Question: help pt. 4 mite oi bonk n. How much or the 20 he phyment is intenent? b. How mith of the 20 he pavmont it

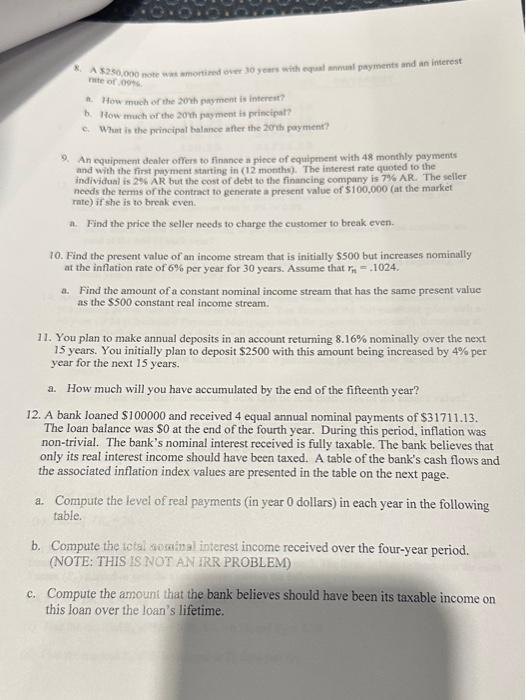

mite oi bonk n. How much or the 20 he phyment is intenent? b. How mith of the 20 he pavmont it principal? 9. An equipment denler offers to finance a piece of equipenent with 48 monthly payments and with the first payment starting in (12 months). The interest rate quoted to the nocds the tema of the contract to generate a present value of 5100,000 (at the market rate) if she is to break even. a. Find the price the seller noeds to charge the customer to break even. 10. Find the present value of an income stream that is initially $500 but increases nominally at the inflation rate of 6% per year for 30 years. Assume that rn=.1024. a. Find the amount of a constant nominal income stream that has the same present value as the $500 constant real income stream. 11. You plan to make annual deposits in an account returning 8.16% nominally over the next 15 years. You initially plan to deposit $2500 with this amount being increased by 4% per year for the next 15 years. a. How much will you have accumulated by the end of the fifteenth year? 12. A bank loaned $100000 and received 4 equal annual nominal payments of $31711.13. The loan balance was $0 at the end of the fourth year. During this period, inflation was non-trivial. The bank's nominal interest received is fully taxable. The bank believes that only its real interest income should have been taxed. A table of the bank's cash flows and the associated inflation index values are presented in the table on the next page. a. Compute the level of real payments (in year 0 dollars) in each year in the following table. b. Compute the total aowingl interest income received over the four-year period. (NOTE: THIS IS NOT AN IRR PROBLEM) c. Compute the amount that the bank believes should have been its taxable income on this loan over the loan's lifetime

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts