Question: help plz NANCE 32 YY Test a S pring 9 Calculate the present value of $800 received at the beginning of year 1, $400 received

help plz

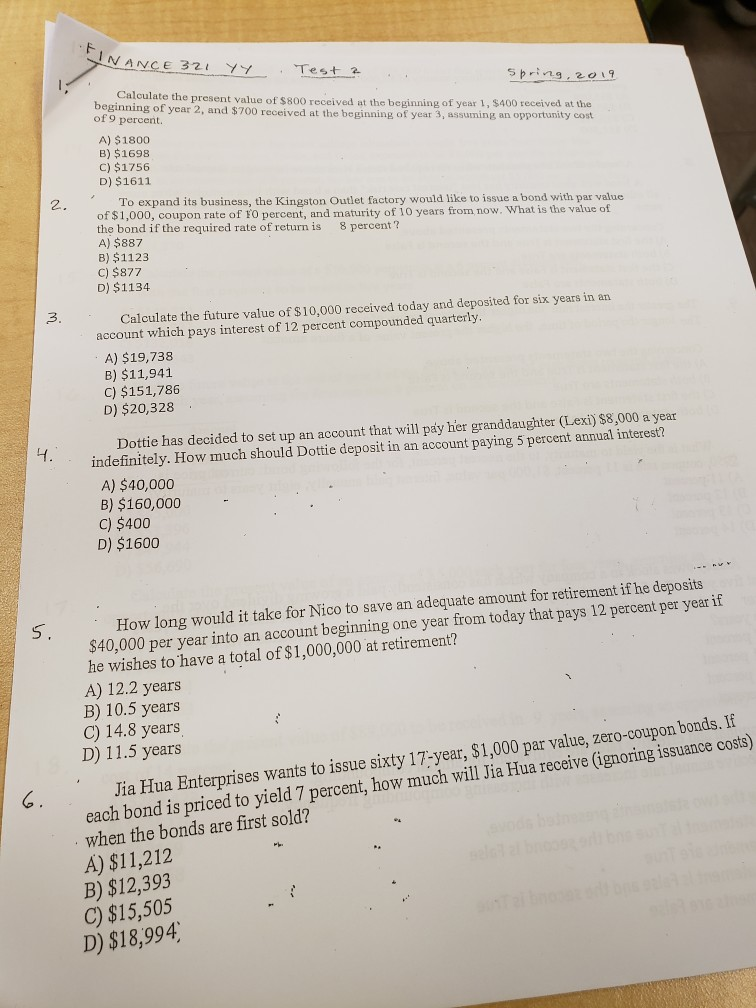

NANCE 32 YY Test a S pring 9 Calculate the present value of $800 received at the beginning of year 1, $400 received at the eginning of year 2, and $700 received at the beginning of year 3, assuming an opportunity cost of 9 percent. A) $1800 B) $1698 c) $1756 D) $1611 To expand its business, the Kingston Outlet factory would like to issue a bond with par value of $1,000, coupon rate of FO percent, an the bond if the required rate of return is 8 percent? A) $887 B) $1123 C) $877 D) $1134 2. d maturity of 10 years from now. What is the value of 3. Calculate the future value of $10,000 received today and deposited for six years in an account which pays interest of 12 percent compounded quarterly A) $19,738 B) $11,941 C) $151,786 D) $20,328 Dottie has decided to set up an account that will pay her granddaughter (Lexi) $8,000 a year indefinitely. How much should Dottie deposit in an account paying 5 percent annual interest? A) $40,000 B) $160,000 c) $400 D) $1600 4. How long would it take for Nico to save an adequate amount for retirement if he deposits $40,000 per year into an account beginning one year from today that pays 12 percent per year if he wishes to 'have a total of $1,000,000 at retirement? A) 12.2 years B) 10.5 years C) 14.8 years D) 11.5 years 5. par value, zero-coupon bonds. If Jia Hua Enterprises wants to issue sixty 17-year, $1,000 each bond is priced to yield 7 percent, how much will Jia Hua receive (ignoring issuance costs) when the bonds are first sold? A) $11,212 B) $12,393 C) $15,505 C. D) $18,994

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts