Question: help plz: 6 9 1 4 678 SA223 10 Question 21 Pique Corporation wants to purchase a new machine for $300,000. Management predicts that the

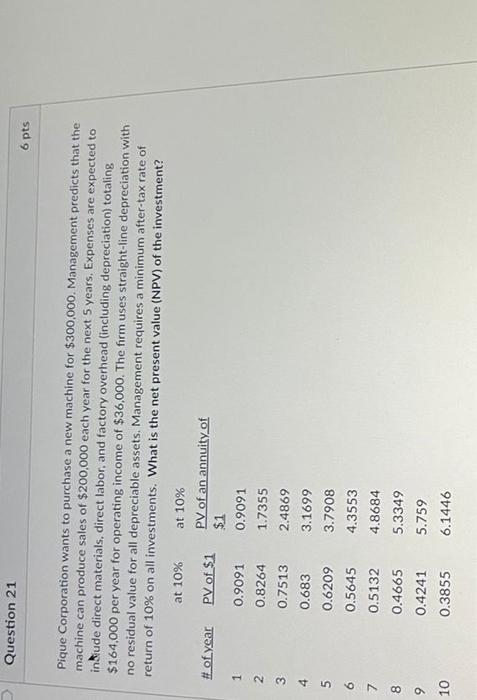

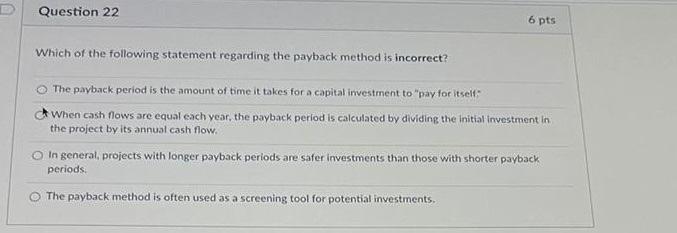

6 9 1 4 678 SA223 10 Question 21 Pique Corporation wants to purchase a new machine for $300,000. Management predicts that the machine can produce sales of $200,000 each year for the next 5 years, Expenses are expected to indude direct materials, direct labor, and factory overhead (including depreciation) totaling $164,000 per year for operating income of $36,000. The firm uses straight-line depreciation with no residual value for all depreciable assets. Management requires a minimum after-tax rate of return of 10% on all investments. What is the net present value (NPV) of the investment? # of year PV of $1 at 10% 0.9091 0.8264 at 10% PV of an annuity of $1 0.9091 1.7355 0.7513 2.4869 0.683 3.1699 0.6209 3.7908 6 pts 0.5645 4.3553 0.5132 4.8684 0.4665 5.3349 0.4241 5.759 0.3855 6.1446 Question 22 6 pts Which of the following statement regarding the payback method is incorrect? The payback period is the amount of time it takes for a capital investment to "pay for itself" When cash flows are equal each year, the payback period is calculated by dividing the initial investment in the project by its annual cash flow. O In general, projects with longer payback periods are safer investments than those with shorter payback periods. The payback method is often used as a screening tool for potential investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts