Question: help question 4 and 5 please 4. Simone works for Successful Business Inc. in Qubec and earns an annual salary of $30,500.00 paid on a

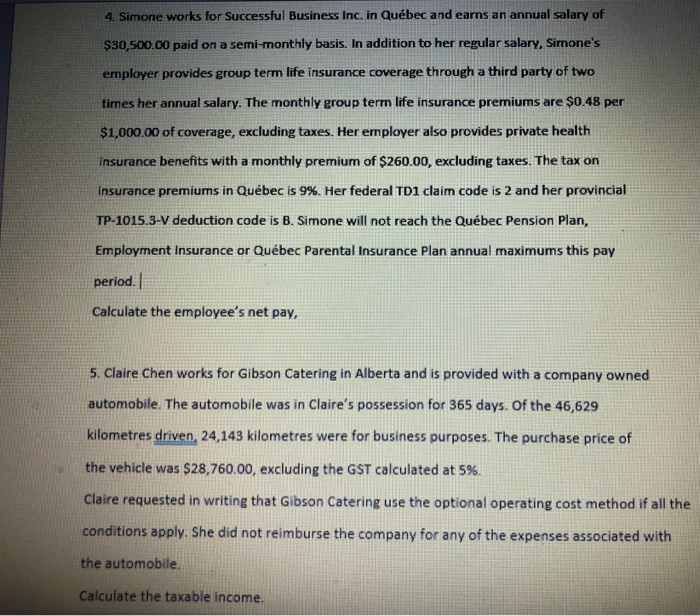

4. Simone works for Successful Business Inc. in Qubec and earns an annual salary of $30,500.00 paid on a semi-monthly basis. In addition to her regular salary, Simone's employer provides group term life insurance coverage through a third party of two times her annual salary. The monthly group term life insurance premiums are $0.48 per $1,000.00 of coverage, excluding taxes. Her employer also provides private health insurance benefits with a monthly premium of $260.00, excluding taxes. The tax on insurance premiums in Qubec is 9%. Her federal TD1 claim code is 2 and her provincial TP-1015.5-V deduction code is B. Simone will not reach the Qubec Pension Plan, Employment Insurance or Qubec Parental Insurance Plan annual maximums this pay period. Calculate the employee's net pay, www. 5. Claire Chen works for Gibson Catering in Alberta and is provided with a company owned automobile. The automobile was in Claire's possession for 365 days. Of the 46,629 kilometres driven, 24,143 kilometres were for business purposes. The purchase price of the vehicle was $28,760.00, excluding the GST calculated at 5%. Claire requested in writing that Gibson Catering use the optional operating cost method if all the conditions apply. She did not reimburse the company for any of the expenses associated with the automobile. Calculate the taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts