Question: Help, plz show your work so that I can understand the materials. Miller Company acquired an 80 percent interest in Taylor Company on January 1,

Help, plz show your work so that I can understand the materials.

Help, plz show your work so that I can understand the materials.

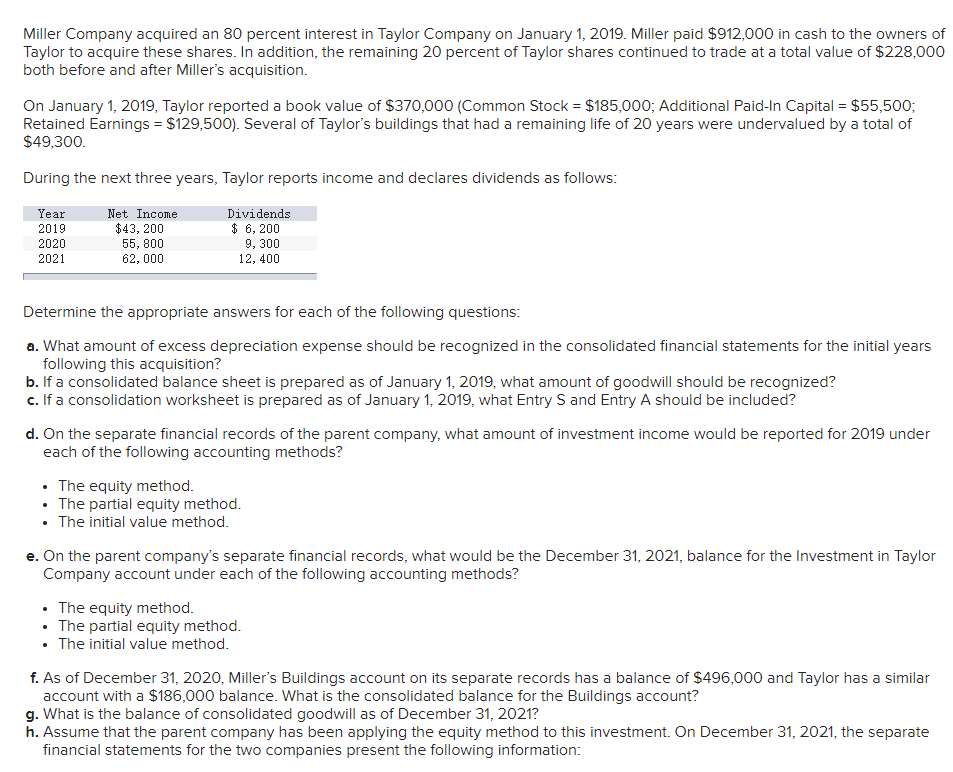

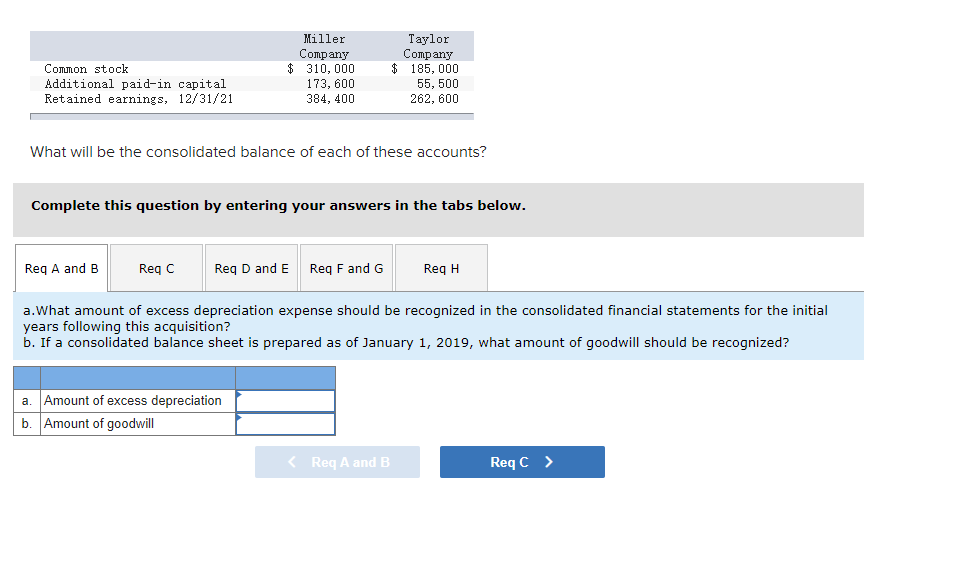

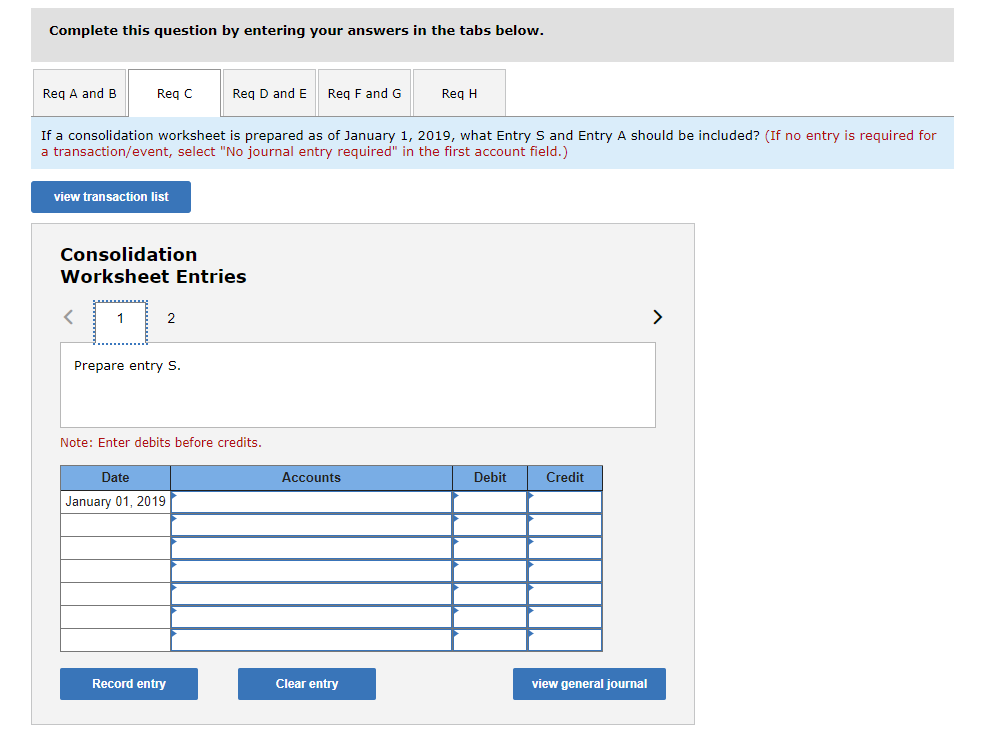

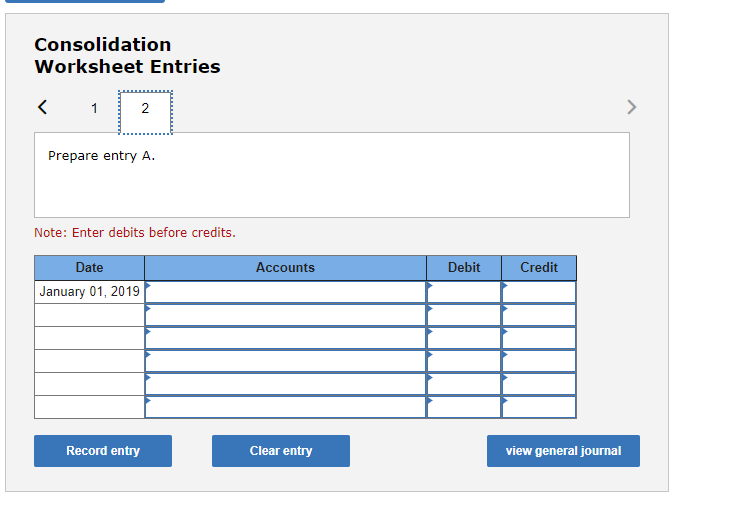

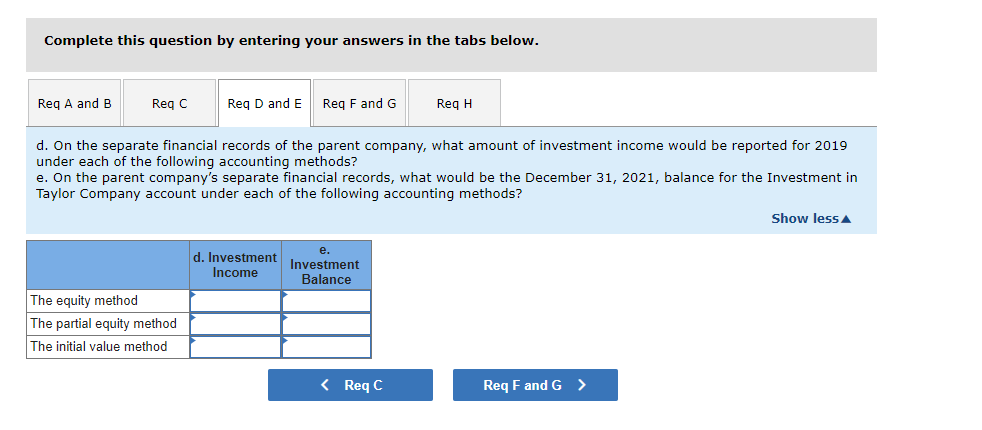

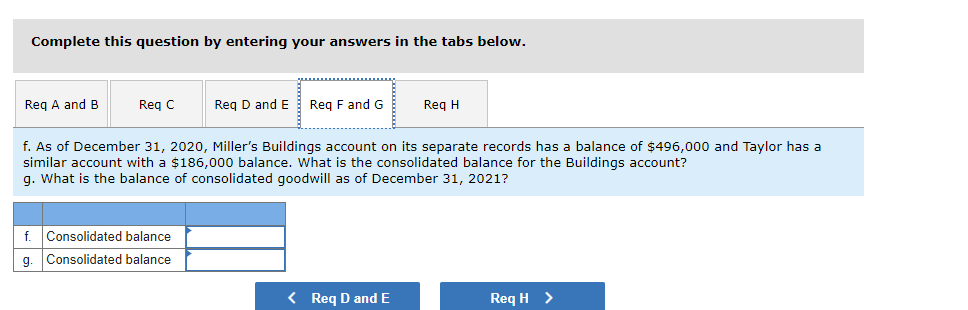

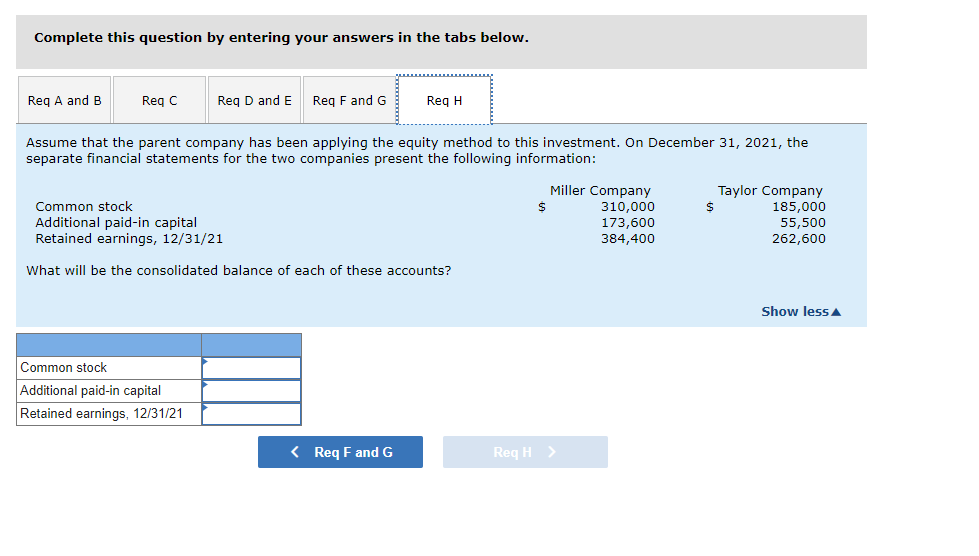

Miller Company acquired an 80 percent interest in Taylor Company on January 1, 2019. Miller paid $912,000 in cash to the owners of Taylor to acquire these shares. In addition, the remaining 20 percent of Taylor shares continued to trade at a total value of $228,000 both before and after Miller's acquisition. On January 1, 2019, Taylor reported a book value of $370,000 (Common Stock = $185,000; Additional Paid-In Capital = $55,500; Retained Earnings = $129,500). Several of Taylor's buildings that had a remaining life of 20 years were undervalued by a total of $49,300. During the next three years, Taylor reports income and declares dividends as follows: Year 2019 2020 2021 Net Income $43,200 55, 800 62,000 Dividends $ 6, 200 9, 300 12, 400 Determine the appropriate answers for each of the following questions: a. What amount of excess depreciation expense should be recognized in the consolidated financial statements for the initial years following this acquisition? b. If a consolidated balance sheet is prepared as of January 1, 2019, what amount of goodwill should be recognized? c. If a consolidation worksheet is prepared as of January 1, 2019, what Entry S and Entry A should be included? d. On the separate financial records of the parent company, what amount of investment income would be reported for 2019 under each of the following accounting methods? The equity method. The partial equity method. The initial value method. e. On the parent company's separate financial records, what would be the December 31, 2021, balance for the Investment in Taylor Company account under each of the following accounting methods? The equity method. The partial equity method. The initial value method. f. As of December 31, 2020, Miller's Buildings account on its separate records has a balance of $496,000 and Taylor has a similar account with a $186,000 balance. What is the consolidated balance for the Buildings account? g. What is the balance of consolidated goodwill as of December 31, 2021? h. Assume that the parent company has been applying the equity method to this investment. On December 31, 2021, the separate financial statements for the two companies present the following information: Common stock Additional paid-in capital Retained earnings, 12/31/21 Miller Company $ 310,000 173, 600 384, 400 Taylor Company 185, 000 55,500 262, 600 What will be the consolidated balance of each of these accounts? Complete this question by entering your answers in the tabs below. Req A and B ReqC Reg D and E Req F and G ReqH a.What amount of excess depreciation expense should be recognized in the consolidated financial statements for the initial years following this acquisition? b. If a consolidated balance sheet is prepared as of January 1, 2019, what amount of goodwill should be recognized? a. Amount of excess depreciation b. Amount of goodwill Complete this question by entering your answers in the tabs below. Req A and B Reqc Reg D and E Req F and G ReqH If a consolidation worksheet is prepared as of January 1, 2019, what Entry S and Entry A should be included? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries Prepare entry S. Note: Enter debits before credits. Date Accounts Debit Credit January 01, 2019 Record entry Clear entry view general journal Consolidation Worksheet Entries Prepare entry A. Note: Enter debits before credits. Accounts Debit Credit Date January 01, 2019 Record entry Clear entry view general journal Complete this question by entering your answers in the tabs below. Req A and B Reqc Reg D and E Req F and G ReqH d. On the separate financial records of the parent company, what amount of investment income would be reported for 2019 under each of the following accounting methods? e. On the parent company's separate financial records, what would be the December 31, 2021, balance for the Investment in Taylor Company account under each of the following accounting methods? Show less d. Investment Income e. Investment Balance The equity method The partial equity method The initial value method Complete this question by entering your answers in the tabs below. Req A and B Reqc Reg D and E Reg F and G ReqH f. As of December 31, 2020, Miller's Buildings account on its separate records has a balance of $496,000 and Taylor has a similar account with a $186,000 balance. What is the consolidated balance for the Buildings account? g. What is the balance of consolidated goodwill as of December 31, 2021? f. Consolidated balance g. Consolidated balance Complete this question by entering your answers in the tabs below. Req A and B Reg C Reg D and E Reg F and G ReqH Assume that the parent company has been applying the equity method to this investment. On December 31, 2021, the separate financial statements for the two companies present the following information: Common stock Additional paid-in capital Retained earnings, 12/31/21 Miller Company S 310,000 173,600 384,400 Taylor Company 185,000 55,500 262,600 What will be the consolidated balance of each of these accounts? Show less Common stock Additional paid-in capital Retained earnings, 12/31/21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts