Question: help pls with this Osborn Manufacturing uses a predetermined overhead rate of $18.40 per direct labor-hour. This predetermined rate was based on a cost formula

help pls with this

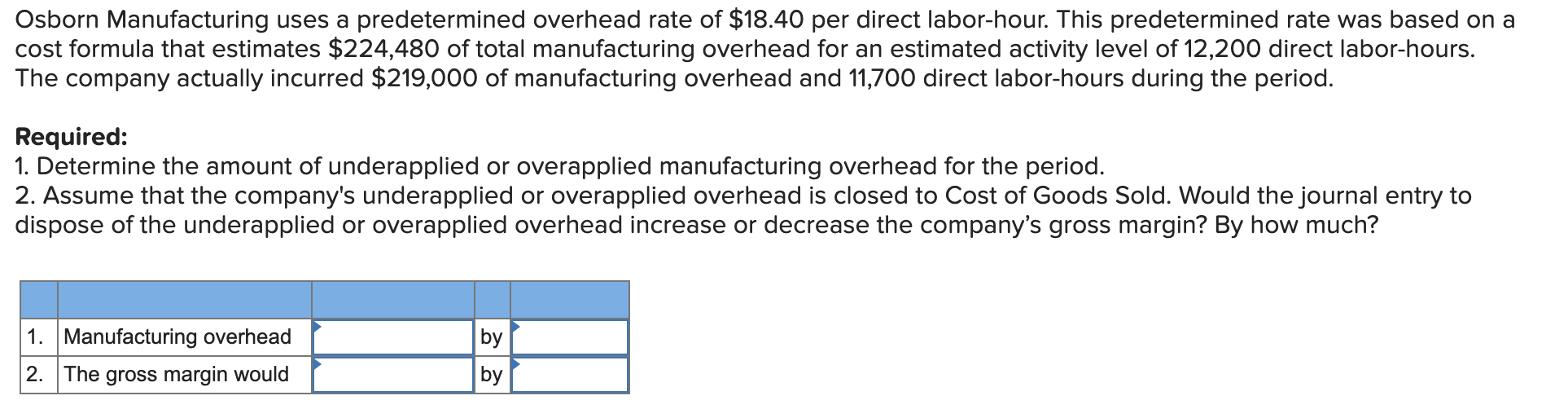

Osborn Manufacturing uses a predetermined overhead rate of $18.40 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $224,480 of total manufacturing overhead for an estimated activity level of 12,200 direct labor-hours. The company actually incurred $219,000 of manufacturing overhead and 11.700 direct laborhours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would thejournal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? . Manufacturing overhead _I- 2. The gross margin would _I

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts