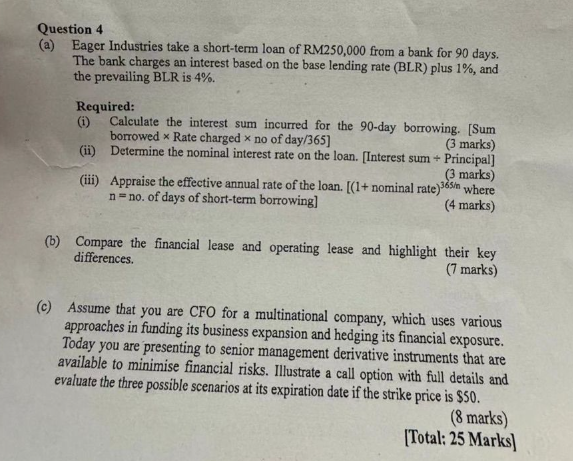

Question: help Question 4 ( a ) Eager Industries take a short - term loan of RM 2 5 0 , 0 0 0 from a

help Question

a Eager Industries take a shortterm loan of RM from a bank for days.

The bank charges an interest based on the base lending rate BLR plus and

the prevailing BLR is

Required:

i Calculate the interest sum incurred for the day borrowing. Sum

borrowed Rate charged no of day

marks

ii Determine the nominal interest rate on the loan. Interest sum Principal

marks

iii Appraise the effective annual rate of the loan. where

no of days of shortterm borrowing

marks

b Compare the financial lease and operating lease and highlight their key

differences.

marks

c Assume that you are CFO for a multinational company, which uses various

approaches in funding its business expansion and hedging its financial exposure.

Today you are presenting to senior management derivative instruments that are

available to minimise financial risks. Illustrate a call option with full details and

evaluate the three possible scenarios at its expiration date if the strike price is $

marks

Total: Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock