Question: help plz :) Sandhill Tools uses the allowance method to account for uncollectible accounts. May 20 The account of Barack Obama for $1,217 was deemed

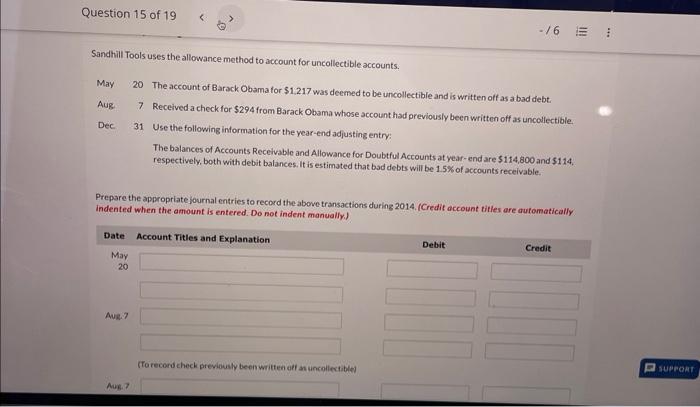

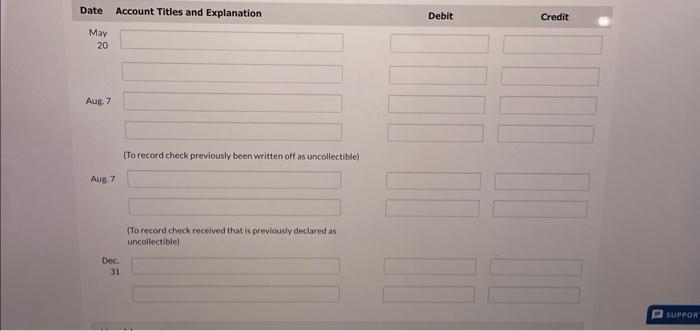

Sandhill Tools uses the allowance method to account for uncollectible accounts. May 20 The account of Barack Obama for $1,217 was deemed to be uncollectible and is written off as a bad debt: Aug. 7 Received a check for $294 from Barack Obama whose account had previously been written off as uncollectible. Dec 31 Use the following information for the year-end adjusting entry: The balances of Accounts Receivable and Allowance for Doubtful Accounts at year-end are $114,800 and $114. respectively, both with debit balances. It is estimated that bad debts will be 1.5% of accounts receivable. Prepare the appropriate journal entries to record the above transactions during 2014. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit May 20 Aug 7 (To record check previously been written off as uncollectible) Aug 7 (fo record check received that is previously declared as uncollectible) Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts