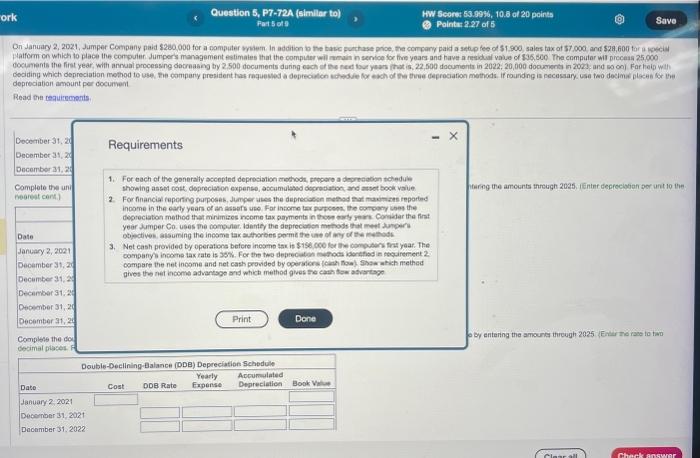

Question: help pls pls help with question! depreciation amount per document Read the reauireonants. On January 2, 2021, Jumper Company paid $280,000 for a computer system.

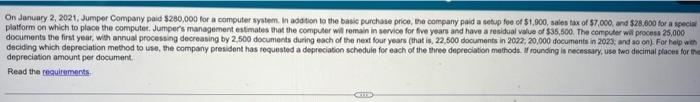

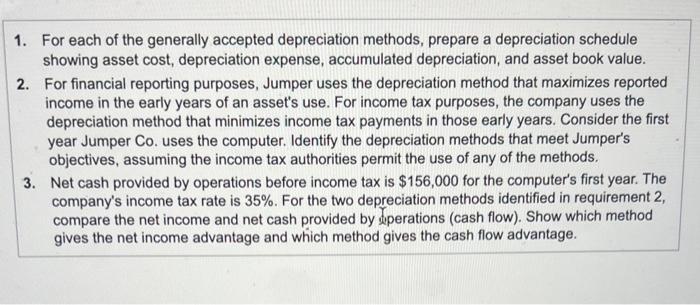

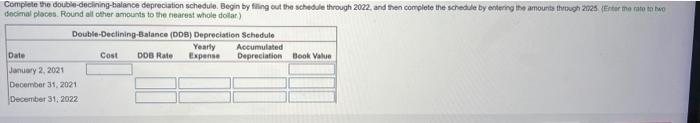

depreciation amount per document Read the reauireonants. On January 2, 2021, Jumper Company paid \$280,000 for a computer system. in addtion to the basic purchase price, Bho company paid a setup fee or $1,900, saios tax of $7,000, and \$28.000 for a seveiar platform on which to place the computer. Jumper's management estmates that the compuler wit remsin in semproe for fre years and have a residual value of $35,500. The cemputer wil process 25.000 deciding which depreciation method to use, the company president has tequested a depreciabon schedulo for each of the three depreciation methods. If rounsing is necessain, use twe decimal placett for in depreciaton amount per document. Read the ceauirements. 1. For each of the generally accepted depreciation methods, prepare a depreciation schedule showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. For financial reporting purposes, Jumper uses the depreciation method that maximizes reported income in the early years of an asset's use. For income tax purposes, the company uses the depreciation method that minimizes income tax payments in those early years. Consider the first year Jumper Co. uses the computer. Identify the depreciation methods that meet Jumper's objectives, assuming the income tax authorities permit the use of any of the methods. 3. Net cash provided by operations before income tax is $156,000 for the computer's first year. The company's income tax rate is 35%. For the two depreciation methods identified in requirement 2 , compare the net income and net cash provided by dperations (cash flow). Show which method gives the net income advantage and which method gives the cash flow advantage. docimal places. Round all other amounts to the nearest whole dolar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts