Question: help pls need explanations on how to do it as well as answers 1. (5 points) Suppose one year ago you converted dollars to euros

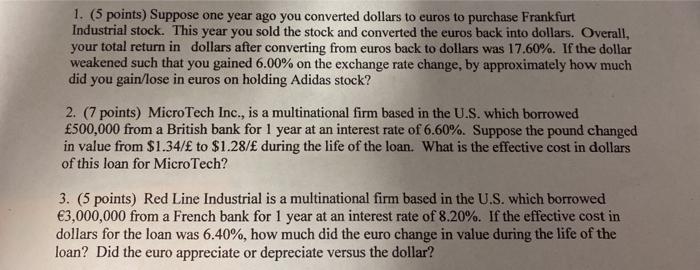

1. (5 points) Suppose one year ago you converted dollars to euros to purchase Frankfurt Industrial stock. This year you sold the stock and converted the euros back into dollars. Overall, your total return in dollars after converting from euros back to dollars was 17.60%. If the dollar weakened such that you gained 6.00% on the exchange rate change, by approximately how much did you gain/lose in euros on holding Adidas stock? 2. (7 points) MicroTech Inc., is a multinational firm based in the U.S. which borrowed 500,000 from a British bank for 1 year at an interest rate of 6.60%. Suppose the pound changed in value from $1.34/ to $1.28/ during the life of the loan. What is the effective cost in dollars of this loan for MicroTech? 3. (5 points) Red Line Industrial is a multinational firm based in the U.S. which borrowed 3,000,000 from a French bank for 1 year at an interest rate of 8.20%. If the effective cost in dollars for the loan was 6.40%, how much did the euro change in value during the life of the loan? Did the euro appreciate or depreciate versus the dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts