Question: help Question 13 2 pts You have a 401(k) plan, which is used for retirement savings, at work. If you plan to invest $5,000 at

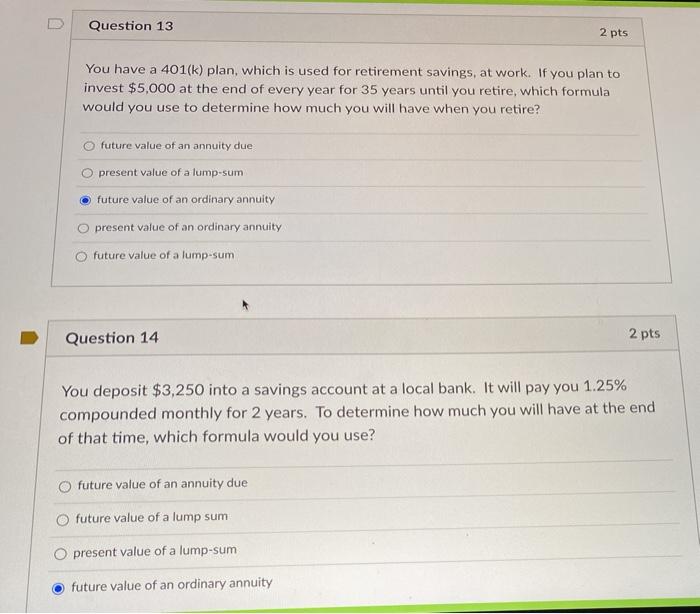

Question 13 2 pts You have a 401(k) plan, which is used for retirement savings, at work. If you plan to invest $5,000 at the end of every year for 35 years until you retire, which formula would you use to determine how much you will have when you retire? O future value of an annuity due O present value of a lump-sum future value of an ordinary annuity present value of an ordinary annuity future value of a lump-sum Question 14 2 pts You deposit $3,250 into a savings account at a local bank. It will pay you 1.25% compounded monthly for 2 years. To determine how much you will have at the end of that time, which formula would you use? future value of an annuity due O future value of a lump sum O present value of a lump-sum future value of an ordinary annuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts