Question: help pls Use the journal entries from the previous question to create a year-end balance sheet for Mike's Motors. Assume they started the year with

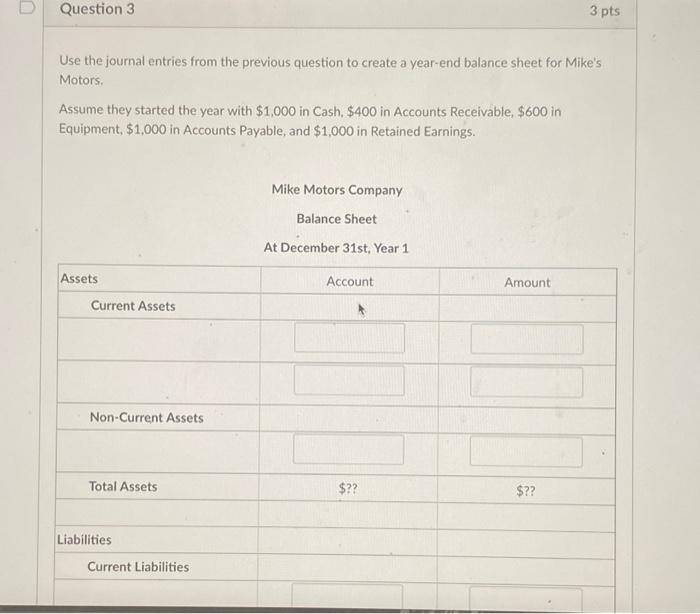

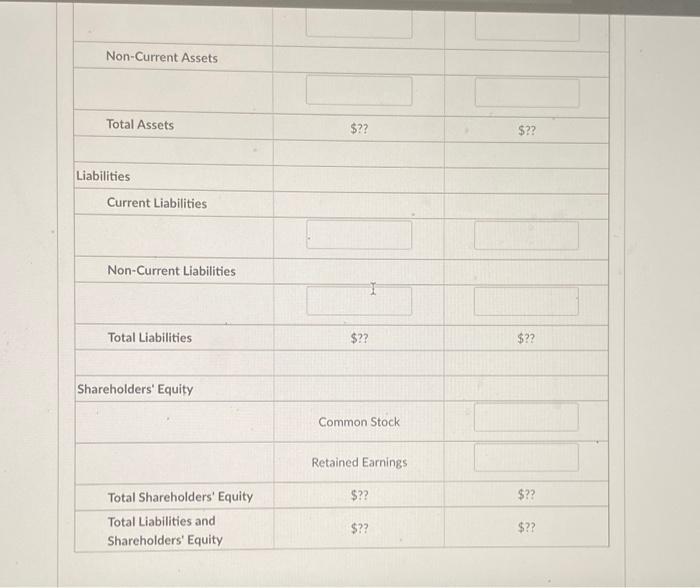

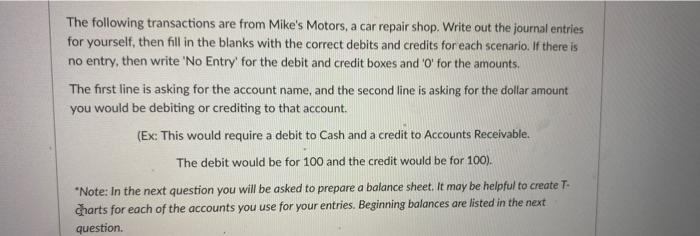

Use the journal entries from the previous question to create a year-end balance sheet for Mike's Motors. Assume they started the year with $1,000 in Cash, $400 in Accounts Receivable, $600 in Equipment, $1,000 in Accounts Payable, and $1,000 in Retained Earnings. The following transactions are from Mike's Motors, a car repair shop. Write out the journal entries for yourself, then fill in the blanks with the correct debits and credits for each scenario. If there is no entry, then write 'No Entry' for the debit and credit boxes and ' 0 ' for the amounts. The first line is asking for the account name, and the second line is asking for the dollar amount you would be debiting or crediting to that account. (Ex: This would require a debit to Cash and a credit to Accounts Receivable. The debit would be for 100 and the credit would be for 100 ). "Note: In the next question you will be asked to prepare a balance sheet. It may be helpful to create T. charts for each of the accounts you use for your entries. Beginning balances are listed in the next question. Use the journal entries from the previous question to create a year-end balance sheet for Mike's Motors. Assume they started the year with $1,000 in Cash, $400 in Accounts Receivable, $600 in Equipment, $1,000 in Accounts Payable, and $1,000 in Retained Earnings. The following transactions are from Mike's Motors, a car repair shop. Write out the journal entries for yourself, then fill in the blanks with the correct debits and credits for each scenario. If there is no entry, then write 'No Entry' for the debit and credit boxes and ' 0 ' for the amounts. The first line is asking for the account name, and the second line is asking for the dollar amount you would be debiting or crediting to that account. (Ex: This would require a debit to Cash and a credit to Accounts Receivable. The debit would be for 100 and the credit would be for 100 ). "Note: In the next question you will be asked to prepare a balance sheet. It may be helpful to create T. charts for each of the accounts you use for your entries. Beginning balances are listed in the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts