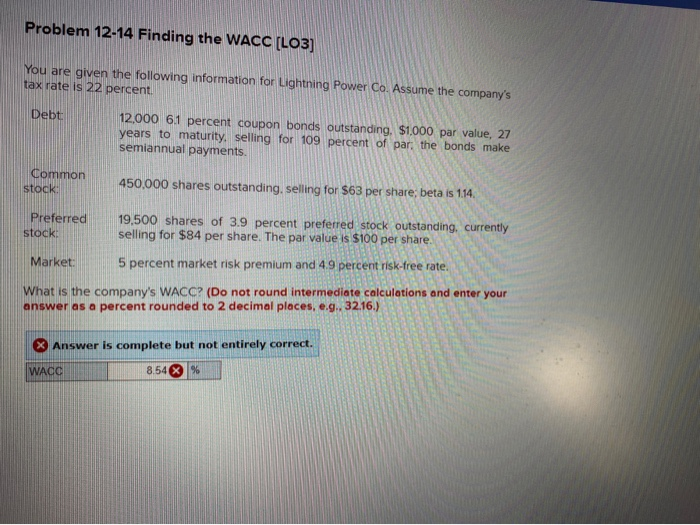

Question: help pls Problem 12-14 Finding the WACC (LO3) You are given the following information for Lightning Power Co. Assume the company's tax rate is 22

Problem 12-14 Finding the WACC (LO3) You are given the following information for Lightning Power Co. Assume the company's tax rate is 22 percent Debt 12,000 61 percent coupon bonds outstanding. $1.000 par value, 27 years to maturity, selling for 109 percent of par the bonds make semiannual payments. Common Stock 450,000 shares outstanding, selling for $63 per share, beta is 114 Preferred stock 19,500 shares of 3.9 percent preferred stock outstanding, currently selling for $84 per share. The par value is $100 per share. Market 5 percent market risk premium and 4.9 percent risk-free rate. What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) Answer is complete but not entirely correct. WACC 8.54 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts