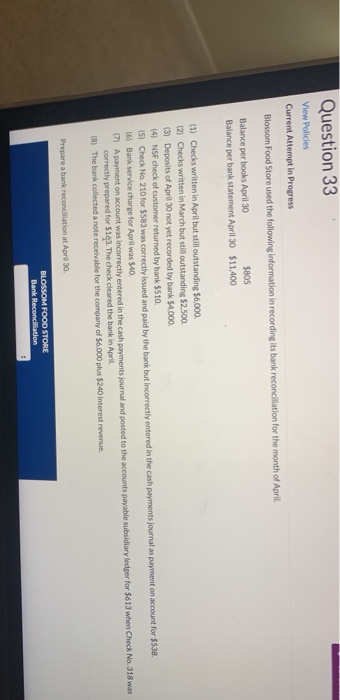

Question: help ! Question 33 View Policies Current Attempt in Progress Blossom Food Store used the following information in recording its bank reconciliation for the month

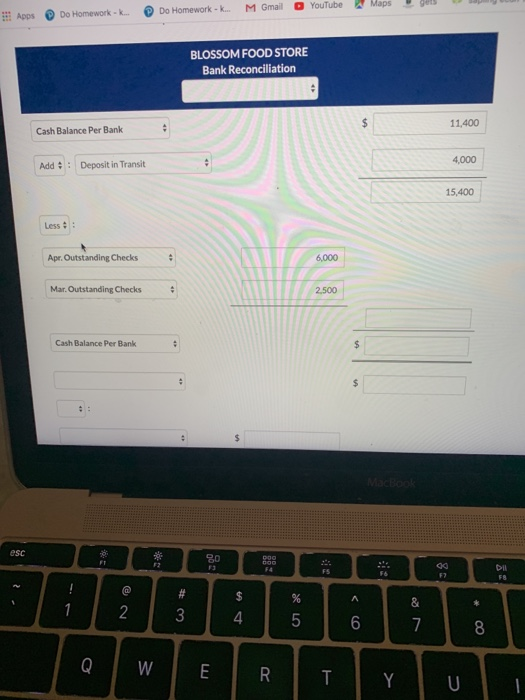

Question 33 View Policies Current Attempt in Progress Blossom Food Store used the following information in recording its bank reconciliation for the month of April, Balance per books April 30 $805 Balance per bank statement April 30 $11.400 (1) Checks written in April but still outstanding $6,000. (2) Checks written in March but still outstanding $2,500 (3) Deposits of April 30 not yet recorded by bank $4,000 (4) NSF check of customer returned by bank $510 15) Check No. 210 for $583 was correctly issued and paid by the bank but incorrectly entered in the cash payments journal as payment on account for $538. (6) Bank service charge for April was $40. 17) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary leder for 5613 when Check No. 318 was correctly prepared for $13. The check cleared the bank in April. (8) The bank collected a note receivable for the company of $6,000 plus $240 interest revenue Prepare a bank reconciliation at April 30. BLOSSOM FOOD STORE Bank Reconciliation M Gmail YouTube A Maps Apps Do Homework Do Homework - k. BLOSSOM FOOD STORE Bank Reconciliation + $ 11,400 Cash Balance Per Bank 4,000 Add :: Deposit in Transit 15,400 Less Apr. Outstanding Checks 6,000 Mar. Outstanding Checks 2,500 Cash Balance Per Bank + $ . $ MacBook esc 80 bog F FS F6 DIL F F7 @ # A & * 1 2 $ 4 3 5 6 7 8 W E R T Y U $ $ Cash Balance Per Books

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts