Question: help!!! Problem 3-3A (Algo) Preparing adjusting entries, adjusted trial balance, and financial statements LO P1, P2, P3, P4, P5 [The following information applies to the

![the questions displayed below] Wells Technical Institute (WTI). a school owned by](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6718849942714_05667188498ba152.jpg)

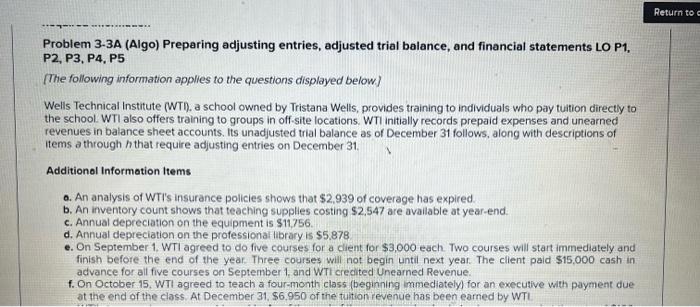

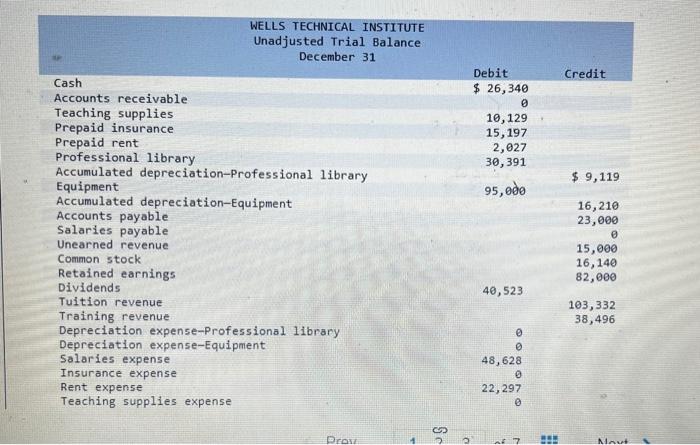

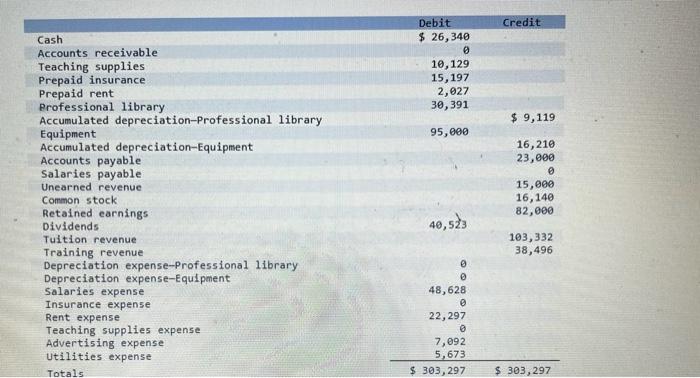

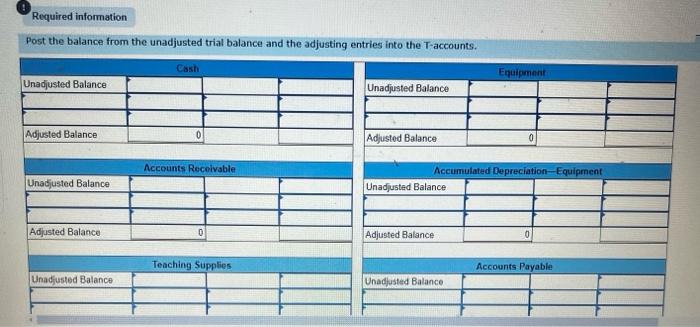

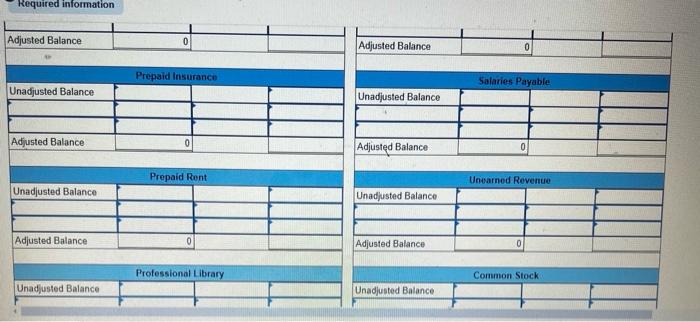

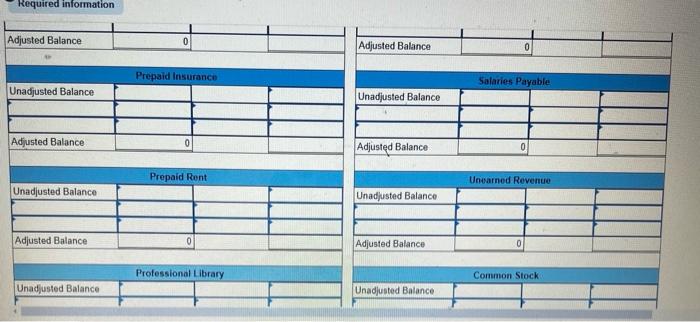

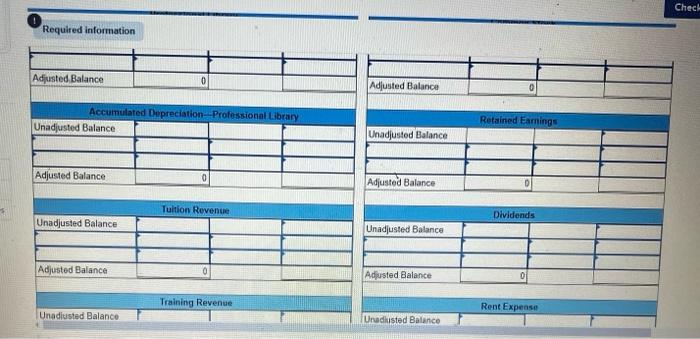

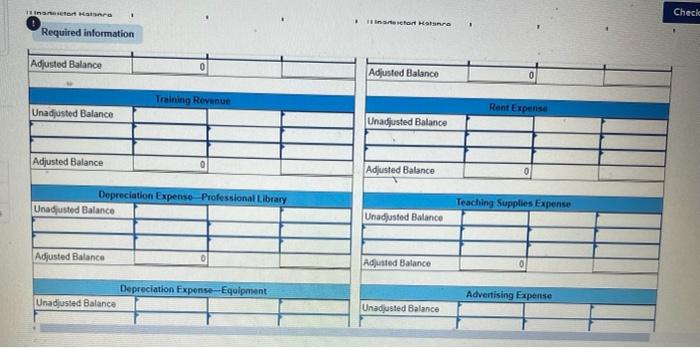

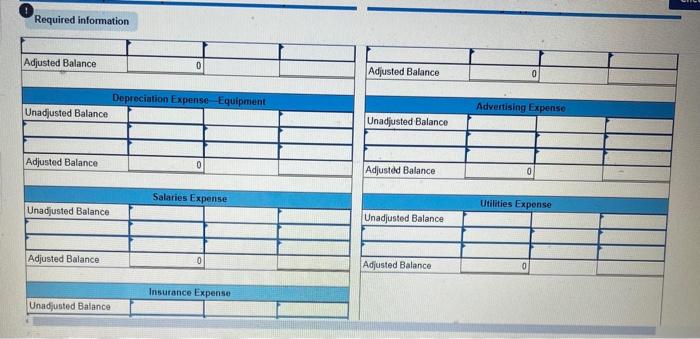

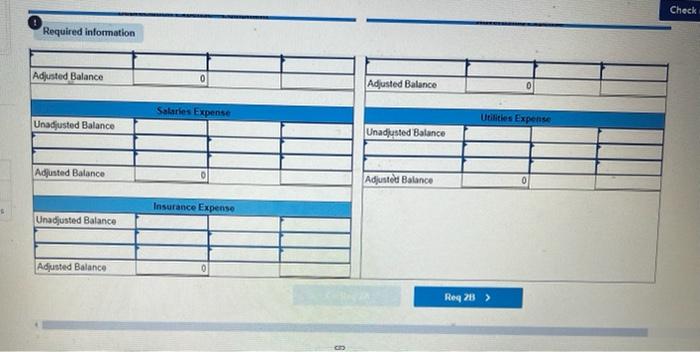

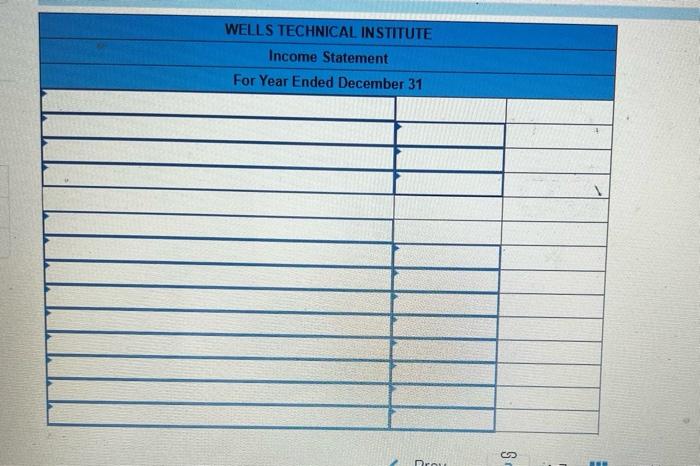

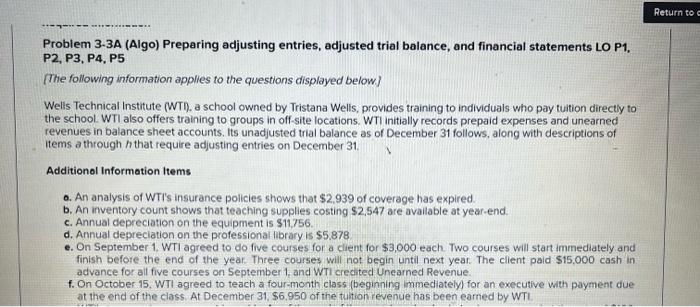

Problem 3-3A (Algo) Preparing adjusting entries, adjusted trial balance, and financial statements LO P1, P2, P3, P4, P5 [The following information applies to the questions displayed below] Wells Technical Institute (WTI). a school owned by Tristana Wells, provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting entries on December 31. Additional Information Items 0. An analysis of WTi's insurance policies shows that $2,939 of coverage has expired. b. An inventory count shows that teaching supplies costing $2,547 are available at year-end. c. Annual depreciation on the equipment is \$117756. d. Annual depreciation on the professional library is $5.878 e. On September 1. WTI agreed to do five courses for a dient for $3,000 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid $15,000 cash in advance for all five courses on September 1 , and WTi crecited Unearned Revenue. f. On October 15 . WTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at the end of the class. At December 31,$6,950 of the tuition revenue has been earned by WTI 1. Required information \begin{tabular}{l|lllll} Prev & 1 & 2 & 3 & of 7 & He \end{tabular} Next > Post the balance from the unadjusted trial balance and the adjusting entries into the T-accounts. 1. Required information \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Accumulated Dipreciation-Professional Library } \\ \hline & & & & \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Adjusted Balance & \multicolumn{1}{|c|}{ 0 } & \\ \hline & \multicolumn{3}{|r|}{ Training Revinue } \\ \hline Unadjusted Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline Adjusted Balance & & 0 & \\ \hline & & \\ \hline \end{tabular} Required information Required information Problem 3-3A (Algo) Preparing adjusting entries, adjusted trial balance, and financial statements LO P1. P2, P3, P4, P5 [The following information applies to the questions displayed below] Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to individuals who pay tution directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting entries on December 31. Additional Information Items a. An analysis of WTi's insurance policies shows that $2,939 of coverage has expired. b. An inventory count shows that teaching supplies costing $2,547 are available at year-end. c. Annual depreciation on the equipment is \$11.756. d. Annual depreciation on the professional library is $5.878 e. On September 1, WTI agreed to do five courses for a dient for $3,000 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid $15,000 cash in advance for all five courses on September 1 , and WTI crecited Unearned Revenue. f. On October 15 . WTI agreed to teach a four-month class (beginning immediately for an executive with payment due at the end of the class. At December 31,$6.950 of the tution revenue has been eamed by WTL. 1. Required information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts