Question: help pls :) Use the following intormation for the Exercises below. (Algo) [The following information applies to the questions displayed befow] Turner, Roth, and Lowe

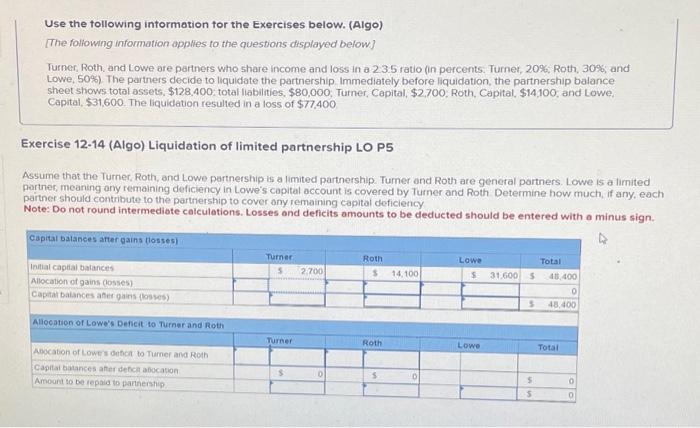

Use the following intormation for the Exercises below. (Algo) [The following information applies to the questions displayed befow] Turner, Roth, and Lowe are partners who share income and loss in a 2.3 .5 ratio in percents: Turner, 20\%, Roth, 30\%; and Lowe, 50\%) The partners decide to liquidate the partnership. Immediately before liquidation, the partnership balance sheet shows total assets, \$128,400, total liabilities, \$80,000, Turner, Cepital, \$2,700, Roth, Capital, \$14,100, and Lowe. Capital, $31,600. The liquidation resulted in a loss of $7,400 Exercise 12-14 (Algo) Liquidation of limited partnership LO P5 Assume that the Turner, Roth, and Lowe partnership is a limited partnership. Tumer ond Roth are general partners. Lowe is a limited partner, meaning arry remaining deficiency in Lowe's capital account is covered by Tumer and Roth. Determine how much, if any, each partner should contribute to the partnership to cover any remaining capital deficiency Note: Do not round intermediate calculations. Losses and deficits amounts to be deducted should be entered with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts