Question: help Question 1 (Total 20 marks) Please state the effects or consequences under Hong Kong Tax Administration in the following situations. What is the requirement

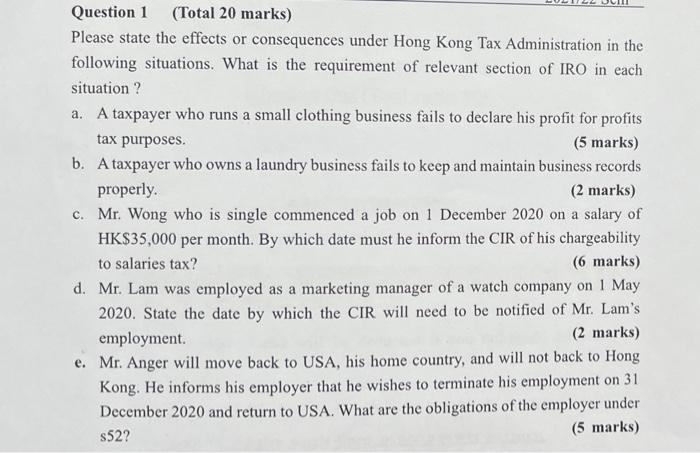

Question 1 (Total 20 marks) Please state the effects or consequences under Hong Kong Tax Administration in the following situations. What is the requirement of relevant section of IRO in each situation ? a. A taxpayer who runs a small clothing business fails to declare his profit for profits tax purposes. (5 marks) b. A taxpayer who owns a laundry business fails to keep and maintain business records properly. (2 marks) c. Mr. Wong who is single commenced a job on 1 December 2020 on a salary of HK$35,000 per month. By which date must he inform the CIR of his chargeability to salaries tax? (6 marks) d. Mr. Lam was employed as a marketing manager of a watch company on 1 May 2020. State the date by which the CIR will need to be notified of Mr. Lam's employment (2 marks) e. Mr. Anger will move back to USA, his home country, and will not back to Hong Kong. He informs his employer that he wishes to terminate his employment on 31 December 2020 and return to USA. What are the obligations of the employer under s52? (5 marks) Question 1 (Total 20 marks) Please state the effects or consequences under Hong Kong Tax Administration in the following situations. What is the requirement of relevant section of IRO in each situation ? a. A taxpayer who runs a small clothing business fails to declare his profit for profits tax purposes. (5 marks) b. A taxpayer who owns a laundry business fails to keep and maintain business records properly. (2 marks) c. Mr. Wong who is single commenced a job on 1 December 2020 on a salary of HK$35,000 per month. By which date must he inform the CIR of his chargeability to salaries tax? (6 marks) d. Mr. Lam was employed as a marketing manager of a watch company on 1 May 2020. State the date by which the CIR will need to be notified of Mr. Lam's employment (2 marks) e. Mr. Anger will move back to USA, his home country, and will not back to Hong Kong. He informs his employer that he wishes to terminate his employment on 31 December 2020 and return to USA. What are the obligations of the employer under s52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts