Question: help QUESTION 20 What is the Portfolio Return if you hold positions in the following stocks displayed in this format (Current price per share. of

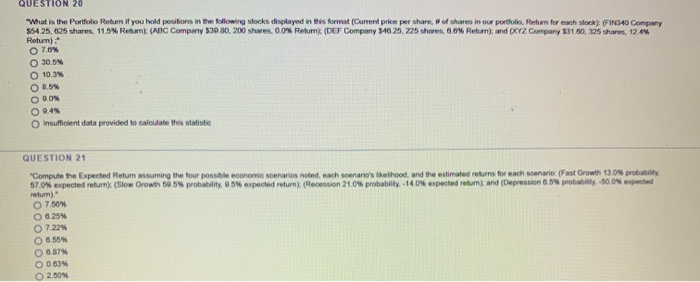

QUESTION 20 What is the Portfolio Return if you hold positions in the following stocks displayed in this format (Current price per share. of shares in our portfolio Return for each stocks (FIN340 Company $54.25, 625 shares. 11.5% Retum) (ABC Company 530 30. 200 shares, 0.0% Return (DEF Company 54625, 225 shares, 6.6% Return), and XYZ Company 331.80, 325 shares, 12 % Return) 7.6% O 305 O 10 O 0.5 O 0.0% O 0.4% Insufficient data provided to calculate this statistie QUESTION 21 "Compute the expected Retum assuming the four possible economie scenarios noted, each scenario's behood, and the estimated returns for each scenario (Fast Growth 13.0% probability 57.0% expected return (Slow Crowe 0.5% probability 0.5% expected return (Recession 21,0% probability. -14.0% expected home and (Depression 0.0% probability 60.0% expected return) 7.50N O 0.25% O 7.22% O 0.559 0.87% O 0.23% O 2.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts