Question: Help provide an analysis overview and explain how the projected ratios compare to the prior year ratios. Explain the importance of this comparison. Projected Ratios

Help provide an analysis overview and explain how the projected ratios compare to the prior year ratios. Explain the importance of this comparison.

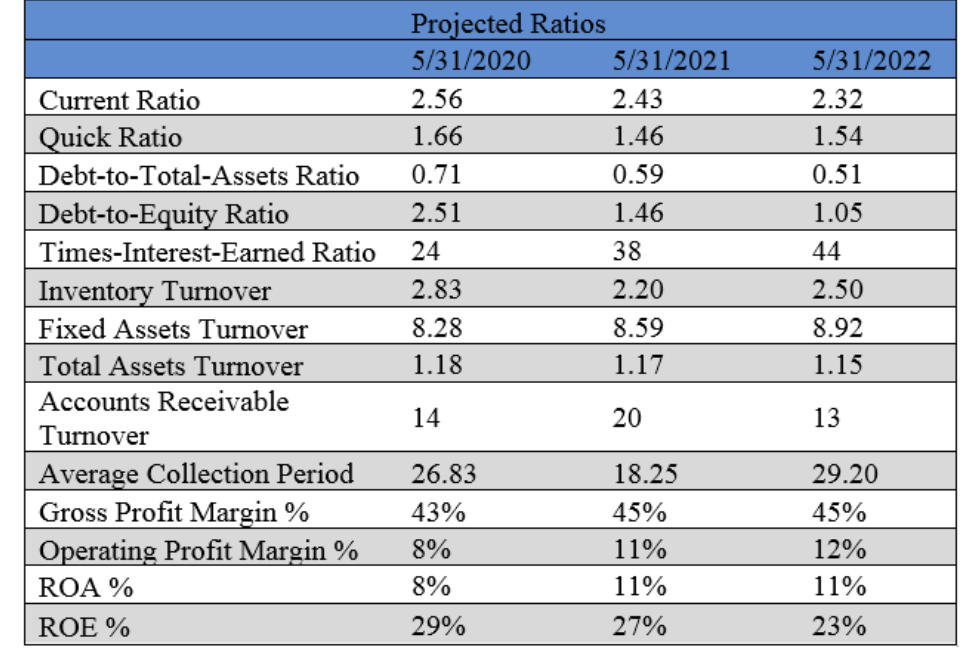

Projected Ratios 5/31/2020 5/31/2021 5/31/2022 Current Ratio 2.56 2.43 2.32 Quick Ratio 1.66 1.46 1.54 Debt-to-Total-Assets Ratio 0.71 0.59 0.51 Debt-to-Equity Ratio 2.51 1.46 1.05 Times-Interest-Earned Ratio 24 38 44 Inventory Turnover 2.83 2.20 2.50 Fixed Assets Turnover 8.28 8.59 8.92 Total Assets Turnover 1.18 1.17 1.15 Accounts Receivable 14 20 13 Turnover Average Collection Period 26.83 18.25 29.20 Gross Profit Margin % 43% 45% 45% Operating Profit Margin % 8% 11% 12% ROA % 8% 11% 11% ROE % 29% 27% 23%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts