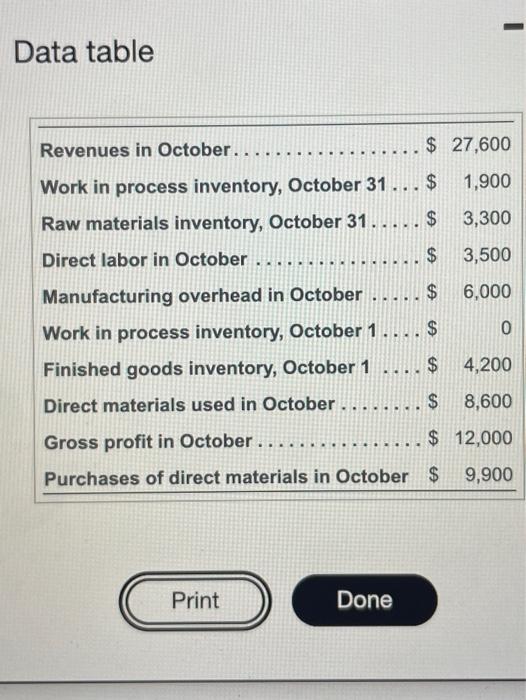

Question: help pls 2 Data table Revenues in October.. $ 27,600 . Work in process inventory, October 31 $ 1,900 Raw materials inventory, October 31. ....

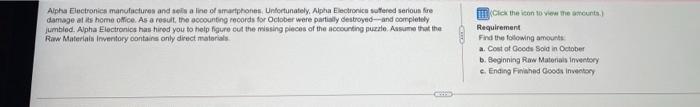

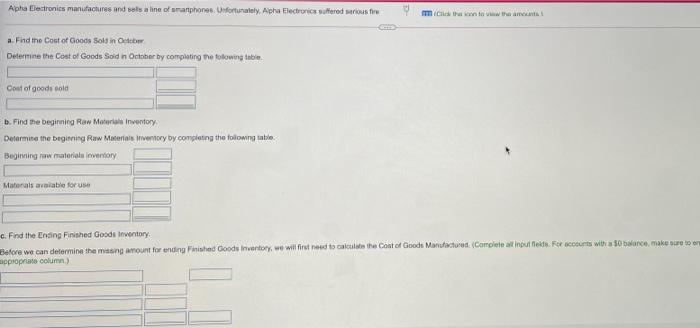

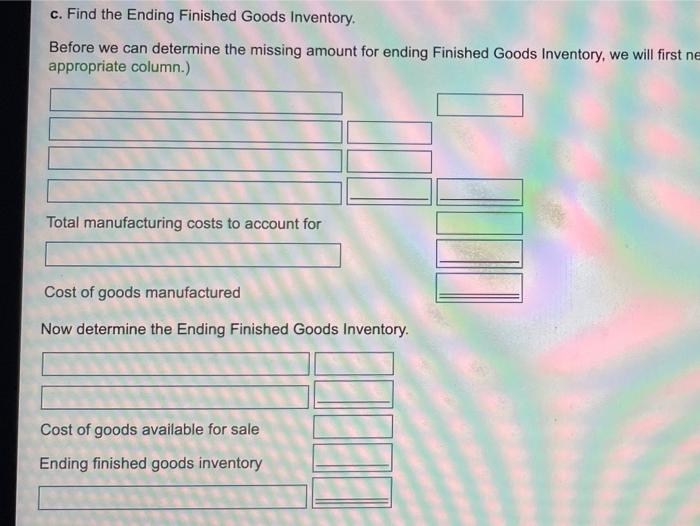

Data table Revenues in October.. $ 27,600 . Work in process inventory, October 31 $ 1,900 Raw materials inventory, October 31. .... $ 3,300 Direct labor in October $ 3,500 Manufacturing overhead in October ..... $ 6,000 Work in process inventory, October 1.... $ 0 Finished goods inventory, October 1.... $ 4,200 Direct materials used in October ........ $ 8,600 Gross profit in October .. $ 12,000 Purchases of direct materials in October $ 9,900 Print Done Alpha Electronics manufactures and in a line of smartphones. Unfortunately, Alpha Electronice suffered serioun fire damage at its home office. As a result, the accounting records for October were partially destroyed--and completely jumbled. Alpha Electronica has hired you to help figure out the missing pieces of the accounting puzzle Assume that the Raw Materials inventory contains only direct materials Click the icon to view the mounts Requirement Find the following amounts a. Cost of Goods Sold in October b. Beginning Raw Materials inventory c. Ending Finished Goods Inventory Apha Dectronics manufactures and selline of ra phones. Unfortunately, Alpha Electronics suffered aroufru mm/wat a. Find the cost of Goods Sold in tem Determine the cost of Goods Sold in October by completing the following tabi Cost of goods sold b. Find the beginning Raw Material Inventory Determine the beginning Raw Materials inventory by completing the folosing table Beginning raw material inventory Materals available for use c. Find the Ending Finished Goods Inventory Before we can determine the missing amount for ending Finished Goods Inventory, we will find to calculate the cost of Goods Manufactured (Complete all input fields. For courts with bace, make sure to en appropriate column) c. Find the Ending Finished Goods Inventory. Before we can determine the missing amount for ending Finished Goods Inventory, we will first ne appropriate column.) Total manufacturing costs to account for TIMI Cost of goods manufactured Now determine the Ending Finished Goods Inventory. Cost of goods available for sale Ending finished goods inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts