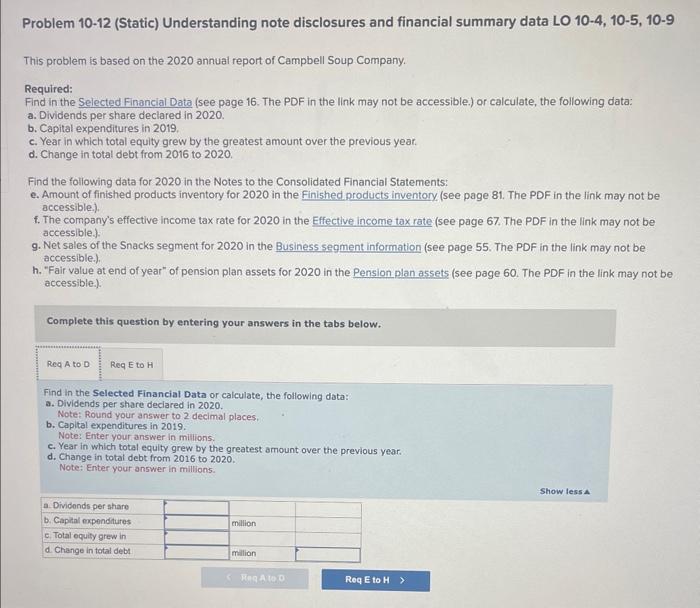

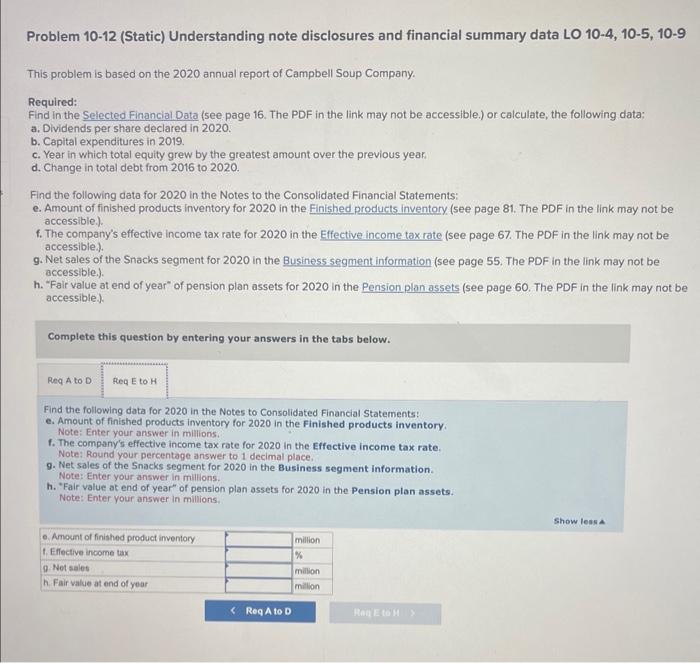

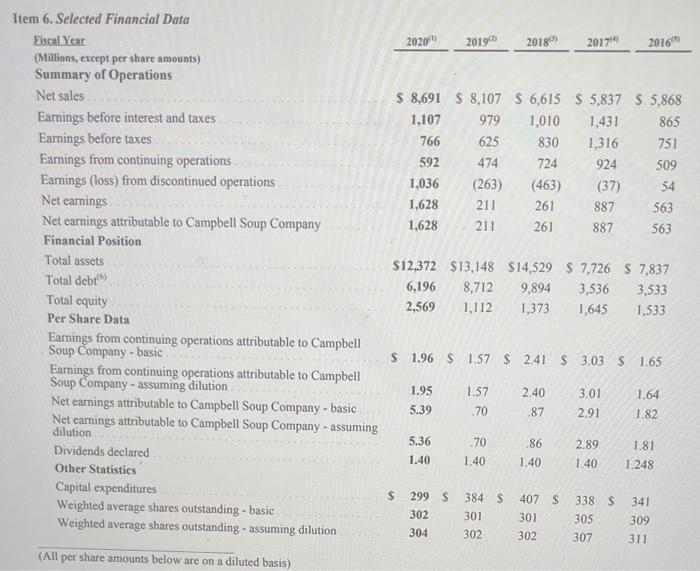

Problem 10-12 (Static) Understanding note disclosures and financial summary data LO 10-4, 10-5, 10-9 This problem is based on the 2020 annual report of Campbell Soup Company. Required: Find in the Selected Financial Data (see page 16. The PDF in the link may not be accessible.) or calculate, the following data: a. Dividends per share declared in 2020. b. Capital expenditures in 2019. c. Year in which total equity grew by the greatest amount over the previous year. d. Change in total debt from 2016 to 2020. Find the following data for 2020 in the Notes to the Consolidated Financial Statements: e. Amount of finished products inventory for 2020 in the Finished products inventory (see page 81 . The PDF in the link may not be accessible.). f. The company's effective income tax rate for 2020 in the Effective income tax rate (see page 67. The PDF in the link may not be accessible.). 9. Net sales of the Snacks segment for 2020 in the Business segment information (see page 55. The PDF in the link may not be accessible.). h. "Fair value at end of year" of pension plan assets for 2020 in the Pension plan assets (see page 60. The PDF in the link may not be accessible.). Complete this question by entering your answers in the tabs below. Find in the Selected Financial Data or calculate, the following data: a. Dividends per share deciared in 2020. Note: Round your answer to 2 decimal places. b. Capital expenditures in 2019 . Note: Enter your answer in millions: c. Year in which total equity grew by the greatest amount over the previous year. d. Change in total debt from 2016 to 2020. Note: Enter your answer in millions. Problem 1012 (Static) Understanding note disclosures and financial summary data LO 10-4, 10-5, 10-9 This problem is based on the 2020 annual report of Campbell Soup Company. Required: Find in the Selected Financial Data (see page 16. The PDF in the link may not be accessible.) or calculate, the following data: a. Dividends per share declared in 2020. b. Capital expenditures in 2019. c. Year in which total equity grew by the greatest amount over the previous year. d. Change in total debt from 2016 to 2020. Find the following data for 2020 in the Notes to the Consolidated Financial Statements: e. Amount of finished products inventory for 2020 in the Finished products inventory (see page 81 . The PDF in the link may not be accessible.). f. The company's effective income tax rate for 2020 in the Effective income tax rate (see page 67 . The PDF in the link may not be accessible). g. Net sales of the Snacks segment for 2020 in the Business segment information (see page 55 . The PDF in the link may not be accessible.). h. "Farr value at end of year" of pension plan assets for 2020 in the Pension plan assets (see page 60 . The PDF in the link may not be accessible.). Complete this question by entering your answers in the tabs below. Find the following data for 2020 in the Notes to Consolidated Financial Statements: e. Amount of finished products inventory for 2020 in the Finished products inventory. Note: Enter your answer in millions. 1. The company's effective income tax rate for 2020 in the Effective income tax rate. Note: Round your percentoge answer to 1 decimal place. 9. Net soles of the 5nacks segment for 2020 in the Business segment information. Note: Enter your answer in millions. h. "Fair value at end of year" of pension plan assets for 2020 in the Pension plan assets. Note: Enter your answer in millions. Item 6. Selected Financial Data Eiscal Year (Millions, exeept per share amounts) Summary of Operations Net sales Earnings before interest and taxes Earnings before taxes Earmings from continuing operations Earnings (loss) from discontinued operations Net earnings Net earnings attributable to Campbell Soup Company Financial Position Total assets Total debt (6) $8,691$8,107$6,615$5,837$5,868 Total equity Per Share Data 1,1077665921,0361,6281,628979625474(263)2112111,010830724(463)2612611,4311,316924(37)88788786575150954563563 Eamings from continuing operations attributable to Campbell Soup Company - basic Earnings from continuing operations attributable to Campbell Soup Company - assuming dilution Net earnings attributable to Campbell Soup Company - basic $12,3726,1962,569$13,1488,7121,112$14,5299,8941,373$7,7263,5361,645$7,8373,5331,533 Net earnings attributable to Campbell Soup Company - assuming. dilution Dividends declared Other Statistics $1.96$1.57$2.41$3.03$1.65 Capital expenditures Weighted average shares outstanding - basic Weighted average shares outstanding - assuming dilution 1.955.395.361.401.57.70.701.402.40.87.861.403.012.912.891.401.641.821.811.248 (All per share amounts below are on a diluted basis)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts