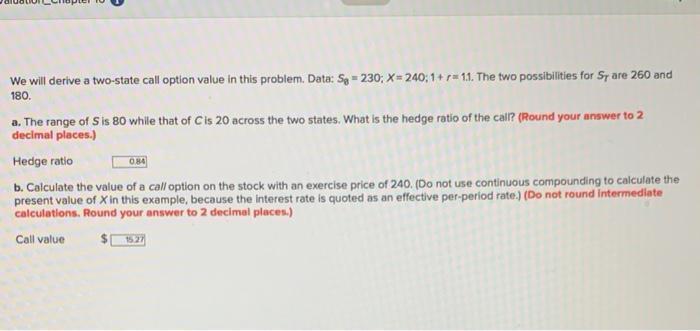

Question: help pls We will derive a two-state call option value in this problem. Data: Sp-230; X=240:1+ = 11. The two possibilities for Sy are 260

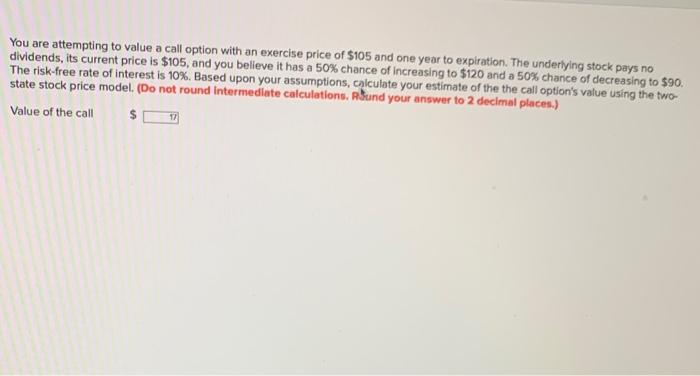

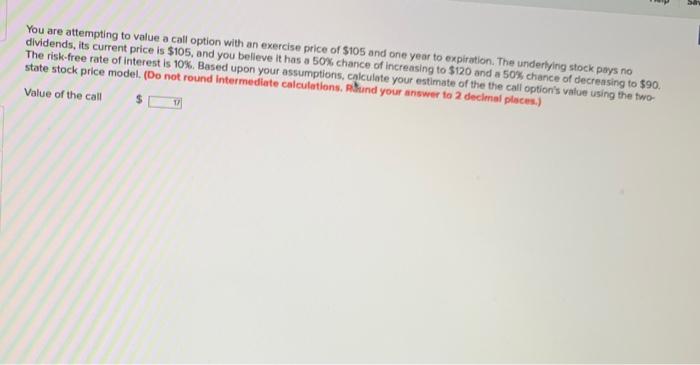

We will derive a two-state call option value in this problem. Data: Sp-230; X=240:1+ = 11. The two possibilities for Sy are 260 and 180. a. The range of Sis 80 while that of Cis 20 across the two states. What is the hedge ratio of the call? (Round your answer to 2 decimal places.) Hedge ratio b. Calculate the value of a call option on the stock with an exercise price of 240. (Do not use continuous compounding to calculate the present value of Xin this example, because the interest rate is quoted as an effective per period rate.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) 084 Call value 15:27 You are attempting to value a call option with an exercise price of $105 and one year to expiration. The underlying stock pays no dividends, its current price is $105, and you believe it has a 50% chance of increasing to $120 and a 50% chance of decreasing to $90. The risk-free rate of interest is 10%. Based upon your assumptions, calculate your estimate of the the call option's value using the two state stock price model. (Do not round intermediate calculations. Rund your answer to 2 decimal places.) Value of the call $ You are attempting to value a call option with an exercise price of S105 and one year to expiration. The underlying stock pays no dividends, its current price is $105, and you believe it has a 50% chance of increasing to $120 and a 50% chance of decreasing to $90. The risk-free rate of interest is 10%. Based upon your assumptions, calculate your estimate of the the call option's vniue using the two state stock price model, (Do not round intermediate calculations, plund your answer to 2 decimal places.) Value of the call $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts