Question: help Presented here are selected transactions for Cullumber Limited for 2024. Cullumber uses straight-line depreciation and records adjusting entries annually. Jan. 1 Sold a delivery

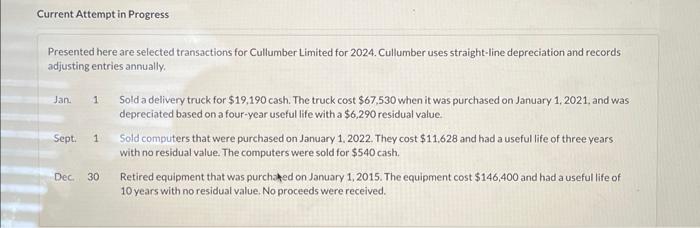

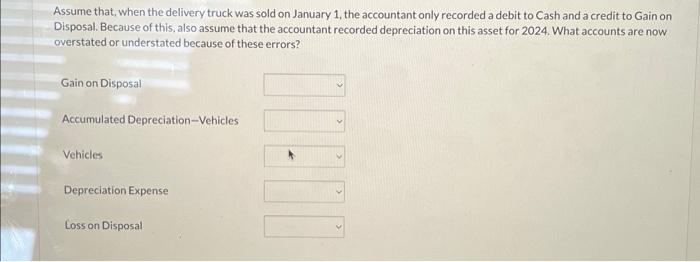

Presented here are selected transactions for Cullumber Limited for 2024. Cullumber uses straight-line depreciation and records adjusting entries annually. Jan. 1 Sold a delivery truck for $19,190 cash. The truck cost $67,530 when it was purchased on January 1,2021 , and was depreciated based on a four-year useful life with a $6,290 residual value. Sept. 1 Sold computers that were purchased on January 1, 2022. They cost $11,628 and had a useful life of three years with no residual value. The computers were sold for $540 cash. Dec. 30 Retired equipment that was purchated on January 1,2015. The equipment cost $146,400 and had a useful life of 10 years with no residual value. No proceeds were received. Assume that, when the delivery truck was sold on January 1, the accountant only recorded a debit to Cash and a credit to Gain on Disposal. Because of this, also assume that the accountant recorded depreciation on this asset for 2024 . What accounts are now overstated or understated because of these errors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts