Question: Help pls will rate if correct need answer Because of changes in the extent to which a piece of equipment is being used, the company,

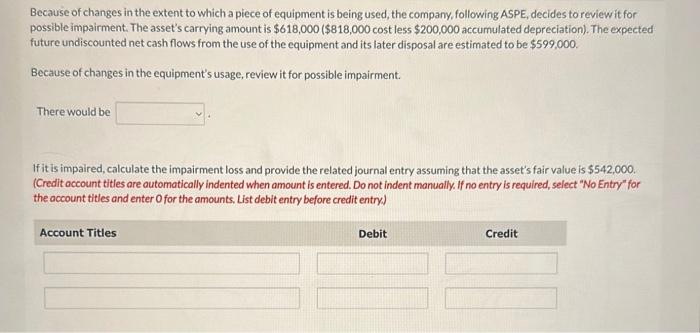

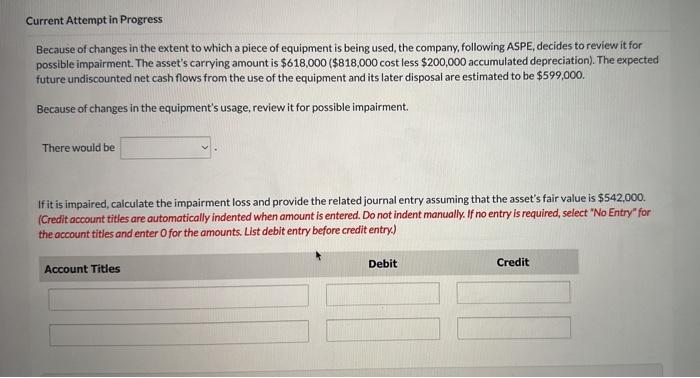

Because of changes in the extent to which a piece of equipment is being used, the company, following ASPE, decides to review it for possible impairment. The asset's carrying amount is $618,000 ( $818,000 cost less $200,000 accumulated depreciation). The expected future undiscounted net cash flows from the use of the equipment and its later disposal are estimated to be $599,000. Because of changes in the equipment's usage, review it for possible impairment. There would be If it is impaired, calculate the impairment loss and provide the related journal entry assuming that the asset's fair value is $542,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select " No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry) Because of changes in the extent to which a piece of equipment is being used, the company, following ASPE, decides to review it for possible impairment. The asset's carrying amount is $618,000 ( $818,000 cost less $200,000 accumulated depreciation). The expected future undiscounted net cash flows from the use of the equipment and its later disposal are estimated to be $599,000. Because of changes in the equipment's usage, review it for possible impairment. There would be If it is impaired, calculate the impairment loss and provide the related journal entry assuming that the asset's fair value is $542,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts