Question: help pls & ty !! 16. Assume that for a given firm, the gross profit margin in 2021 was equal to the gross profit margin

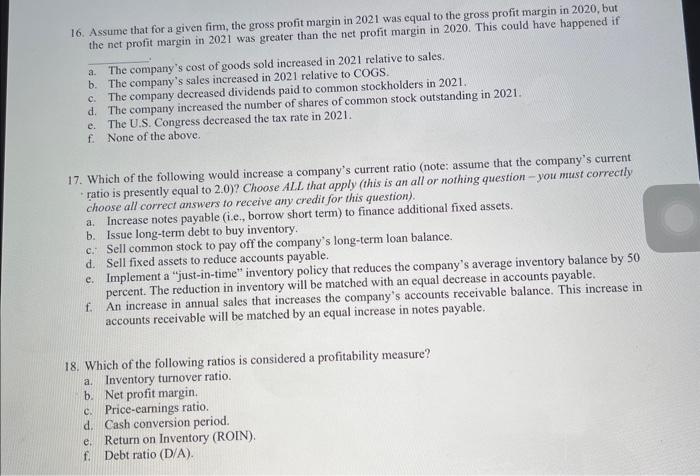

16. Assume that for a given firm, the gross profit margin in 2021 was equal to the gross profit margin in 2020 , but the net profit margin in 2021 was greater than the net profit margin in 2020 . This could have happened if a. The company's cost of goods sold increased in 2021 relative to sales. b. The company's sales increased in 2021 relative to COGS. c. The company decreased dividends paid to common stockholders in 2021. d. The company increased the number of shares of common stock outstanding in 2021 . e. The U.S. Congress decreased the tax rate in 2021 . f. None of the above. 17. Which of the following would increase a company's current ratio (note: assume that the company's current ratio is presently equal to 2.0 )? Choose ALL that apply (this is an all or nothing question-you must correctly choose all correct answers to receive any credit for this question). a. Increase notes payable (i.e., borrow short term) to finance additional fixed assets. b. Issue long-term debt to buy inventory. c. Sell common stock to pay off the company's long-term loan balance. d. Sell fixed assets to reduce accounts payable. e. Implement a "just-in-time" inventory policy that reduces the company's average inventory balance by 50 percent. The reduction in inventory will be matched with an equal decrease in accounts payable. f. An increase in annual sales that increases the company's accounts receivable balance. This increase in accounts receivable will be matched by an equal increase in notes payable. 18. Which of the following ratios is considered a profitability measure? a. Inventory turnover ratio. b. Net profit margin. c. Price-earnings ratio. d. Cash conversion period. e. Return on Inventory (ROIN). f. Debtratio (D/A)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts