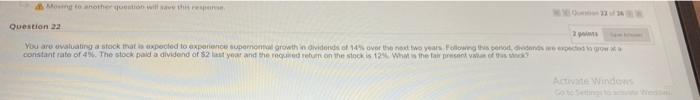

Question: help plz Mon to another with Question 2 You are evaluating a stock maxpected to experience super growth individends of over the next two years

help plz

help plz

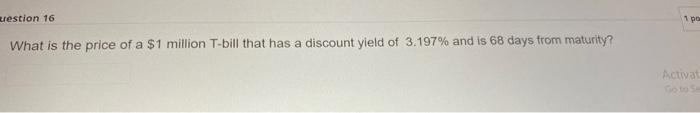

Mon to another with Question 2 You are evaluating a stock maxpected to experience super growth individends of over the next two years Follow constant rate of 4%. The stock and a dividend of 2 last year and the return on the stock is 125 White fapt of Winde uestion 16 1 po What is the price of a $1 million T-bill that has a discount yield of 3.197% and is 68 days from maturity? Activas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts