Question: help Problem 13-23A (Algo) Ratio analysis LO 13-2, 13-3, 13-4, 13-5 The following financial statements apply to Stuart Company: Required Calculate the following ratios for

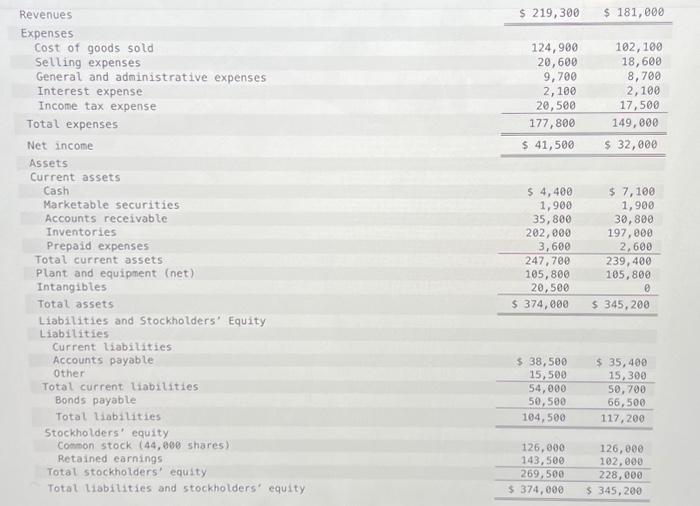

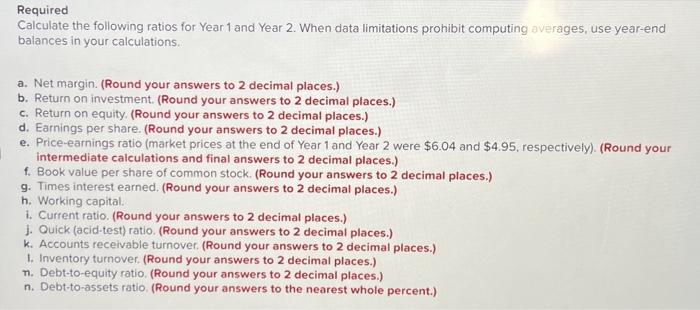

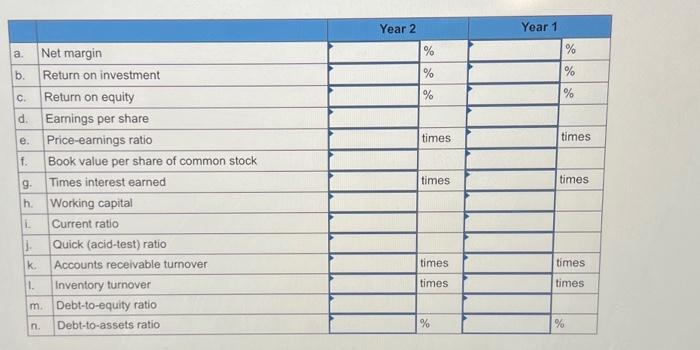

Problem 13-23A (Algo) Ratio analysis LO 13-2, 13-3, 13-4, 13-5 The following financial statements apply to Stuart Company: Required Calculate the following ratios for Year 1 and Year 2. When data limitations prohibit computing averages, use year-end balances in your calculations. a. Net margin. (Round your answers to 2 decimal places.) b. Return on investment. (Round your answers to 2 decimal places.) c. Return on equity. (Round your answers to 2 decimal places.) d. Earnings per share. (Round your answers to 2 decimal places.) e. Price-earnings ratio (market prices at the end of Year 1 and Year 2 were $6.04 and $4.95, respectively). (Round your intermediate calculations and final answers to 2 decimal places.) f. Book value per share of common stock. (Round your answers to 2 decimal places.) g. Times interest earned. (Round your answers to 2 decimal places.) h. Working capital. i. Current ratio. (Round your answers to 2 decimal places.) j. Quick (acid-test) ratio. (Round your answers to 2 decimal places.) k. Accounts receivable turnover. (Round your answers to 2 decimal places.) 1. Inventory turnover. (Round your answers to 2 decimal places.) n. Debt-to-equity ratio. (Round your answers to 2 decimal places.) n. Debt-to-assets ratio, (Round your answers to the nearest whole percent.) Problem 13-23A (Algo) Ratio analysis LO 13-2, 13-3, 13-4, 13-5 The following financial statements apply to Stuart Company: Required Calculate the following ratios for Year 1 and Year 2. When data limitations prohibit computing averages, use year-end balances in your calculations. a. Net margin. (Round your answers to 2 decimal places.) b. Return on investment. (Round your answers to 2 decimal places.) c. Return on equity. (Round your answers to 2 decimal places.) d. Earnings per share. (Round your answers to 2 decimal places.) e. Price-earnings ratio (market prices at the end of Year 1 and Year 2 were $6.04 and $4.95, respectively). (Round your intermediate calculations and final answers to 2 decimal places.) f. Book value per share of common stock. (Round your answers to 2 decimal places.) g. Times interest earned. (Round your answers to 2 decimal places.) h. Working capital. i. Current ratio. (Round your answers to 2 decimal places.) j. Quick (acid-test) ratio. (Round your answers to 2 decimal places.) k. Accounts receivable turnover. (Round your answers to 2 decimal places.) 1. Inventory turnover. (Round your answers to 2 decimal places.) n. Debt-to-equity ratio. (Round your answers to 2 decimal places.) n. Debt-to-assets ratio, (Round your answers to the nearest whole percent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts